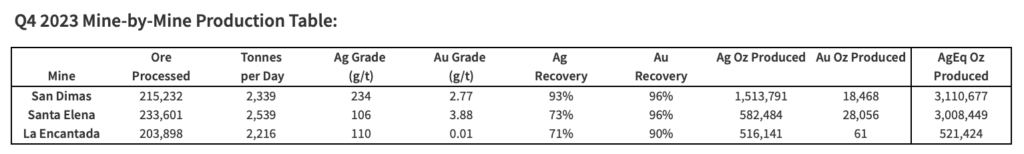

First Majestic Silver Corp. (TSX: FR) concluded 2023 with robust performance, announcing a total production of 6.6 million silver equivalent (AgEq) ounces in the fourth quarter, reflecting a 6% increase from the previous quarter. The quarterly results contributed to the full-year production of 26.9 million silver equivalent ounces, aligning with the revised guidance of 26.2 to 27.8 million AgEq ounces.

As of press time, the company’s share fell as much as 6%, responding to the news.

The company said Santa Elena Silver/Gold Mine achieved record production in the fourth quarter, contributing to the overall increase. The mine set a new quarterly production record of 3.0 million AgEq ounces, marking a significant 13% improvement from the prior quarter. However, La Encantada Silver Mine experienced lower silver production due to ongoing limited water availability, partially offsetting the overall production gain.

Keith Neumeyer, the President & CEO of First Majestic, expressed his satisfaction with the year-end results, stating, “First Majestic finished 2023 on a strong and positive note, despite the challenges endured earlier in the year, and I would like to congratulate the team on their hard work and efforts.”

The company’s exploration endeavors remained active, with a total of 16 drill rigs operating during the fourth quarter, completing 32,881 meters of drilling across its mines in Mexico.

Looking ahead to 2024, First Majestic provided production guidance for its three operating mines in Mexico. The company expects total production to range between 21.1 to 23.5 million AgEq ounces, comprising 8.6 to 9.6 million ounces of silver and 150,000 to 167,000 ounces of gold. The decrease in forecasted gold production is attributed to the temporary suspension of the Jerritt Canyon Gold Mine in Nevada, a decision made in Q1 2023.

The company’s strategic initiatives include the launch of its 100%-owned and operated minting facility, First Mint, currently in the commissioning stage. This facility aims to enhance bullion sales by vertically integrating the production of investment-grade fine silver bullion, enabling First Majestic to sell a greater portion of its silver production directly to customers.

Neumeyer concluded, “We’re expecting 2024 to be an exciting year for our exploration team,” emphasizing the company’s positive outlook and anticipation for continued success in the coming year. Investors and stakeholders are likely to closely monitor First Majestic’s strategic initiatives and operational performance as the company navigates the evolving landscape of the precious metals industry.

First Majestic last traded at $7.41 on the TSX.

The author has no securities or affiliations related to any organization mentioned. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.