Amid the unprecedented onset of the coronavirus pandemic, many Americans suddenly found themselves under mandatory physical distancing measures and economic lockdowns. As a result, unemployment numbers began soaring into the millions, and the US Bureau of Labour Statistics (BLS) was of course in charge of the keeping up-to-date track of the exponentially changing employment rate. However, a startling new discrepancy has emerged, which suggests the BLS statistical models may be significantly inaccurate.

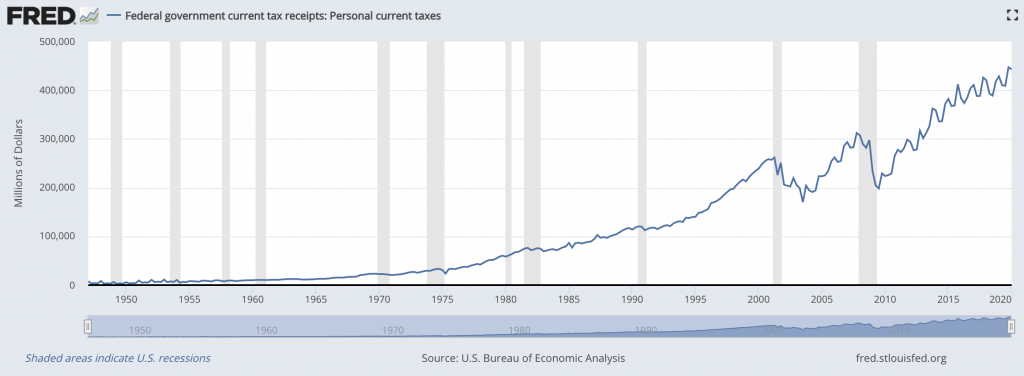

According to the Monthly Treasury Statement for the month of May, the number of federal withheld income tax receipts fell by a record 33% when compared to the same time a year prior. Given that the tax receipts are strongly correlated with worker’s paychecks, the disparity between the reported household employment numbers is three times less of a decline than the reported tax receipts. Such a gap is suggestive of an inaccuracy of both the April and May unemployment numbers as reported by the BLS.

Given that government has not enacted any new legislature amid the coronavirus pandemic that would indicate any unanticipated changes in the withheld gross federal income tax receipts. As a result, a viable explanation would suggest a sudden decrease in salary and wage income would be to blame. With an unemployment rate of approximately 13% and tax receipts falling by 33%, there is a good chance that the BLS data is grossly misrepresented, and there are in fact a lot more Americans experiencing some sort of salary reduction or unemployment as a result of the pandemic.

Information for this briefing was found via CNBC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.