Never let a good crisis go to waste! The post-pandemic energy crisis has sent oil and gas prices soaring, boosting energy companies’ profits and sending global dividend payments to shareholders surging to record-highs.

Major oil and gas companies and particularly state-owned firms in Latin America reaped enormous profits amid the surge in energy prices, and accounted for two-fifths of the overall global increase in dividend payments in the second quarter. Likewise, financial institutions no longer under pandemic-era dividend restrictions also contributed considerably to the growth in payouts, as did major automakers.

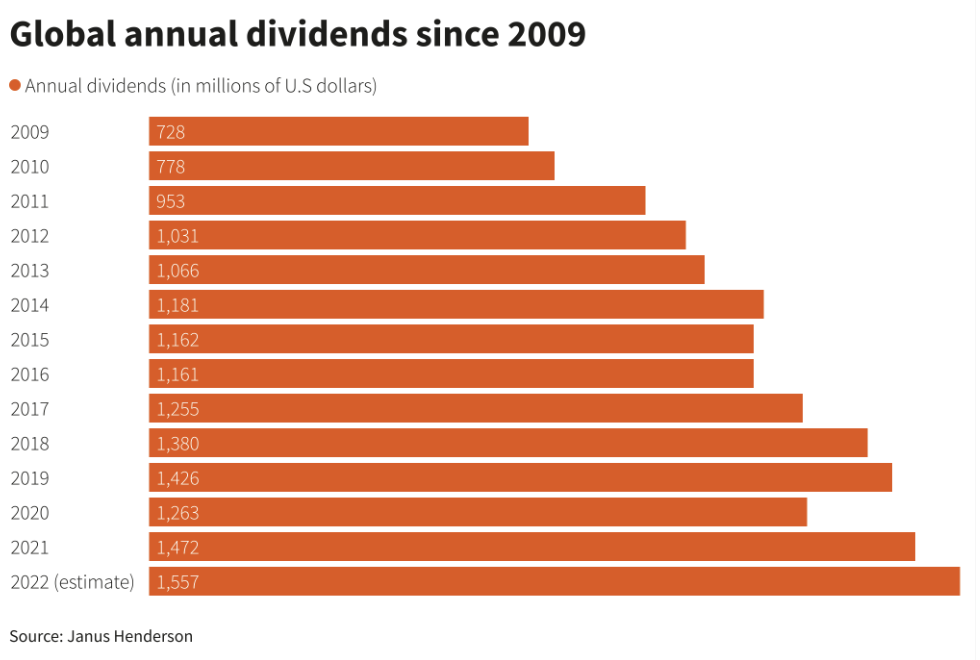

Data from fund manager Janus Henderson, as cited by Reuters, showed that global dividend payments jumped 11.3% from last year to $544.8 billion in the three months ending in June, marking a substantial increase from when companies were forced to cut payouts during the height of the Covid-19 crisis. Janus Henderson estimates that for the entirety of 2022, dividend payments will increase by another 5.8% year-over-year to a record $1.56 trillion.

Major South American oil producers such as Brazilian Petrobras and Columbian Ecopetrol were behind the massive increase in last quarter’s dividend payouts, which is good news for shareholders and most notably, pension funds. However, the current bleak outlook on the global economy may spell trouble for those investors relying too heavily on energy companies for higher payouts.

Despite the benefit of larger dividend payouts to pension funds, governments may be inclined to impose windfall taxes on profits derived from the oil and gas industry. “We would say that companies paying out dividends to shareholders is preferable from an environmental sustainability view than reinvesting into new oil and gas production that contributes to yet further global warming,” commented Carbon Tracker’s Mike Coffin, as cited by Reuters.

Information for this briefing was found via Reuters. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.