On May 16th, Enthusiast Gaming (TSX: EGLX) reported its first quarter financial results. The company announced revenues of $47.2 million, up 57% year over year. While gross profits also saw an increase, going from $5.9 million to $13.5 million this quarter, or a margin of 28.6% versus 19.8% a year ago.

The company attributes the gross margin expansion to it’s Addicting Games and U.GG segments and higher direct/subscription sales. Direct sales came in at $5.2 million, up 136% and subscription revenues grew to $3.3 million. Lastly, the company said it now has 233,000 paid members.

The company said that its partnership with Fractal, an NFT marketplace, will allow Enthusiast Gaming to integrate NFTs into one of their HTML-5-based games called EV.IO.

Enthusiast Gaming currently has 7 analysts covering the stock with an average 12-month price target of C$8.38, or an upside of 210%. Out of the 7 analysts, 2 have strong buy ratings and the other 5 have buy ratings. The street high sits at C$11.50, which represents an upside of 326%.

In Canaccord Genuity’s note on the results, they reiterate their buy rating and increase their 12-month price target on the stock from C$7.00 to C$7.25 saying that the company’s revenue growth and margin expansion helped offset the first-quarter seasonality.

They say that the company reported both better top and bottom-line estimates, roughly 14% above the consensus $41.3 million estimates. They write that this beat gives them “higher confidence on a continued strong trajectory through 2022.”

On EBITDA, the company reported better than expected results, as the line item came in at ($4.8) million, better than their ($8) million estimate. Though Canaccord notes that the company continues to invest in employees which are leading to higher opex.

They additionally add that they believe repeat business was/is a hedge on the normally weak first-quarter results, which they believe acts also as a bottleneck for net new business.

Canaccord agrees with management’s soft guidance of sequential top-line and year-over-year gross margin expansion to continue in 2022. Management also provided “a more confident” view on EBITDA which Canaccord says will relieve some of the company’s balance sheet pressures.

The price target raise comes from a slightly increased multiple of 4x EV/2023 sales. They say that the multiple reflects, “a difficult valuation environment on high growth but negative EBITDA peers and considers all deferred payments as share payments.”

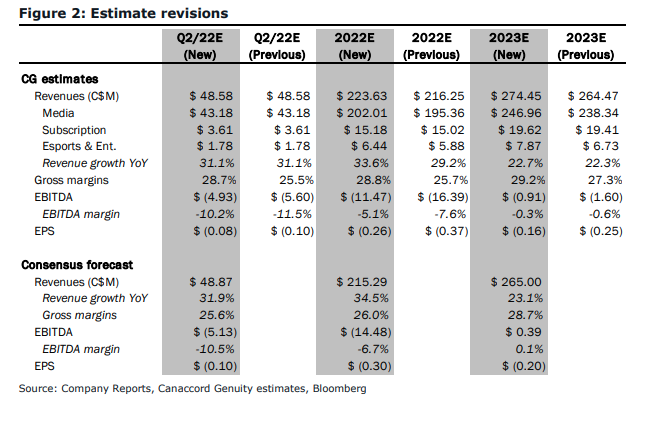

Below you can see Canaccord’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.