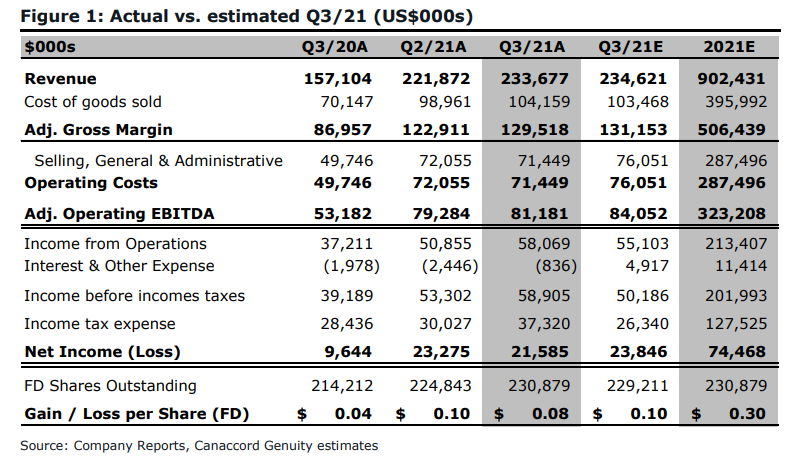

On November 10th, Green Thumb Industries (CSE: GTII) reported its third quarter financial results. The company reported revenues of $233.7 million, an increase of 5.3% increase quarter over quarter but a 48.7% increase year over year. Gross profits meanwhile came in at $129.52 million for the quarter and the firm posted a positive net income of $21.58 million or earnings per share of $0.08. The company indicated that adjusted EBTIDA was $81.2 million, up 2.4% quarter over quarter and 52.6% year over year.

A number of analysts changed their 12-month price targets on Green Thumb, bringing the average 12-month price target to C$58.19 or a 71.5% upside to the current price. Green Thumb currently has 16 analysts covering it, with 4 analysts having a strong buy rating and the other 12 have buy ratings. The street high sits at C$80 from Stifel-GMP while the lowest comes in at C$40.

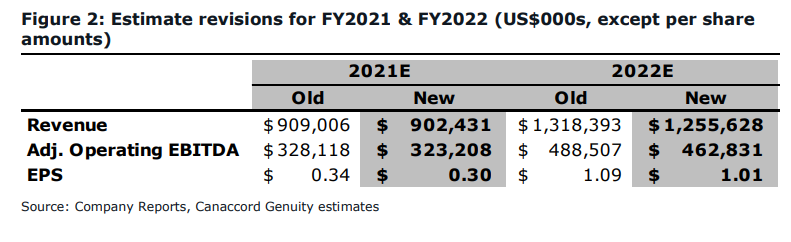

In Canaccord’s third quarter review they reiterate their buy rating but lowered their 12-month price target to C$53 from C$56, saying, “A clean print amid a slower macro environment.” They additionally believe that the results in the face of a tough backdrop “is a testament to the company’s ability to navigate through sector headwinds while maintaining its profitability profile.”

For the quarter, Green Thumb slightly missed on all of Canaccord’s estimates, specifically Canaccord forecasted revenues of $234.62 million, adjusted EBITDA of $84.05 million, and earnings per share of $0.10. Canaccord says that this quarter’s outperformance versus its peers is due to closing multiple tack-on acquisitions which included 5 new retail stores.

For the company’s gross margin, Canaccord is very happy with it being flat quarter over quarter as the company saw decelerating revenue.

Below you can see Canaccord’s updated 2021 and 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.