Surprising absolutely no one, this morning Emerald Health Therapeutics (TSXV: EMH) responded to Village Farms (TSX: VFF) (NASDAQ: VFF) release issued yestereday, wherein Village identified that it had been approved for majority ownership in Pure Sunfarms. The endless saga, which will likely be drawn out until at least February, is related to Emerald’s inability to pay certain required monthly payments to Pure Sunfarms.

The dispute of ownership ratios between the two firms is related to a payment of $5.94 million that Emerald failed to make on November 1, 2019. Following the issuance of a notice, and Emerald’s continued failure to pay up, Village covered the missed payment on November 19, resulting in the issuer applying to Pure Sunfarms for a corresponding ownership increase in the joint venture. Emerald’s shares in Pure Sunfarms are currently held in escrow and released as payments are made. With the missed payment, Village has also requested that Emerald’s corresponding shares be cancelled as well which would further increase Village Farms’ ownership in the venture.

Within the response issued this morning, Emerald reiterated its prior news release and stated, “factually, Emerald and Village Farms each continue to own 50% of PSF.”

On a technical level, Emerald appears to be correct. Under the terms of the shareholder agreement entered into among Emerald Health and Village Farms, an appraisal process is to now occur as a result of Village Farms advancement of funds following Emerald’s failure to pay its dues. Until that appraisal process is conducted, its unclear what percentage Village’s ownership will increase to as a result of covering Emerald’s tab. Until that appraisal process is conducted the two entities will technically remain equal owners in the Pure Sunfarms joint venture. However, the increase in equity ownership will be effective as of November 19, 2019.

Emerald confirms that it did not pay $5.94 million to PSF in connection with the Delta 2 Option Agreement as it had previously notified PSF that it was setting off its $5.94 million payment against the $13 million PSF currently owes Emerald under a demand Promissory Note. As a result of this set-off, Emerald has completed its $5.94 million payment to PSF and, in turn, Village Farms has no right to attempt to make any additional equity contributions to PSF.

Emerald maintains that it made this payment by extinguishing $5.94 million in debt owed to the issuer by the joint venture. In their eyes, as a result, Village Farms has no ground to stand on and the two firms should still maintain equal ownership of Pure Sunfarms.

A look at the amended shareholder agreement, however, brings that claim into question.

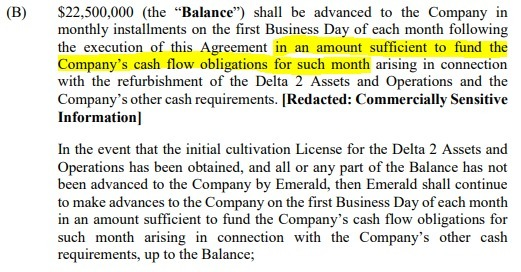

Specifically, it identifies that the monthly payments to Pure Sunfarms by Emerald, of which there are to be $22.5 million in total, are for cash flow purposes. As seen above, this specific text is written into the agreement so as to ensure that payments are made to enable Pure Sunfarms to have the required cash to operate on a monthly basis. By extinguishing debt, this does nothing to support near term cash flow and thereby does not satisfy the amended agreement that Emerald and Village both signed.

The result, is that the two firms are headed to arbitration to determine the outcome of the current situation. A date for this has yet to be determined.

No update was provided by Emerald in today’s news release related to the disputed outstanding $7.0 million tab at Pure Sunfarms owed by Emerald.

Emerald Health last traded at $0.40 on the TSX Venture.

Information for this briefing was found via Sedar, Emerald Health Therapeutics, and Village Farms International. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.