As the Canadian Liberal government eagerly anticipates to begin a second bout of stimulus spending come September 23, several of the country’s largest banks have sounded the alarm of bottomless budget deficits.

Last Thursday, Chrystia Freeland, the new Finance Minister replacing Bill Morneau, held a call with several Canadian banks to deliberate potential economic policies and outlooks. However, according an individual familiar with the discussion, Freeland was also warned about the dangers of racking up an extensive budget deficit, and schooled on why spending should be allocated towards productivity-enhancing causes rather than simply meeting consumer demand.

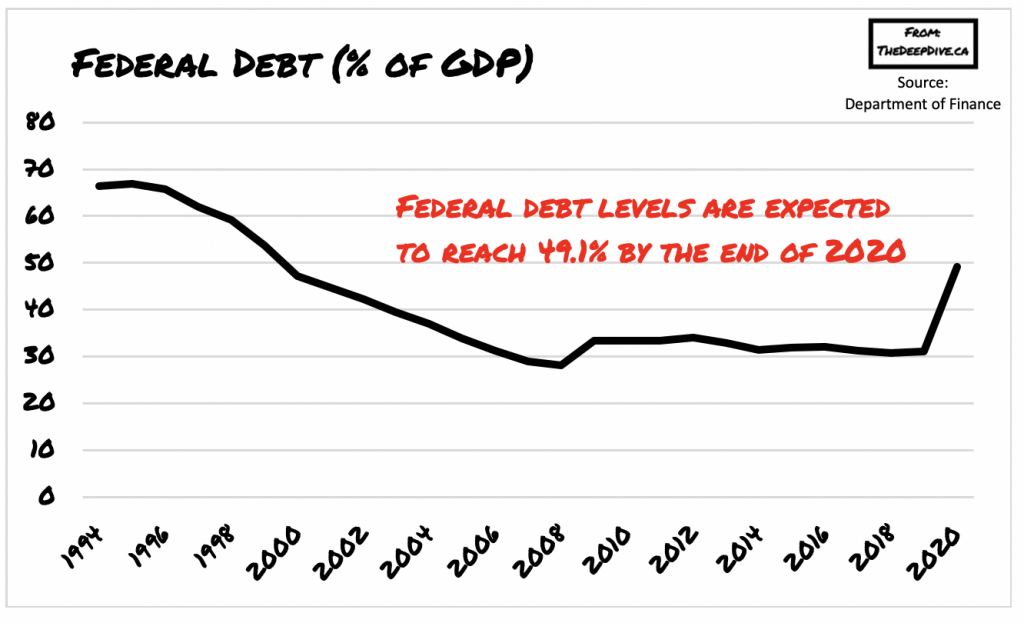

According to several economists, there needs to be a limit set regarding how far Canada’s debt-to-GDP ratio can rise to, contrary to the Liberal’s strong-held belief. Prime Minister Justin Trudeau recently unveiled the government’s plan to continue with increasing the already-ballooning deficit for the foreseeable future and to keep allocating tax dollars towards coronavirus emergency measures. Although seemingly ambitious, further government spending would cause the deficit to increase to approximately 50% of GDP in 2020 – something that does not sit well with many Canadians.

According to Bank of Nova Scotia economists Rebekah Young and Jean-François Perrault, the Canadian government has approximately a 65% debt-to-GDP ratio maximum before the country’s status as a least indebted government is put on the chopping block. If the Liberal government is unable to either curb its “money grows on trees” mentality or spur economic growth soon, the country may be in for some difficult times ahead.

Young and Perrault both suggest that it is now time to look into lowering the country’s debt ratio and begin foregoing additional emergency stimulus – despite the temptation of historically low interest rates. The economists recommend allocating tax dollars towards growth-inducing outcomes, such as increased funding for childcare in order to boost female labour force participation, as well as issuing grants to businesses that invest in capital and intellectual property.

Information for this briefing was found via Bloomberg and Department of Finance. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.