Eloro Resources (TSX: ELO) has released an initial mineral resource estimate for its Iska Iska silver-tin polymetallic project, which is found in southwestern Bolivia. The project is said to host a massive 1.15 billion ounces of silver equivalent on an inferred basis.

The resource estimate when broken out from the silver-equivalent basis, is said to contain a total of 298 million ounces of silver, 4.09 million tonnes of zinc, 1.74 million tonnes of lead, and 130,000 tonnes of tin.

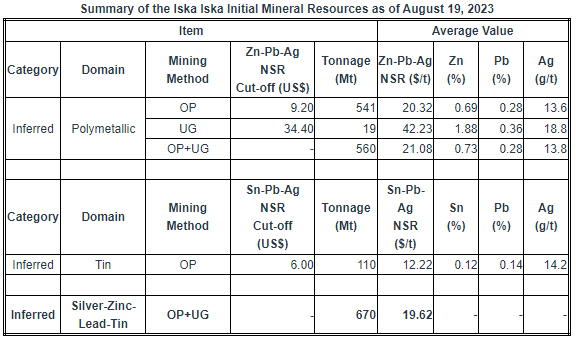

Mining methods for the estimate include both open pit and underground, with the estimate further broken out into what the company refers to as a polymetallic domain, which accounts for a combined 560 million tonnes of 13.8 g/t silver, 0.28% lead and 0.73% zinc, and a tin domain, which accounts for 110 million tonnes of 14.2 g/t silver, 0.14% lead and 0.12% tin. On a combined basis the two domains account for 670 million tonnes.

The estimate is based off of net smelter return cut-off values of US$9.20/t for open pit and US$34.00/t for underground. NSR values were used as cut-off grades as a result of the polymetallic nature of the deposit.

“The recent metallurgical work, particularly the positive ‘ore sorting’ results, has significantly enhanced the potential economics by substantially lowering the NSR cutoff, especially for the potential open pit where the bulk of the resource is located. The fact that this potential pit is 1.4km in diameter and extends to a depth of 750m below the Santa Barbara hill attests to the remarkable size of the Iska Iska mineralized system,” commented CEO Tom Larsen.

“Although the resource is classified as inferred, we are confident that further drilling will upgrade much of this to the indicated category. [..] The overall in situ value based on the net NSR values stated above is approximately US$6.8B of which US$3.3B is in the shallower high-grade zone in the potential open pit. This augers well for the potential for early payback on the project,” he continued.

Moving forward, Eloro intends to conduct definition drilling and further metallurgical test work in advance of a planned preliminary economic assessment.

Eloro Resources last traded at $3.08 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.