On November 15th, Galaxy Digital Holdings Ltd. (TSX: GLXY) reported its third quarter financial results. The company reported total income of $216.53 million and expenses of $151.24 million. Of that $216 million, $149.7 million came from realized gains on digital assets.

Below those line items, the company saw a $379.49 million and $144.29 million unrealized gain on digital assets and investments respectively. bringing the net income to $532.9 million. The company boasts $275.8 million of cash on hand, around $2.1 billion of digital assets, and another $500 million in digital assets receivables.

Galaxy currently only has 3 analysts covering the stock with the average 12-month price target being C$45.67, or a 30% upside to the current price. Out of the 3 analysts, 1 has a strong buy rating, 1 has a buy rating and the last analyst has a hold rating on the company. The street high sits at C$48 from BTIG while the lowest comes in at C$44.

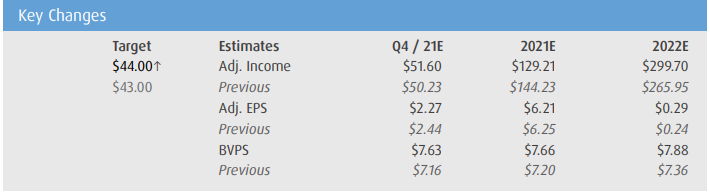

In BMO’s third quarter review, they reiterate their outperform rating and raise their 12-month price target to C$44 from C$43. They say that this quarter shows accelerating momentum into the fourth quarter while the company pushed back their U.S listing and BitGo acquisition closing from the fourth quarter to the first quarter of 2022.

For the results, BMO says that the company beat their EPS and BVPS estimates of $1.12 and $5.43, as the company reported $1.48 and $5.81 respectively. This beat was attributed to the crypto market being up 35% this quarter, while they say that operating revenue came in lower due to “trading volumes recovered slower than crypto prices, and slower initial capacity ramp in bitcoin mining.”

BMO says that the company pushing its U.S listing back to the first quarter of 2022 is disappointing but not entirely surprising since the company has to convert its financials to U.S GAAP and “re-domestication” into the U.S. This is all happening while the company is completing its BitGo acquisition.

Lastly, BMO touches on Galaxy’s management, saying that institutional understanding of cryptocurrencies is a lot higher than investment levels. This is primarily due to the lack of regulatory clarity for the sector. BMO writes, “Galaxy expects an unprecedented spike in private investment to accelerate innovation and drive higher growth in 2022, notwithstanding the risk of a tax-driven correction in Q1.”

Below you can see BMO’s updated estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.