Chinese authorities are reportedly considering lifting its unofficial two-year ban on Australian coal imports. Rumors about the move intensified after Australian Foreign Minister Penny Wong and Chinese counterpart Wang Yi met Friday, marking the first time the two countries have engaged in a diplomatic talk since 2019.

Chinese Foreign Ministry spokesman Wang Wenbin also said on Thursday that there is an opportunity to “build up positive energy, and create favorable conditions for sound and steady development between China-Australia trade relations.”

Beijing undertook an official ban on Australian imports since late 2020 after hostilities between the two countries escalated with Canberra barring Chinese tech firm Huawei Technologies from building a 5G network in the country. This was further exacerbated by then-Australian Prime Minister Scott Morrison’s call for investigating China related to the coronavirus origins.

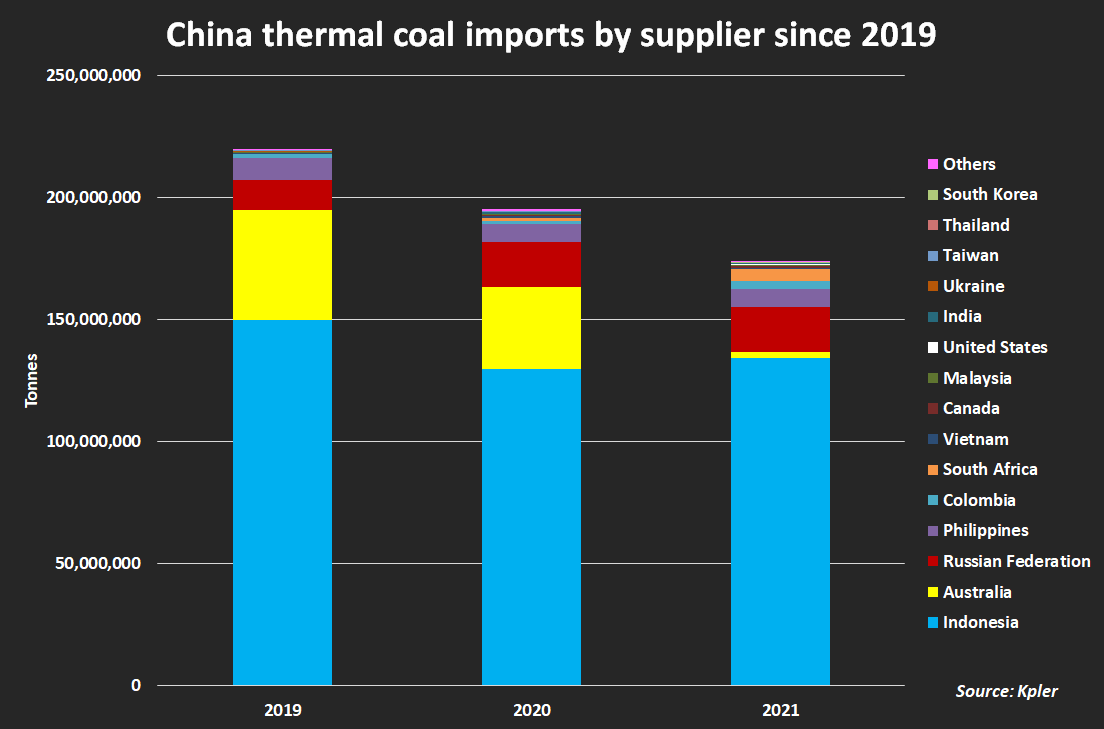

The ban on Australian coal specifically–China’s largest source after Indonesia–has hit the country’s energy supply, marred by rolling blackouts and surging coal prices.

Chinese policymakers were reportedly submitting a proposal related to the country’s energy outlook, including staying the ban on Australian coal imports. The reversal of the ban is believed to be beneficial as mounting sanctions on Russia are taking a toll on its state clients, as well as providing competition for other coal exporters to China that could effectively bring down costs.

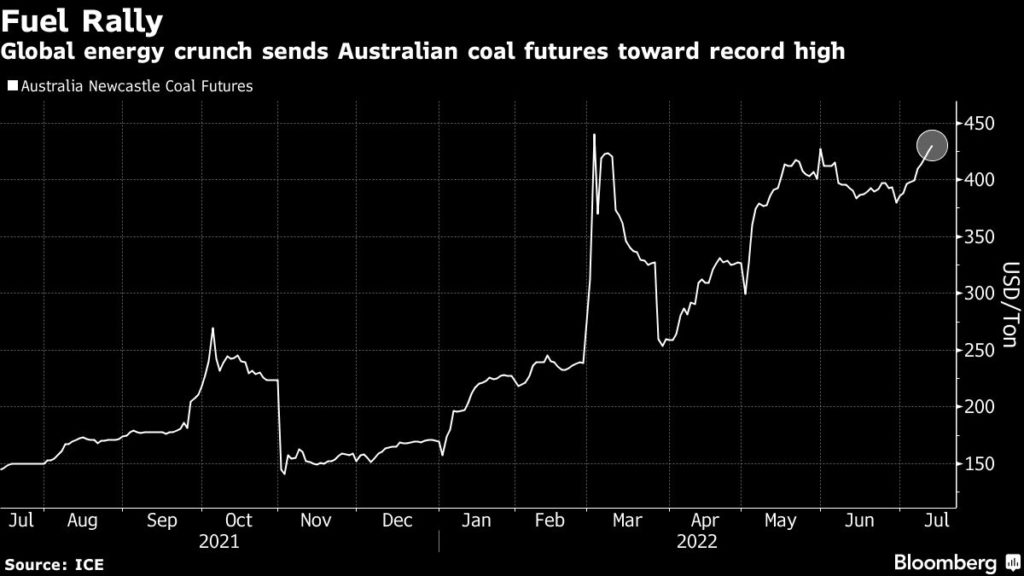

Australian coal futures have seen record high prices, back to the levels it has seen at the onset of the Russia-Ukraine war. But the reverse happened on Chinese coal producers since the news, sending coking coal on the Dalian Commodity Exchange down by as much as 4.1%, while coke dropped as much as 5.2%.

Information for this briefing was found via Reuters and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.