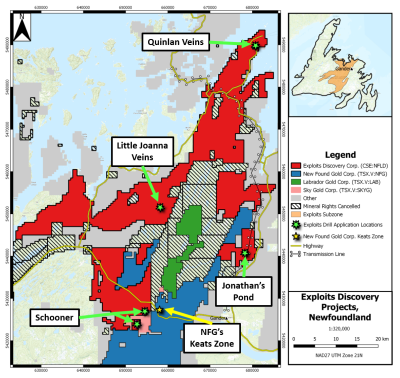

Exploits Discovery (CSE: NFLD) is looking to conduct a drill program at the Little Joanna and Quinlan Vein targets at its Dog Bay Gold project in Newfoundland. The company this morning announced that it has applied for drill permits for 4,500 metres of drilling at the targets.

The drill program is to be equally split between each of the two targets, with 9 holes and 2,250 metres of drilling to occur at each location. The program is in addition to the submitted permits for the Jonathan’s pond project, which brings total scheduled drilling to 10,500 metres thus far for 2021.

The Little Joanna target consists of quartz veins that contain visible gold, with surface samples previously assaying as high as 194 g/t gold. The veins are believed to be controlled by the Little Joanna Fault, a two kilometre long tertiary displacement fault. The Quinlan Vein prospect also consists of quartz veins with visible gold at surface, which has returned sample assays with values of 61.3 g/t gold and 189 g/t silver. Both targets are considered to be analogous to the Keats Zone discovery by New Found Gold.

“The successful sampling campaign Exploits conducted in late 2020, coupled with the efforts of our inhouse team and partner GoldSpot Discoveries, has doubled our tier one drill targets to four across our projects in the Exploits Subzone. The Exploits team is excited to refine each high value target for drilling programs as we drive towards discovery in 2021.”

Michael Collins, CEO of Exploits Discovery

Drill programs are expected to begin this spring, pending approval from the appropriate regulators.

Exploits Discovery last traded at $0.42 on the CSE.

FULL DISCLOSURE: Exploits Discovery Corp is a client of Canacom Group, the parent company of The Deep Dive. The company has been compensated to cover Exploits Discovery Corp on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.