As widely expected, the Federal Reserve hiked borrowing costs another 25 basis points, wrapping up its two-day policy meeting and bringing the fed funds rate to a range between 4.5% and 4.75%.

Interest rates are now sitting at the highest since October 2007, and Fed officials indicated they will continue to keep raising them until inflation returns to the 2% target range— pending incoming economic data, of course. “In determining the extent of future increases in the target range, the Committee will take into account the cumulative tightening of monetary policy, the lags with which monetary policy affects economic activity and inflation, and economic and financial developments,” read the FOMC statement.

Still, Fed Chair Jerome Powell didn’t wane from the bank’s aggressive policy, alluding that high interest rates will remain in place for the foreseeable future. “Given our outlook, I don’t see us cutting rates this year, if our outlook comes true,” he said in a follow-up press conference. “If we do see inflation coming down much more quickly, that will play into our policy setting, of course.”

“We are going to be cautious about declaring victory… We have a long way to go.”

— Bloomberg (@business) February 1, 2023

If inflation does come down faster than expected, that will be incorporated in the Fed’s thinking about policy, Jerome Powell says https://t.co/VGwNjtkdyd pic.twitter.com/oioMkO196m

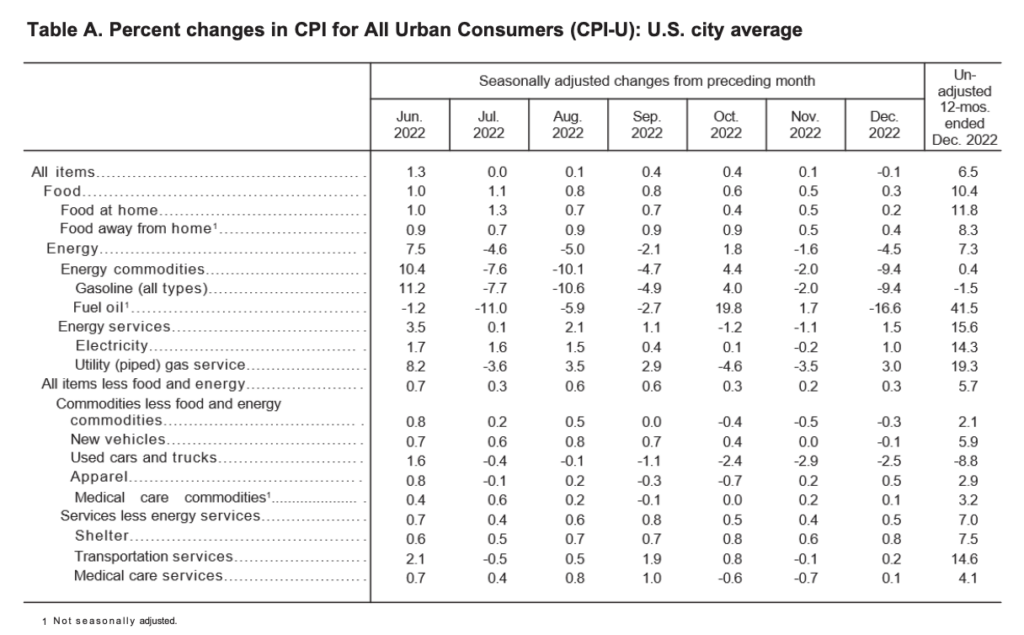

Inflation sat at 6.5% in December— more than three times the Fed’s target rate of 2%; however, Powell pointed out that the disinflationary process is unravelling across America’s economy. We can now say I think for the first time that the disinflationary process has started. We can see that and we see it really in goods prices so far.” He did add, though, that it’s still too early to declare a victory, because disinflation is still in the very early stage.

The FOMC reiterated its observations that employment levels remain robust, and growth in spending and production remains modest. “We’ve raised rates four and a half percentage points, and we’re talking about a couple of more rate hikes to get to that level we think is appropriately restrictive,” Powell said during the press conference. “Why do we think that’s probably necessary? We think because inflation is still running very hot.” With that, Powell anticipates the US economy will still expand this year, but at a subdued pace. “My base case is that there will be positive growth this year,” he added.

Jerome Powell: New Year; New me

— Triffin (@BrotherhoodXIV) February 1, 2023

However, FOMC members cited a number of global risks that could force a pivot in the Fed’s monetary path, primarily the war in Ukraine. “The Committee would be prepared to adjust the stance of monetary policy as appropriate if risks emerge that could impede the attainment of the Committee’s goals,” the FOMC statement added.

what if Jerome Powell was just like pic.twitter.com/1by39MbmFe

— Kyle S. Gibson (@KyleSGibson) February 1, 2023

Information for this story was found via the Federal Reserve and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.