CAVA Group, Inc. (NYSE: CAVA), a Mediterranean fast-casual restaurant chain, last week completed the first IPO in the U.S. in some time, and the company’s offering was quite successful.

The company, which one observer cheekily described as “Chipotle Mexican Grill Inc. (NYSE: CMG), for 30+ [aged] people who feel like they should eat more fiber,” issued 14.4 million shares to the public at US$22 per share, which was above the estimated US$17-US$19 price range when the company initially filed with the SEC. Furthermore, the stock immediately traded well above its IPO price, reaching a high of nearly US$47 on June 15 and closing at US$38.15 on June 16.

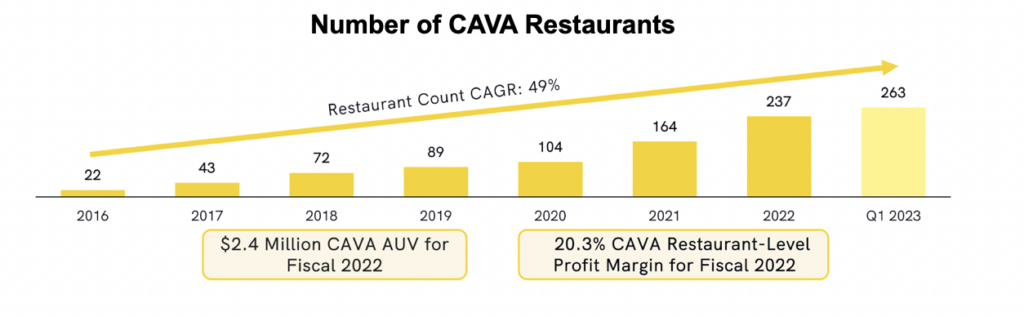

CAVA operates 263 restaurants and plans to grow that total to around 300 by year-end 2023. This 2023 forecasted growth, plus additional planned openings in future years, will be facilitated by proceeds from the IPO.

However, investors’ reaction to CAVA seems too enthusiastic given the financials underlying the company. Consider the following:

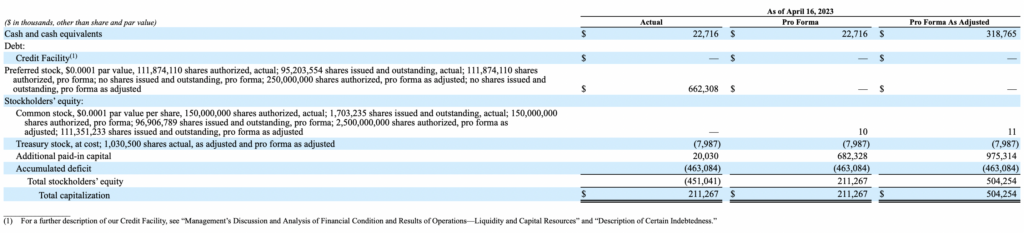

- 1) The number of CAVA common shares outstanding after the offering is 111.4 million, putting its stock market capitalization at around US$4.25 billion.

- 2) After reflecting proceeds from the IPO, CAVA’s pro forma cash balance is US$318 million. In addition, the company will have no debt or preferred stock outstanding.

- 3) CAVA’s pro forma enterprise value (EV) is about US$3.93 billion (US$4.25 billion less US$318 million of net cash).

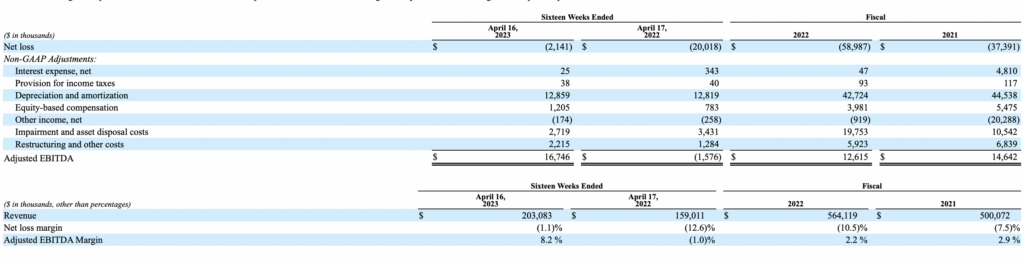

- 4) CAVA is not yet profitable — its net loss was US$2.1 million over the 16 weeks ended April 16, 2023 — but it did post positive adjusted EBITDA of US$16.7 million over that period. This suggests a current annual adjusted EBITDA run rate of about US$55 million.

- 5) CAVA’s revenue over the first 16 weeks of 2023 was US$203.1 million, equivalent to a current annualized pace of US$660 million.

- 6) CAVA therefore trades at EV-to-adjusted EBITDA and EV-to-revenue multiples of around 70x and 6x, respectively. Neither multiple can be considered low for a restaurant chain. For example, fast-growing, highly valued Chipotle trades at an EV-to-EBITDA multiple of around 35.5x.

CAVA Group, Inc. last traded at US$38.15 on the NYSE.

Information for this story was found via Edgar and the sources and companies mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.