Electric vehicle (EV) manufacturers have faced many obstacles over the last six or months or so. Most start-up OEMs have experienced high cash burn levels as they develop their models. Moreover, supply chain issues, particularly for semiconductors, have exacerbated this heavy cash usage problem. In turn, the share prices of EV makers have been, and remain, under intense pressure. Many, including Rivian Automotive, Inc. (NASDAQ: RIVN), Lordstown Motors Corp. (NASDAQ: RIDE), and Lucid Group, Inc. (NASDAQ: LCID) have seen 60%-90% of their stock market valuations disappear over this period.

Until recently, EVs had two decisive advantages over conventional gas-powered vehicles: lower operating costs and frequently lower purchase prices versus comparable internal combustion engine (ICE) vehicles. However, both of these edges, or selling points, appear to be steadily eroding over the last few months.

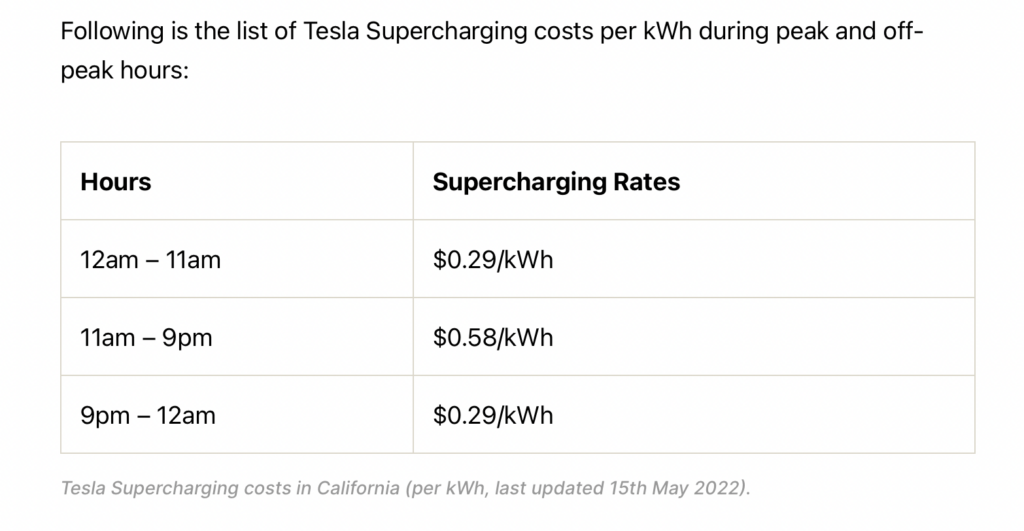

First, the cost of supercharging an EV has exploded as rising oil and natural gas commodity prices has translated into a jump in electricity prices. Supercharging, a direct current (DC) charging method, is the fastest way to charge an EV. Level 2 charging equipment, which uses AC current and can be installed at home, is used by many EV owners to charge their vehicles overnight. Level 2 charging can replenish between 12 to 80 miles of range per hour.

Tesla supercharging costs in California are US$0.58 per kilowatt-hour (Kwh) of electricity used during the peak hours of 11:00 am through 9:00 pm each day. To put that into perspective, a typical EV’s efficiency is 3-4 miles per Kwh. This implies that an EV requires US$0.58 of “fuel” to travel 3-4 miles. Travelling 24.2 miles, which is the average fuel economy per gallon of gas for passenger vehicles in the U.S. (per the Alternative Fuels Data Center), would require a supercharging fee of about US$4.00 (US$0.58 times 24.2 miles divided by 3.5 miles).

Since the average price of gasoline is around US$5.00 per gallon, an EV’s “equivalent fuel” cost of ~US$4.00 per gallon is still 20% less than that of a typical ICE vehicle. However, the magnitude of this relative advantage is now much lower than it was.

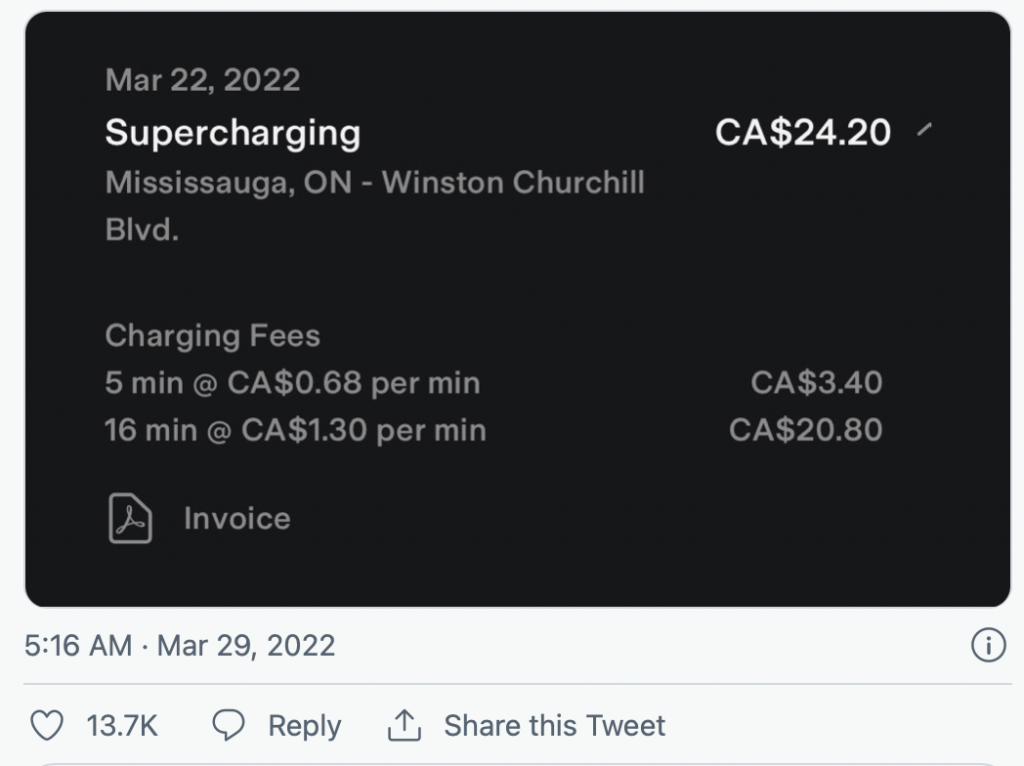

The relative operating cost advantage of EV’s may be reduced even further in countries like Canada where supercharging rates are assessed per minute rather than per Kwh. One customer in March 2022 shared the details of a C$24.20 invoice for 21 minutes of charging.

(If an EV owner religiously charges a vehicle overnight using a Level 2 charging device, the per-Kwh cost will be more reasonable than supercharging fees.)

Second, EV OEM’s have been forced to raise model prices dramatically to reflect the soaring prices of metals used in EV batteries, such as lithium and nickel. For example, in March 2022, Tesla increased the prices of its Model X SUV to US$114,990 from US$104,990 and the Model X Tri Motors, its highest trim model, to US$138,990 from US$126,490. Similarly, both Rivian and Lucid have recently announced 10+% price increases on their vehicle offerings.

After burning through substantial cash (and a significant portion of their one-time extremely buoyant stock market capitalizations), EV OEMs now face the added challenge of reduced operating cost advantages versus traditional gas-powered cars. Also, many EV manufacturers have been compelled to boost sticker prices to reflect rising manufacturing costs.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.