Microsoft (NASDAQ: MSFT) was the first big tech company to buck the current trend with their earnings on April 26. Microsoft saw it’s total revenues grow 18% year over year to $49.36 billion. Operating income grew at the same pace, hitting $20.36 billion. While net income was $16.73 billion, up 8% and earnings per share grew to $2.22.

Microsoft’s CFO, Amy Hood, commented, “Continued customer commitment to our cloud platform and strong sales execution drove better than expected commercial bookings growth of 28% and Microsoft Cloud revenue of $23.4 billion, up 32% year over year.” While the company’s intelligent cloud revenue was up 26% to $19.1 billion and Azure revenue grew 46% quarter over quarter. Additionally, the company saw its gaming segment grow 4% year over year.

Lastly, the company said it returned an astounding $12.4 billion to investors via both dividends and share repurchases during the quarter, which is up by 25% year over year. The company repurchased slightly over 26 million shares in the quarter at an average price between $294 and $309 per share.

On the earnings call, management says that they expect fourth-quarter Azure growth to come in slightly lower than this quarter, but reaffirmed that fiscal 2023 revenue will grow by “double digits.”

A number of analysts have revised their 12-month price target, slightly lowering the consensus from $371 to $366, which represents a 30% upside to the current stock price. Microsoft currently has 52 analysts covering the stock with 20 having strong buy ratings, 30 have buys and 2 have hold ratings. The street high price target sits at $426, or a 50% upside to the current stock price.

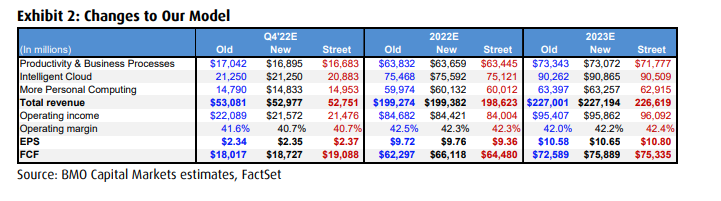

In BMO Capital Markets’ note on Microsoft’s earnings, they reiterate their outperform rating and raise their 12-month price target on the stock from $340 to $345. They say that management’s guidance and overall results were bullish for the stock and, “could serve to modestly help alleviate pervasive macro fears for software investors more broadly.”

On the booking results, BMO says that normalized bookings grew 29% year over year, which is a deceleration of 7% quarter over quarter but calls the fourth quarter a harder comp to use. Otherwise, they reiterate their bullishness for the stock by saying, “We believe bookings momentum remains strong,” but cast some doubt on the June quarter as they believe Microsoft will be facing tough comps year over year.

On the same note, they call Microsoft a “robust” free cash flow story as Microsoft reported operating cash flow margins of 51.4% and free cash flow margins of 40.6%, which was above BMO’s estimates. They say that the companies billing and collections were robust even in the face of supply chain issues and uncertainty. BMO has now increased its full-year 2022 and 2023 free cash flow margin estimates by 33.2% and 33.4%, respectively.

Lastly, BMO says that the fiscal fourth quarter Azure growth guidance of 47%, which includes 2% help from Nuance, is reasonable. They believe that Azure growth will remain robust in the future and that the growth is “defensible in any macro environment.”

Below you can see BMO’s updated fourth quarter, full-year 2022, and 2023 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.