Shares of Excelsior Mining Corp. (TSX: MIN), a junior copper exploration and production company in the U.S. state of Arizona, have declined around 40% since mid-February and more than 20% over the last week. The stock’s weak performance may be attributed to reduced flow rates at its 100%-owned, 9,560-acre Gunnison Copper Project, which is being mined via an in-situ recovery (ISR) solution-based method.

Excelsior now believes it will achieve its target 25 million pound per year production target in the first half of 2022. In late January 2021, when Excelsior sold its first 90,000 pounds of copper cathode from Gunnison, the company said it believed the 25 million pound rate would be achieved sometime this year.

The presence of carbon dioxide has impeded the ramp-up to the target production rate. The company is now cycling back and forth between water injection — the cycling has demonstrated its ability to remove carbon dioxide and restore flows — during daily operations, and Excelsior expects this action will, over time, eliminate carbon dioxide as an issue. It is also investigating whether a fluid other than water could be a better flushing agent.

To date, Excelsior has produced about 230,000 pounds of copper cathode (including the 90,000 pounds noted above). Production continues during the ramp-up to nameplate capacity.

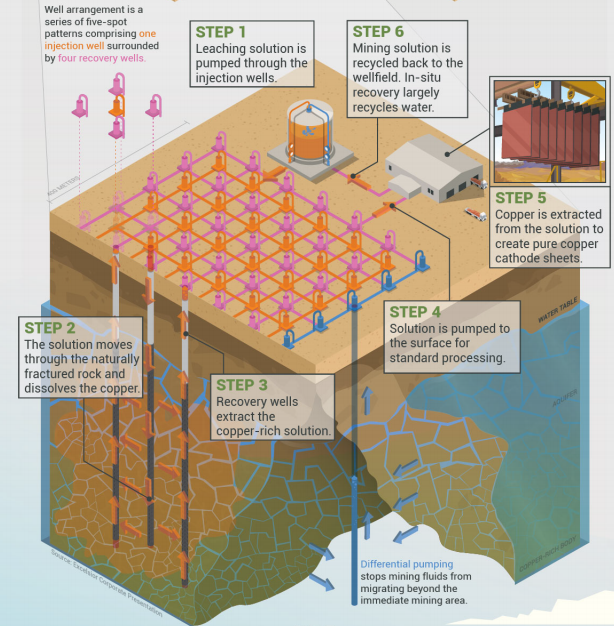

In-Situ Recovery (ISR) Mining

An environmentally friendly mining method, ISR mining is injected-solution mining which dissolves the copper from the host material. The copper-bearing solution, which also includes water and chemicals that accelerate the process, is pumped back to the surface. ISR mining causes little surface disturbance or dust generation, both of which are associated with underground mining.

