First Majestic Silver (TSX: FR) closed on Thursday its previously announced transaction to sell its 100% owned past producing La Guitarra Silver Mine to Sierra Madre Gold & Silver (TSXV: SM).

The mining firm first announced the proposed acquisition back in May 2022. In exchange for the sale, First Majestic received 69,063,076 Sierra Madre shares at a presumed price of $0.65 per share, for a total estimated value of $44.9 million (US$35.0 million).

Sierra Madre last traded at $0.74 before trading was halted following the acquisition announcement last year. Following the transaction’s completion, First Majestic owns about 48.4% of Sierra Madre’s issued and outstanding common shares.

First Majestic’s common shares are subject to contractual resale restrictions. The shares will be released in four 25% tranches every six months starting September 2023. The company also maintains participation rights in any future equity issuances by Sierra. According to the provisions of the agreement with Sierra Madre, First Majestic may distribute to First Majestic’s shareholders all common shares in excess of 19.9% of the issued and outstanding Sierra Madre common shares on a pro-rata basis, with resale restrictions not applying to those distributed shares.

The move comes after the mining firm temporarily suspend mining activities at Jerritt Canyon, which represented approximately 21% of the Company’s 2022 revenue. The firm is also reducing investments at the mine in an effort to reduce overall costs.

Acquired in 2021 from Sprott Mining, First Majestic paid $470 million for the asset in the form of shares, plus an additional 5 million common share purchase warrants. The underground mine has attempted to run at a rate of 3,000 tpd in an effort to reach the point of free cash flow, however the firm failed to reach that level at a steady rate.

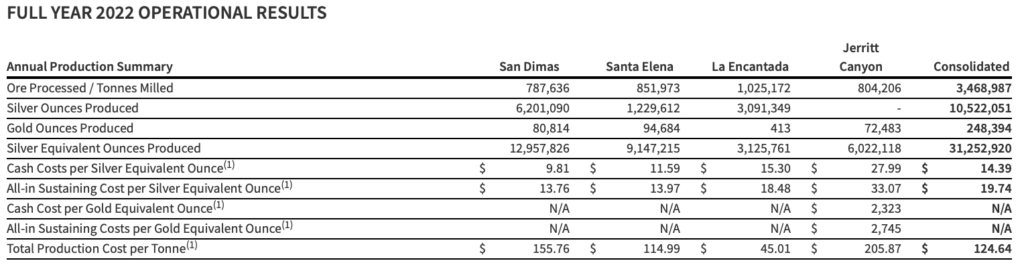

For its 2022 results, First Majestic produced a total of 31.3 million silver equivalent ounces. Jerritt Canyon contributed 6.0 million ounces but San Dimas and Santa Elena produced more at 13.0 million ounces and 9.1 million ounces, respectively. La Encantada added 3.1 million ounces.

Jerritt Canyon also has the highest all-in sustaining cost per ounce of silver equivalent at $33.07 when compared to the other mines.

The firm suspended 2023 guidance for the mine, while guidance for the firms Mexican operations are slated to be released in July.

Previously issued guidance for 2023 suggested the mine would produce 119,000 to 133,000 ounces of gold at a cash cost of between $1,502 and $1,592 per ounce, while all-in sustaining costs were slated to be between $1,733 and $1,842 per ounce.

First Majestic last traded at $9.44 on the TSX.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.