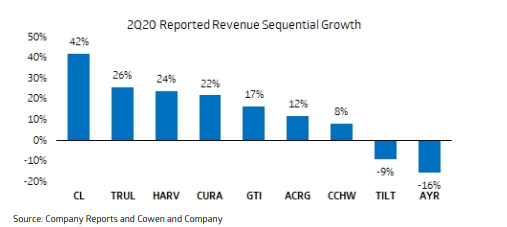

On the first of the month, Cowen and Co sent out an industry update specifically for the U.S. multi-state operators, which analyst Vivien Azer headlines “MSO earnings review adds to our conviction on US operators.” Azer reiterates Cowen’s Outperform rating on Green Thumb, Cresco Labs, and Curaleaf within the report

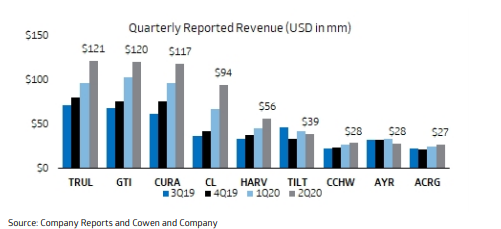

Cowen’s top pick for the U.S. cannabis space is Green Thumb Industries. The company has generated over $100 million in quarterly revenues with a +50% gross margin while using money in ways that affect the bottom line in adjusted EBITDA says Azer.

Azer, given these reasons, says “GTI being one of the few U.S. cannabis companies that are generating positive free cash flow,” and believes that there is more room for Green Thumb to expand and scale in I.L. and in P.A., which have seen a massive uptick in growth on the medical market. She outlines that potential catalysts that are not priced into her estimate would be N.J. legalizing for adult use on the upcoming November ballot.

Within Cowen’s commentary on Cresco Labs, Azer states, “CL Wholesale Strength, Market Penetration and Whitespace Warrant Outperform Rating” and says that although Cresco Labs is not as diverse as other multi-state operators, it has a tremendous wholesale business that continues to grab market share in their largest state of I.L. as well as P.A. She says that distribution in C.A. has helped increase revenues and profitability as it is approaching $100 million revenue per quarter.

Azer says that “based on the current landscape and CL’s solid execution, we model for FY20 revenue to approach $400 mm.” As for the upcoming potential catalysts, Azer says that AZ’s potential to legalize adult-use on the November ballot is not accounted for in her revenue estimates and add more upside.

On the topic of Curaleaf, Azer headlines “Execution, Geographic Expansion, and M&A Present Unique Operating Structure Which Should Serve CURA Well,” and gives Curaleaf the title of one the most geographically diverse cannabis operators in the U.S. She adds that with the outstanding leadership in charge, the revenues should “inflect meaningfully starting in 3Q, inclusive of the Grassroots acquisition.”

Azer also says that Curaleaf is well-positioned for the upcoming catalysts in N.J. and AZ if they go adult use. Vivien states that “MSO Valuations Remain Attractive on a Relative Basis.” As the multi-state operators trade at a discount relative to their Canadian counterparts, Azer says that the multi-state operators are “clearly set up for continued scale and a long runway for growth.”

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.