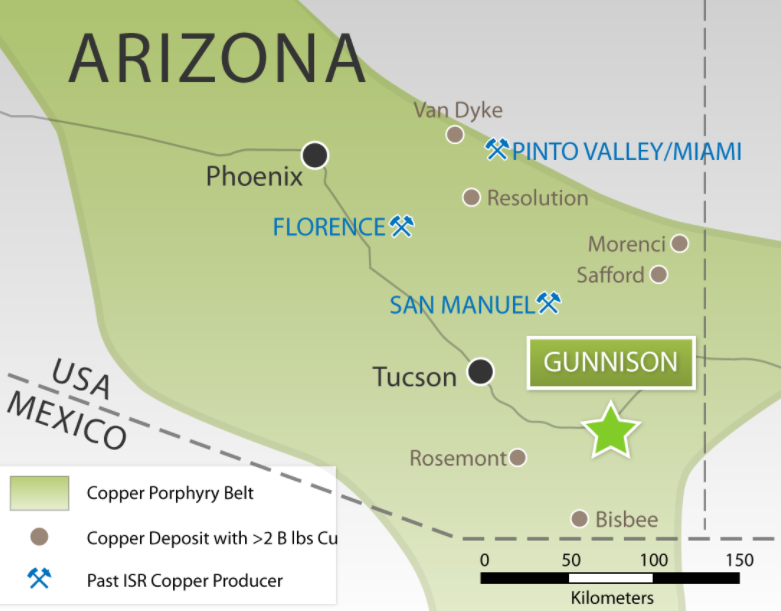

Gunnison Copper Project

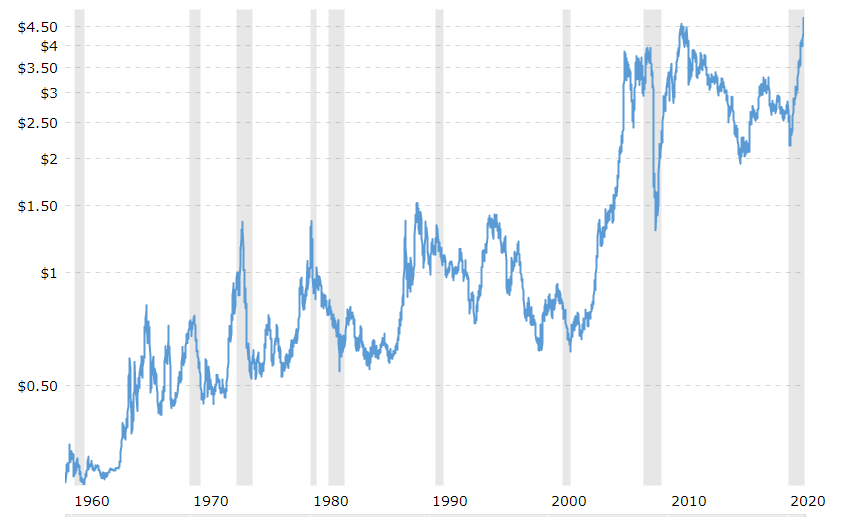

According to a 2017 Feasibility Study, Gunnison has a US$807 million net present value and a 40% internal rate of return, based on a copper price of US$2.75 per pound and a 7.5% discount rate. (Current copper prices are much higher, in the range of US$4.63 per pound). Production is expected to ramp up from an initial 25 million pounds of copper per year to an annual rate of 125 million pounds, all based on a mine life of 24 years.

Solid Balance Sheet

Excelsior raised C$31.7 million of equity through a bought deal public offering of shares and warrants in February 2021. As of March 31, 2021, the company’s cash balance totaled about US$31 million (C$39 million). Over the last five reported quarters, Excelsior’s operating cash flow deficit averaged around US$2.8 million per quarter.

| (in thousands of US $, except for shares outstanding) | 1Q 2021 | 4Q 2020 | 3Q 2020 | 2Q 2020 | 1Q 2020 |

| Operating Income | ($3,004) | ($1,839) | ($1,951) | ($3,499) | ($1,448) |

| Operating Cash Flow | ($1,869) | ($3,336) | ($1,037) | ($4,713) | ($3,097) |

| Cash – Period End | $31,068 | $13,606 | $18,225 | $22,072 | $15,637 |

| Debt – Period End | $15,159 | $15,864 | $16,217 | $16,195 | $5,090 |

| Shares Outstanding (Millions) | 274.4 | 240.2 | 239.6 | 239.6 | 239.6 |

Copper prices have soared about 120% over the past twelve months, reaching US$4.63 per pound last week. Infrastructure spending has been a priority in China and other countries as many governments have funded such projects to stimulate their economies after COVID-19-induced slowdowns. If copper prices were to reverse lower, the share prices of Excelsior Mining and other copper miners could come under pressure. Also, Excelsior Mining shares could suffer if removal of the carbon dioxide at Gunnison continues to be problematic.

If Excelsior can remedy the carbon dioxide issue at Gunnison and increase the project’s ISR mining flow rate to 25 million pounds of copper per year, and eventually to 125 million pounds annually, the stock’s valuation could be re-rated substantially higher. This potential is underscored by buoyant copper prices (essentially at all-time highs).

Excelsior Mining Corp. last traded at $0.63 on the TSX Exchange.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

3 Responses

No the entire project is surrounded by underground water…..

Will getting sufficient water be a problem for Excelsior? -L.

Will getting water sufficient for their purposes be a problem in bone-dry Arizona? -L.