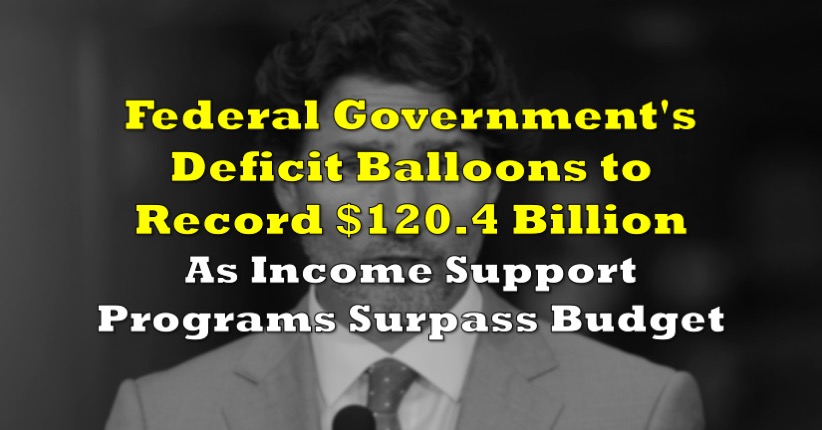

It appears that Canadians are in for a challenging road ahead, as the country’s budget deficit balloons to a record $120.4 billion for the three months ending in June – the biggest shortfall Canada has ever run.

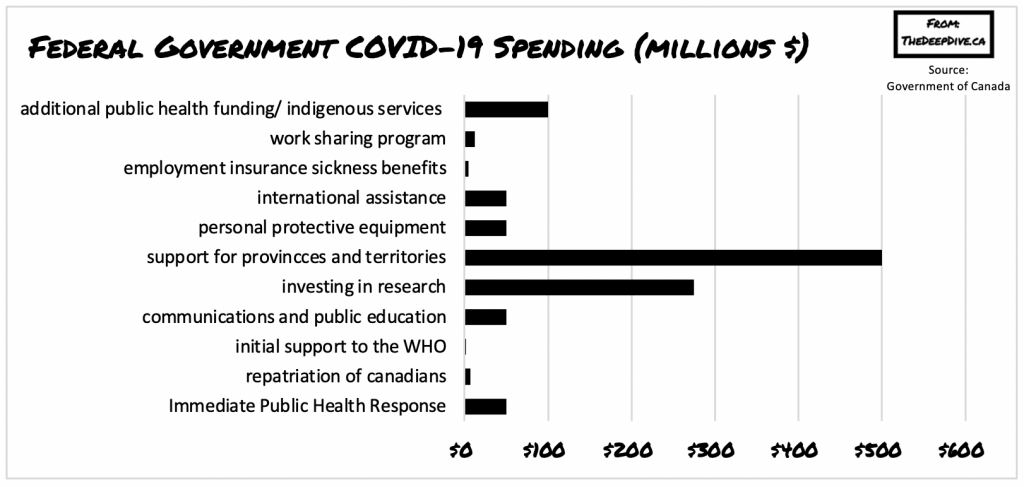

Since the onset of the pandemic, the federal government has implemented a series of programs to help mitigate the impact from the economic fallout and help suddenly-struggling Canadians via income support. Now six months into the pandemic, the Liberal’s flagship programs have collectively run up costs of $167.9 billion, which amounts to a 117% increase compared to the same period a year prior.

That is certainly a hard pill to swallow for many Canadians, given that Justin Trudeau’s government has exponentially burned through over one third of the country’s projected deficit for the entire year. Back in July, the federal government projected that the fiscal year deficit, which began on April 1, will expand to a whopping $343 billion, or 16% of GDP. The previous record was set when the Harper government racked up a shortfall of $56 billion back in 2009.

On the other end of the spectrum, incoming revenues have fallen drastically by 38%, as tax receipts from corporations and sales taxes continue to decline. Despite declining revenues and ballooning deficits, it appears that the Trudeau government is not done with the generous spending habits. Amid another ethics scandal that hurt the Prime Minister’s image so badly he had to hastily prorogue parliament, the Liberal government plans to come back with yet another ambitious spending plan aimed at filling gaps in the public health system.

Although that would certainly be a kind gesture for Canada’s health system which has been exposed to significant stressors as a result of the pandemic, the support among Canadians for deeper budget deficits is beginning to show signs of erosion. According to a recent Nanos Research survey, 43% of Canadians are in favour of reducing deficits close to pre-pandemic levels, even if it results in less benefits, while another 41% are not opposed to increased shortfalls. Nonetheless, whichever route the federal government chooses to take, we must keep in mind one thing – there is no such thing as a free lunch.

Information for this briefing was found via Statistics Canada. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.

Bond Junkies: Federal Reserve to Start Buying High Yield Corporate Bonds

In the duration of a month, over 16 million of unemployed Americans have been desperately...