On March 3rd, Curaleaf Holdings, Inc. (CSE: CURA) reported its fourth quarter and full year 2021 results. The company announced that its revenue grew 93% year over year to $1.2 billion with gross profits of $588 million or a 48.5% margin. Additionally, it saw its adjusted EBITDA grow to $298 million, up 107% year over year. Though it did see its net losses almost double from -$57.2 million to -$101.7 million, bringing it’s year-end earnings per share at -$0.15.

For the quarterly results, the company saw its growth stall, only growing revenues 0.9% this quarter to $320 million. The company saw its gross profits rise to $159 million, or a ~50% gross margin. The company reported adjusted EBITDA of $79.6 million and reported its 9th consecutive net loss of -$27.5 million or earnings per share of -$0.04.

A number of analysts slashed their 12-month price target on Curaleaf after the results, bringing the average 12-month price target to C$20.18, down from $24.10 last month. The company currently has 16 analysts covering the stock with 5 having strong buy ratings, 9 having buy ratings and 2 analysts having hold ratings. The street high sits at C$27, which represents a 250% upside to the current stock price.

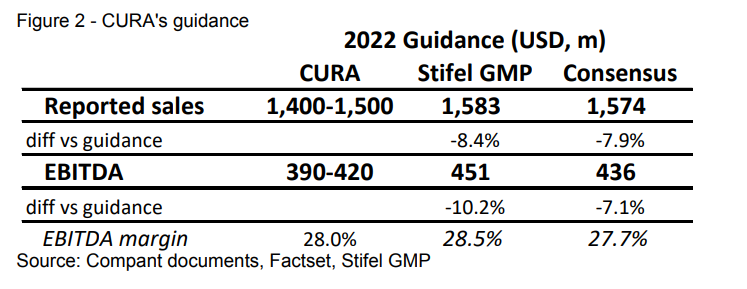

Stifel-GMP calls Curaleaf’s fourth quarter results a mixed bag but calls the company’s 2022 full-year guidance “a sobering outlook” as the company guides to revenues of $1.4 – $1.5 billion, which would be 20% year over year growth at the midpoint. Though way below both Stifel’s and consensus estimates of $1.57 billion.

For the fourth quarter results, Curaleaf looks to have beaten all of Stifel’s estimates, with the largest beat coming in on the margins. Adjusted gross profits came in at 53%, better than the 51.8% estimate and adjusted EBITDA margins of 24.9%, better than the 23.7% estimate.

Back to the 2022 full-year guidance, Stifel says that there are 4 assumptions management used to provide this guidance which includes New Jersey recreational sales starting on May 1st, 2022, Tryke closing October 1st, 2022, personal disposable income decreasing, and “an increasingly competitive environment with cost inflationary pressure that cannot be passed on to the consumer.”

With these assumptions, Stifel says that the company is being conservative with their New Jersey recreational estimate, as all 36 retail locations are not being operational at the perceived start of recreational sales. They comment that they expect revenue per store is understated as they believe that sales will only be limited by the number of customers they can get through the doors. Stifel notes that the 2022 EBITDA margin guidance of 28% comes in line with the consensus estimates.

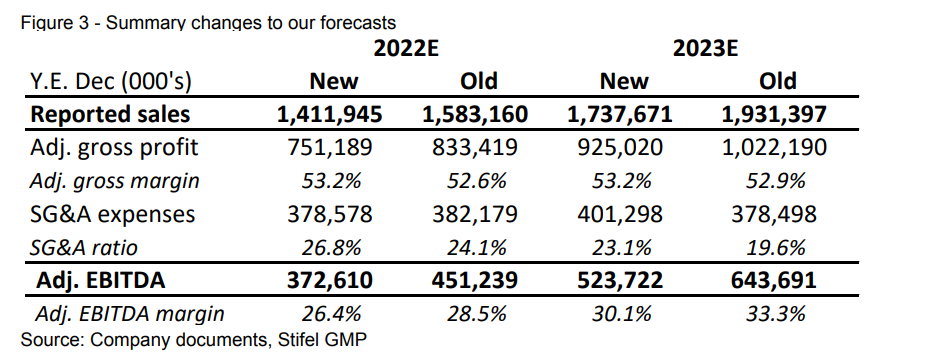

Below you can see Stifel-GMP’s updated 2022 and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.