As a response to the ongoing coronavirus pandemic, the Democrats have unveiled a second coronavirus stimulus bill, which comes with a hefty $3 trillion price tag.

The coronavirus pandemic has severely stricken the US economy with unemployment numbers in the millions, and infection rates surpassing a third of total infections worldwide. The lifting of restrictions across the country are so far not contributing to a turnaround in the economy, but rather causing coronavirus cases to continue increasing exponentially. As a desperate response, the House Democrats have come up with a second $3 trillion stimulus package.

The 1,800 page package allocates $1 trillion to local governments, $200 billion to essential workers facing increased health risks, $75 billion to go towards increased coronavirus testing and contact tracing, and $175 billion to help those struggling to make utility payments. The bill also earmarks funds to provide Americans with a second round of $1,200 one-time payments, $10 billion in emergency disaster assistance grants, and subsidies for employees that lose their employer-funded healthcare coverage. Lastly, the bill also proposes extending the federal unemployment insurance benefit from July to January, as well as setting aside money for election safety and increasing mail voting during the pandemic.

However, upon further inspection of the emergency relief bill, we see that it is nothing more than a wolf disguised in a sheep’s wool. Remember when Donald Trump included a provision in the first stimulus package outlining tax breaks for some of the wealthiest of Americans? Well, contrary to the Democrat’s perceived persona of heroism in the face of Republican inclemency, the new $3 trillion bill also comes with its own set of provisions favoring wealthy democratic donors and powerful lobbyists.

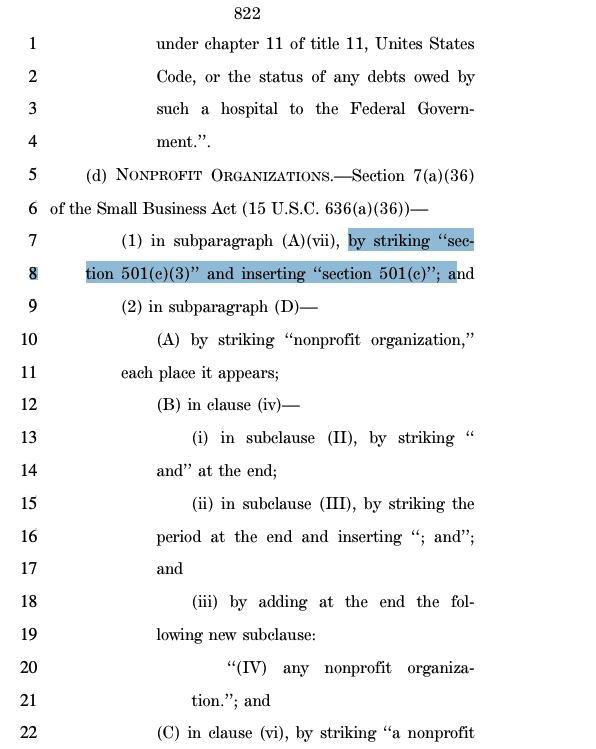

In the bill’s section earmarked for small businesses, there is a inconspicuous provision which would allow Washington-based lobbyist groups, airlines, Wall Street Banks, and for-profit colleges to seize the loans that are otherwise allocated for humble small businesses in local communities.

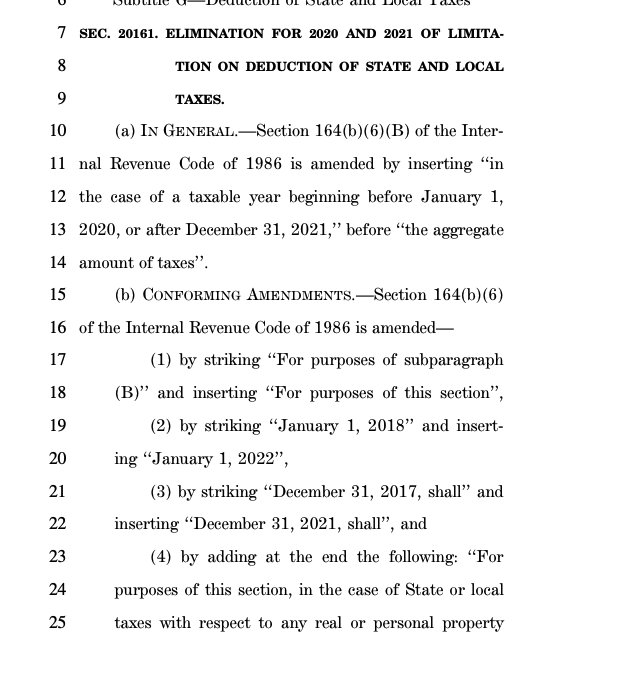

As if that wasn’t a big enough slap in the face for honest small businesses, the $3 trillion bill also includes provisions which would allow upper income tax cuts for real estate owners in Democrat-majority states for both 2020 and 2021.

We’re not finished yet though! Within the bill is also an anti-poverty provision, which on the surface appears to be aimed at helping America’s most vulnerable via an income tax credit; however, that is sadly not quite the case. In the provision, wealthy individuals that earn an pretty income from royalties and dividends can also claim the income tax credit – once again, the rich get richer.

It seems as if the Democrats totally forgot about their supposed progressive values, and instead allowing massive tax breaks for the wealthiest of Americans, meanwhile imposing strict provisions to prevent working-class Americans from double dipping of the already tiny sliver of the one-time $1,200 payment.

Information for this briefing was found via CNBC and RT News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.