Galaxy Digital (TSX: GLXY) yesterday announced that it would be terminating its acquisition of BitGo due to BitGo’s failure to deliver its 2021 audited financial statements by July 31, 2022.

Commenting on the termination, Galaxy stated that it remains focused “on executing its business objectives and driving long-term performance for investors.” This includes rolling out their Galaxy One Prime, an institutional product focused on “trading, lending, and derivatives alongside access to qualified custody all through a unified tech platform.”

Galaxy Digital has three analysts covering the stock with an average 12-month price target of C$18, or an upside of 100%. Out of the three analysts, one has a strong buy rating, one analyst has a buy rating, and the last analyst has a hold rating on the stock. The street high price target sits at C$28, or an upside of 217%.

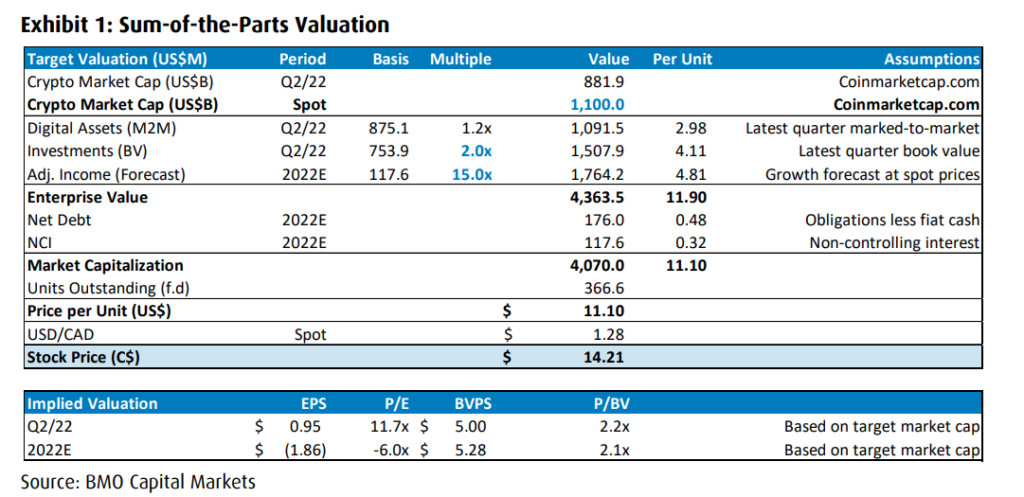

In BMO Capital Markets’ note on the news, they reiterated their outperform rating but cut their 12-month price target to C$14 from C$16 to reflect the lowered multiple as a result of the termination of the acquisition. They have lowered Galaxy to 15x 2022 EV/sales versus 20x prior.

BMO writes, “Although this is a negative surprise, we see several near-term implications that are positive for Galaxy,” saying the biggest tailwind for the stock would be its U.S listing.

On the news, BMO was slightly caught off guard, saying that they were surprised the deal was terminated and expected this to reflect poorly on management. They also believe that Galaxy is walking away from future synergies and technology developers in-house, while adding that the BitGo $100 million lawsuit against Galaxy “does not help.”

Though they say that the ultimate silver lining is that “this is a definitive step forward for Galaxy amidst ongoing regulatory uncertainty around their U.S. listing.” One of the bigger positives is that the market has seen a 50% correction since the deal was announced, while BitGo’s cash burn and balance sheet have likely “deteriorated significantly” since then.

Below you can see BMO’s sum-of-the-parts valuation for Galaxy.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.