Draslovka, the world’s largest producer of sodium cyanide, has no choice but to slash output in Europe due to astronomically high energy prices.

The Czech-based maker of cyanide, a key chemical needed for the extraction of gold and silver from ore, told the Financial Times it was forced to halt European production due to surging natural gas prices. The compounding effect of already-historically high energy prices and the escalating Russia-Ukraine crisis has pushed the cost of natural gas in the country about 12 times higher than in the US this year, compared to only 1.5 times in 2020.

“We need to decrease production to a minimum for a temporary period and see what the free economy does,” CEO Pavel Bruzek said. “The whole of Europe is in a similar situation.” The price of raw materials needed to make cyanide— such as ammonia and caustic soda— as well as the energy required for production— have surged about 270% in the past 12 months. As a result, global cyanide prices have jumped anywhere between 25-30% during that period.

Draslovka provides cyanide supplies to a variety of precious metals mining companies, particularly in Latin America, Turkey, and Africa. The company recently acquired several cyanide production facilities from US-based Chemours for about $521 million, as well as several plants from Africa-based petrochemicals company Sasol, under the assumption that energy prices would continue increasing in Europe. However, Bruzek did not expect costs to increase so rapidly. “The speed and magnitude is surprising,” he said.

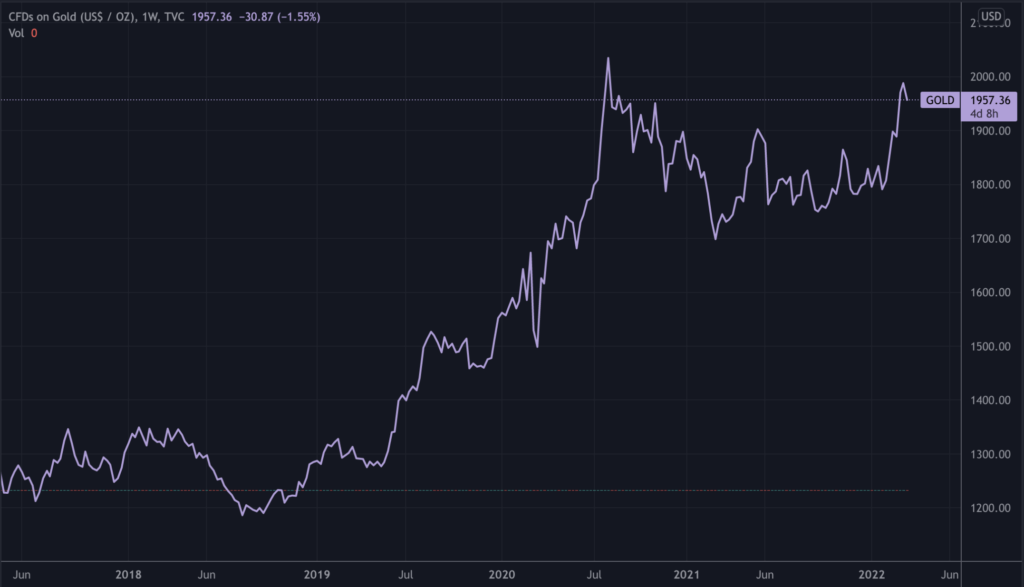

The price of gold has risen steadily over the past several weeks, and is sitting at almost $2,000 per ounce. Bruzek warned that some miners could face higher input costs and even cyanide shortages, since more cyanide is needed to extract precious metals from poor quality ores.

Information for this briefing was found via the Financial Times. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.