Even amid the rapid and sharp erosion of purchasing power, nearly half of Americans still have some money left in their wallets— that they’re probably overlooking.

According to a recent survey conducted by CreditCards.com, 47% of consumers currently have at least one gift card, store credit, or voucher laying around that they have yet to use. The survey, which collected responses from 2,372 adults, found that the average amount on the unused credits increased from $116 in July 2021 to $175. With prices at 40-year highs, such a sum could make a substantial difference for consumers’ wallets.

“It’s like finding that $20 bill in that jacket pocket from last winter,” said CreditCards.com senior industry analyst Ted Rossman. “But in this case, it’s even more money than that.” He cautioned that holding onto unused gift cards is not a wise financial move given that inflation erodes away at the purchasing power of the sums, the card could get lost, or the store issuing the card could charge inactivity fees. “There’s really no good that comes from letting these lie around.”

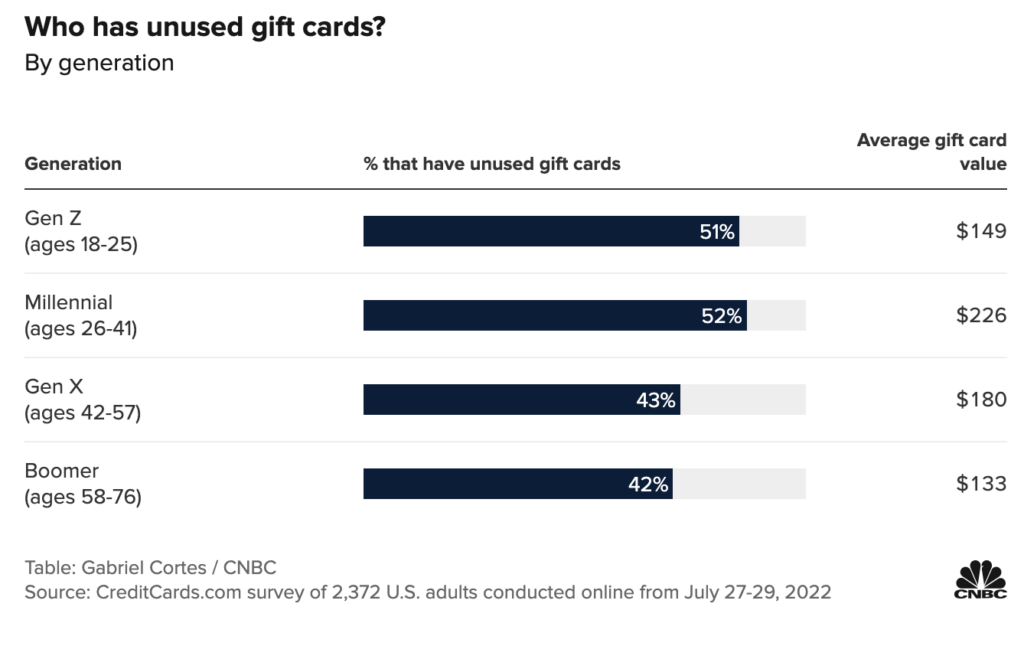

The survey found that millennials were the most likely to carry unspent balances on gift cards, with 52% of the demographic holding onto an average value of $226. Likewise, about 52% of the Gen Z population had unused balances around $149 each. Both Gen X and baby boomers also failed to spend their gift cards, carrying around unused sums of $180 and $133, respectively.

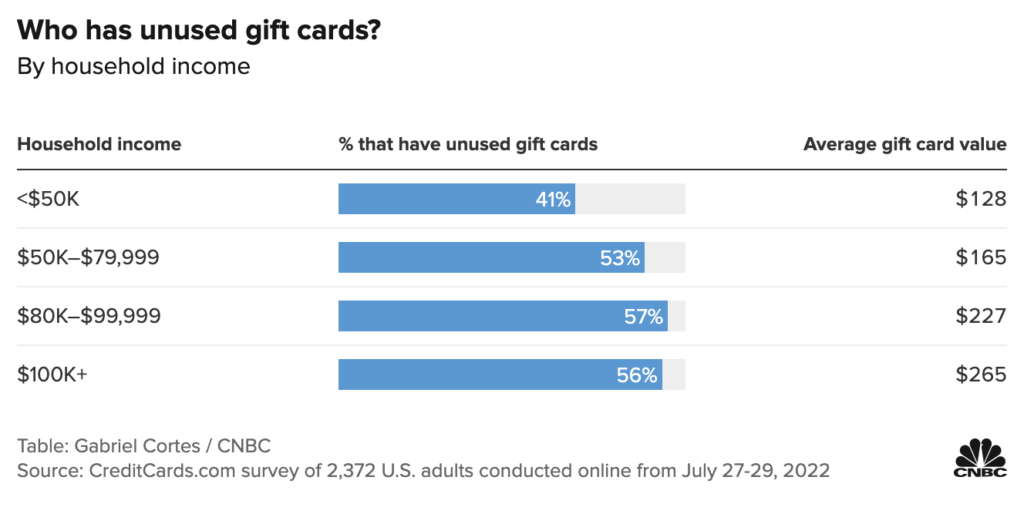

As expected, those with lower income levels were less likely to not use their gift cards. The survey found that 57% of respondents earning between $80,000 and $99,999 held an average unused value of $227, followed by those with incomes over $100,000 at 56%.

Information for this briefing was found via CNBC and CreditCards.com. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.