Today Cresco Labs announced they are acquiring Origin House for C$1.1B which works out to $12.68 per share. Not exactly a giant premium, but the combined entity will create arguably the largest cannabis company in the United States.

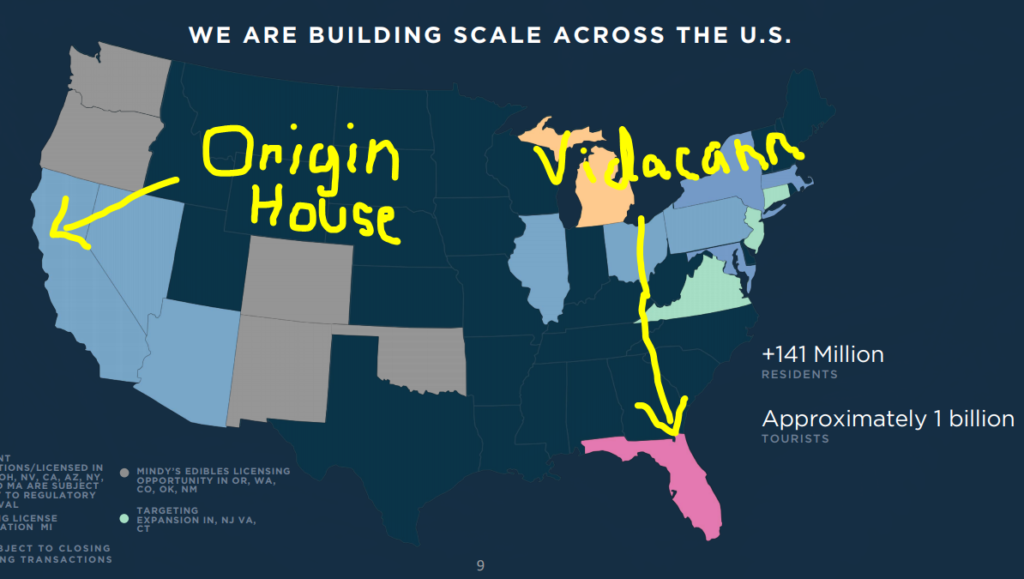

Origin House is a top distributor in California. The company offers a full suite of support services to transform cannabis products into strong California consumer brands. Origin House delivers over 50+ cannabis brands to more than 500 dispensaries in California, representing approximately 60% market penetration.

Shortly after the news release, Deep Dive correspondents reached out to two shareholders who had the following comments, “I’d say thanks if there were any premium…..unreal” and from another shareholder “F***** b****** premium”…

This is somewhat reminiscent of the the MPX/iAnthus merger where shareholders only received a 30% premium. Given this is an all-stock transaction, shareholders should do well from the synergies provided. The California market is very competitive and fragmented, for Cresco Labs to pick up a strong California operator to add to their large East Coast footprint, they now have most the majority of the US cannabis market covered.

Cresco Labs recently made noise when they announced the purchase of VidaCann in a $120 million cash and stock deal, one of the last remaining operators in the state of Florida. Which effectively gives Cresco Labs a footprint on par with any operator in the country. This is likely kicking off a competition to the top. In such a nascent industry, it is very difficult to question who is deploying their capital wisely, but in terms of national footprint, this acquisition makes sense for both shareholders.

This represents over 100x trailing sedar based sales, but of course that would be an unfair metric. Or using the last quarters run rate, approximately 44x sales. And of course, the most recent sedar data is rarely reflective of a growing companies current run rate.

And one final interesting thought is that synergies will be picked up with the ability for Cresco to roll out the Origin House brands and services over all their nascent operations.

Information for this analysis was found via Sedar, Origin House and Cresco Labs. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.