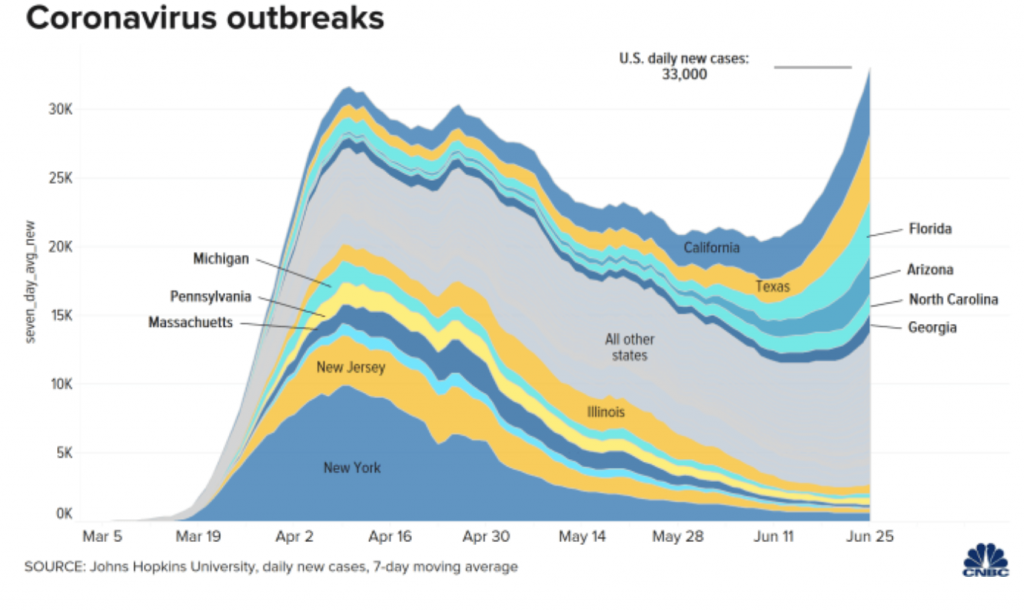

The demand for US oil hit a disastrous low during the onset of the coronavirus pandemic, as government-mandated economic lockdowns and travel restrictions forced Americans to succumb to the safety of their homes. By May, the US economy was in such a state of disarray that governments decided to start easing restrictions and get people back to work so as to subside further economic collapse.

The easing of restrictions sparked an uptake in the demand for oil, as Americans started venturing out of their homes once again traveling by vehicle as opposed to air travel. In addition, businesses such as retailers, restaurants, and bars reopened to full capacity, predominantly in Texas, California, and Florida. However, things soon took a turn for the worse, as infection rates began to increase at an alarming rate setting a record of daily new cases.

In response to what appears to be a second resurgence of the deadly virus, several hard-hit states have rolled back their reopening plans, and are once again imposing restrictions on non-essential businesses. Now, demand for oil is falling once more, as American’s attitudes in response to a second wave of the coronavirus are shifting once again. Despite the attractiveness of a National Lampoon’s road-trip-style vacation, the threat of an even deadlier coronavirus wave could offset any travel plans indefinitely.

Information for this briefing was found via Bloomberg and CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.