The fundamentals for one of the world’s most scorned commodities, thermal coal, continue to improve, and it is difficult to see a marked change coming over the near to intermediate term that would cause energy-starved countries to move away from the polluting fuel. In particular, India, the world’s second biggest coal-consuming country (to China) needs to and plans to buy more coal. Even U.S. power utilities appear to be boosting stockpiles from low levels.

India’s Central Electricity Authority declared that coal stocks are at or below critical levels at 81 of 150 coal-fired plants in India. In more detail, the Indian newspaper The Indian Express reports that power plants that use domestic coal had only about eight days of coal stockpiles as of mid-April. The typical benchmark is 24 days.

Phrased another way, the Indian plants on April 20 had 20.6 million tonnes of aggregate coal, far less than the government’s 58 million tonne goal it hoped to achieve to avoid a power crisis similar to that of October 2021. Power outages occurred last year in Indian states such as Punjab, Utter Pradesh and Haryana. Electricity produced by burning thermal coal accounts for about 75% of India’s power.

India’s peak power demand exceeded 200 gigawatts (GW) for the first time in 2021 and is expected to be even higher in 2022. By comparison, the peak demand in the lower 48 states of the U.S. reached 720 GW in August 2021.

In addition, China is promoting the use of coal production and coal-fired power again after economic growth proved less than satisfactory in 2021. Power shortages caused blackouts and factory outages a year ago in the region.

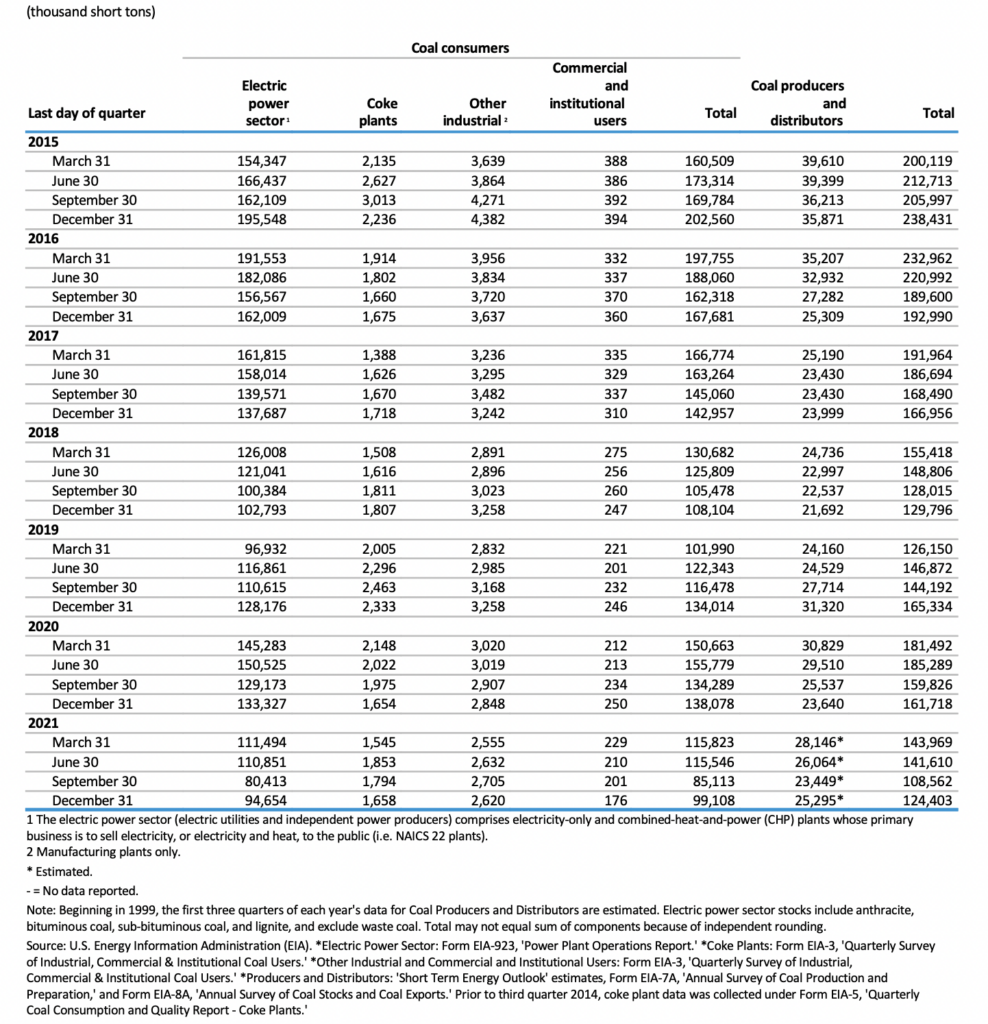

In the U.S., utility coal stockpiles recovered somewhat in December 2021 but still sit near multi-year lows. Because of strong coal demand, American Electric Power Company, Inc. (NYSE: AEP), a U.S. utility reliant on coal, had to idle some of its West Virginia power plants last fall to avoid running out of coal during peak winter months. (Admittedly, some of the decline in utility coal inventory in the U.S. over the last few years traces to the country’s decision to emphasize renewable energy as opposed to environmentally unfriendly sources of energy like coal.)

After peaking at about US$430 per tonne when Russia invaded Ukraine, thermal coal has lost about a quarter of its value and is trading at around US$326. Still, the commodity is up more than 500% in only 18 months. Unprecedented sanctions imposed on Russian coal have bolstered coal prices, and those constraints seem likely to remain in place for quite some time.

Information for this briefing was found via Edgar and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.