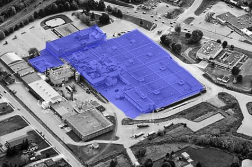

FSD Pharma (CSE: HUGE, OTCMKTS: FSDDF) announced late last night that it had cut ties with Auxly Cannabis (TSXV: XLY, OTCMKTS: CBWTF) in an unexpected turn of events. The two were jointly developing the expansion of the FSD Pharma facility in Cobourg, Ontario at the former Kraft plant.

The agreement between the two entities was to see the eventual development of the proposed 3.8 million square foot facility located in Cobourg. While FSD Pharma owns the facility, the joint venture called for Auxly Cannabis to own the streaming rights to 49.9% of the product that was grown in the facility. In exchange, there were a number of services that Auxly was to provide, in addition to the full funding of the expansion.

The reasonable assumption behind the termination of the agreement by FSD Pharma pertains to the current status of the facility expansion. Originally slated to be completed in December 2018, the anticipated completion date was pushed to January 2019 in late fall of last year. This date has now since come and gone, with the facility still not substantially complete – with responsibility for this falling on that of Auxly Cannabis.

The terms of the FSD Pharma expansion

Under the terms of the definitive agreement that was signed on March 5, 2018 between the two parties, Cannabis Wheaton, now Auxly, was to provide for and manage several aspects of the operation. This included:

- the design of each phase of development at the Facility and the management and supervision of all professional services performed in connection therewith, including architectural services, engineering services, construction services and security services;

- the selection of and provision of Cannabis genetics (e.g. seeds, cuttings or clones) for each phase of development at the Project Facility;

- assisting in the hiring, training and oversight of professional and operational staff;

- assisting in the development and implementation of distribution strategies for all Products produced at the Project Facility including sourcing unique distribution channels for such Products; and

- assisting with the regulatory licensing process including facilitating interaction between FV Pharma and Health Canada.

- Cannabis Wheaton has primary responsibility for financing and/or sourcing the funds required for the capital expenditures for each Project Phase at the Project Facility, to be comprised of both equity and debt financing provided directly by Cannabis Wheaton or by a third party lender arranged for and designated by Cannabis Wheaton.

With the dissolution of this agreement, it is unclear what financial penalty FSD Pharma will ultimately be on the hook for. Although we attempted to find a copy of the original signed material contract between the two parties, no such contract had been filed by either company with Sedar or the CSE. It can be assumed that they will be responsible for the repayment of expenses associated with the current development of Phase I that still remains in progress.

The cost to FSD Pharma for dissolution

What we do know in regards to the dissolution of the joint venture, is that it will cost FSD Pharma in one form or another – either in terms of cash, or in terms of the cost of capital once Auxly Cannabis begins dumping its shares in the company. At last count, the company had at minimum 7,500,000 shares of FSD Pharma.

Although the current expansion is not as of yet complete, the total cost of the first phase was estimated to be $55mm in total. Should FSD have to reimburse this amount to Auxly, it will very quickly find itself in a cash crunch, based on the $33mm it had in company coffers as of September 30, 2018. This does not include any potential penalties which may exist as a result of breaking the definitive agreement. Additionally, the company still has minimal sources of revenue, given that it has yet to be granted its sales license under the Cannabis Act.

Further to this, is the time value of money. As it stands, FSD Pharma will undoubtedly not have the funds to continue with the buildout of the Phase I expansion by the time it is done repaying Auxly for site developments. This further delays any substantial square footage from coming online for production – after already facing multiple months of delays. Thus, the timeline for profitability for FSD Pharma has been put into question entirely.

FSD Pharma will thereby be forced to perform a capital raise in order to fund the facility retrofit – both for the completion of Phase I, as well as subsequent expansions. Given it’s bloated, over diluted dual share structure, the firm will be hard pressed to find institutional dollars in a market that is careening towards summer doldrums. Without a major investor, the company is facing a significant going concern.

Interestingly enough, within its listing statement filed last May, FSD Pharma identified the potential loss of the joint venture with Auxly Cannabis as a major risk to it’s operation.

It reads, “The Corporation’s business plan contemplates several strategic partnerships or relationships that may not necessarily materialize in the course of the Corporation’s business, particularly with respect to its proposed cultivation Facility. In connection therewith, the Corporation expects to be dependent on its strategic relationship with Cannabis Wheaton, whose management team will assist FV Pharma with all aspects the design, development, financing, build-out and operations of its Facility as well as the marketing, branding and distribution of the cannabis and cannabis-derived products generated by the Facility. If this relationship is unsuccessful, or if the Corporation is unsuccessful in establishing it, the Corporation may be unable to effectively develop, manufacture, market and distribute its products in accordance with its business plan.”

FSD Pharma’s path forward

So, where is FSD Pharma to go from here? Fair question. Within the same news release, it was also announced that the companys Chief Executive Officer was removed from the position after being on the job for a little over two months. Raza Bokhari, the co-chairman of the company, will be serving as interim CEO until a suitable replacement is found.

Commenting on the matter, Bokhari stated, “The Board believes the Company has unique and invaluable assets and is taking appropriate actions that will support long-term positive cash flow and shareholder value.” In short, a generic statement that does nothing to quell investor concerns or fears.

With the replacement of Rupert Haynes, an ex-GW Pharmaceuticals executive, shareholders are left wondering what direction the company is headed – ties have been severed in the direction of both mass cannabis production, as well as pharmaceuticals. With this, expect some share price commotion as investors reevaluate their appetite for risk.

Information for this briefing was found via Sedar, The CSE, and FSD Pharma. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.