Equinox Gold Corp. (TSX: EQX) last week reported its second quarter financial results. The company announced that it produced 120,813 ounces of gold, slightly up from 117,452 last quarter. The firm also said it sold 120,395 ounces of gold for an average price of $1,856 per ounce.

Cash costs for the quarter came out to $1,482 per ounce, jumping from $1,237, while its all-in sustaining costs increased to $1,657 from $1,577.

As a result, the company reported $224.6 million in revenue, basically flat quarter over quarter. At the same time, the company’s net losses ballooned from a net loss of $19.8 million last quarter to $78.7 million this quarter. This equates to earnings per share of -$0.26, compared to -$0.07 in the prior period.

The company ended the quarter with $159.7 million in cash and cash equivalents while having a net debt position of $472.2 million.

Equinox Gold currently has 12 analysts covering the stock with an average 12-month price target of C$9.83, or an upside of 78%. Out of the 12 analysts, one has a strong buy rating, five have buy ratings, another five analysts have hold ratings, and one analyst has a sell rating on the stock. The street high price target sits at C$16 and represents an upside of 190%.

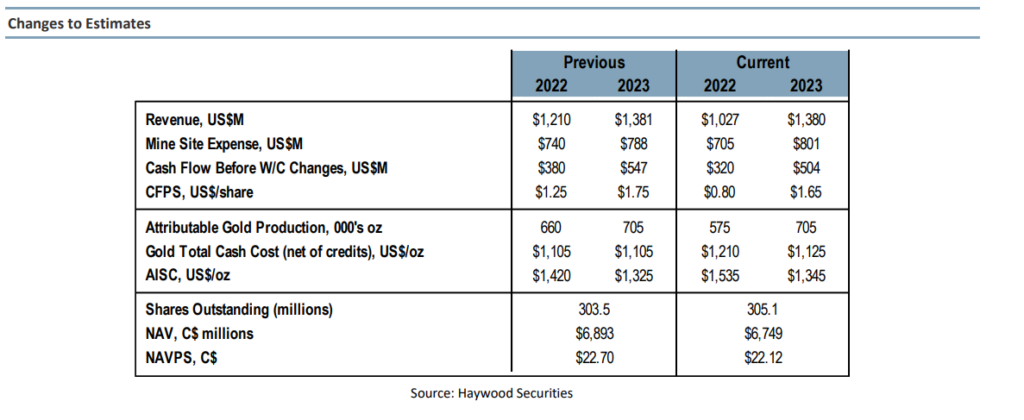

In Haywood Capital Market’s note on the results, they reiterated their buy rating but cut their 12-month price target from C$11 to C$10, saying that the quarter was ultimately disappointing, and coupled with lowered guidance, made them ultimately lower their future estimates on Equinox Gold.

On the results, Haywood says that production was way below their 132,000-ounce estimate, which was lower than the consensus estimate going into the quarter, and is the second quarter that Equinox has come in under estimates. At the same time, cash flow per share came in at $0.05 versus the estimate of US$0.19.

On the specific mines, Haywood says that the start-up at Santa Luz “is going very slow,” while they add that “RDM also had a terrible quarter.” Though they note that Los Filos had decent production, it was ultimately overshadowed by much higher cash costs of US$2,043 per ounce versus their estimate of US$1,790.

Haywood writes, “Overall, a very disappointing Q2 with only Mesquite performing well. With high costs at Los Filos, RDM, and Santa Luz, these three operations had negative US$57.6 million of minesite free cash flow.”

The company’s total cash costs came in well above Haywood’s US$1,201 estimate. This miss was translated into higher all-in sustaining costs than Haywood’s US$1,547 estimate. This, in turn made Equinox report lower than expected cash flows from operations.

On the updated guidance, Haywood says that even though the company’s production results were always going to be back half weighted, but, “Equinox has had a terrible six months.” As a result, Haywood has updated their full-year estimates to be in line with the guidance. They now forecast production to be 575,000 ounces at a cash cost of US$1,210 and an all-in sustaining cost of US$1,535.

Below you can see Haywood’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.