The EU continues to shoot itself in the foot, this time by refusing to meet Russian President Vladimir Putin’s demands to pay for natural gas shipments in rubles.

Although the price of natural gas has modestly subsided from last month’s record-highs, the EU still faces a major supply problem, particularly in wake of Russia’s retaliatory measures against western sanctions. Earlier this week, Putin ordered the central bank to devise a system forcing “hostile” countries to pay for Russia’s natural gas exports in rubles instead of the euro or US dollar. The move would essentially help prop up Russia’s domestic currency, after it was sent plummeting by the West’s sanctions on its economy and financial system.

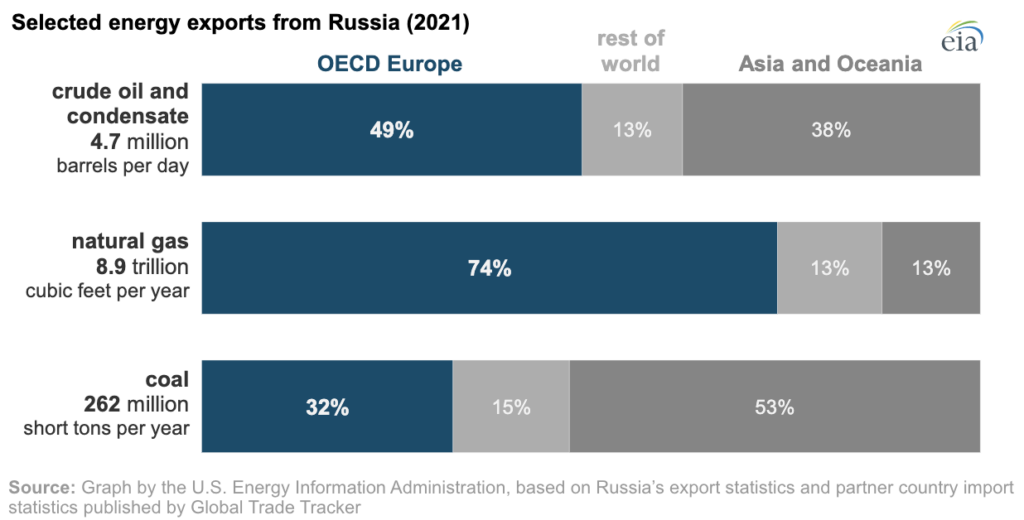

The EU, which accounts for more than 72% of Russia’s gas exports, currently does not have an equivalent replacement to meet its growing energy needs. Germany, for its part, went as far as to halt extending the lifespan of its nuclear power plants, instead deciding to keep coal power plants on standby while maintaining gas imports from Russia.

There is no doubt that Russia has the EU on puppet strings, and any refusal to play by Moscow’s rule book would result in the EU getting the short end of the stick, even in face of crippling sanctions aimed at decimating Russia’s economy. But, despite Europe’s vast dependence on Russia’s gas, member nations are refusing to meet Putin’s demands. “It’s a contract violation, and contracts will be considered violated if Russia implements this condition,” said Italian Prime Minister Mario Draghi, as cited by Bloomberg.

“Most agreements and most treaties are absolutely precise about the currency in which the payment has to be done,” German Chancellor Olaf Scholz said during a news conference on Thursday. However, the EU’s rejection of conducting transactions in rubles could further exasperate the bloc’s gas shortages, especially if Russia refuses to bow down. “It’s pretty clear that it makes no sense for us to supply our goods to the European Union, to the U.S. and receive payments in dollars, euros, other currencies,” said Putin, as cited by the Kremlin website.

Information for this briefing was found via Bloomberg and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

2 Responses

Reading this article one could be forgiven for believing Russia gave the EU gas as a charity project and it’s not about to lose one of their biggest revenue streams right in the middle of massive sanctions and a war.

The price EU is paying is quarter of the market price today. So yeah, kind of charity. Not to mention that price will double in case of EU refusing the gas. Which means that Russia would only need to sell 15% of the gas refused by EU to someone else and make MORE money. Russia is praying that EU breaks the deal, they don’t want to lose money to hostile countries.