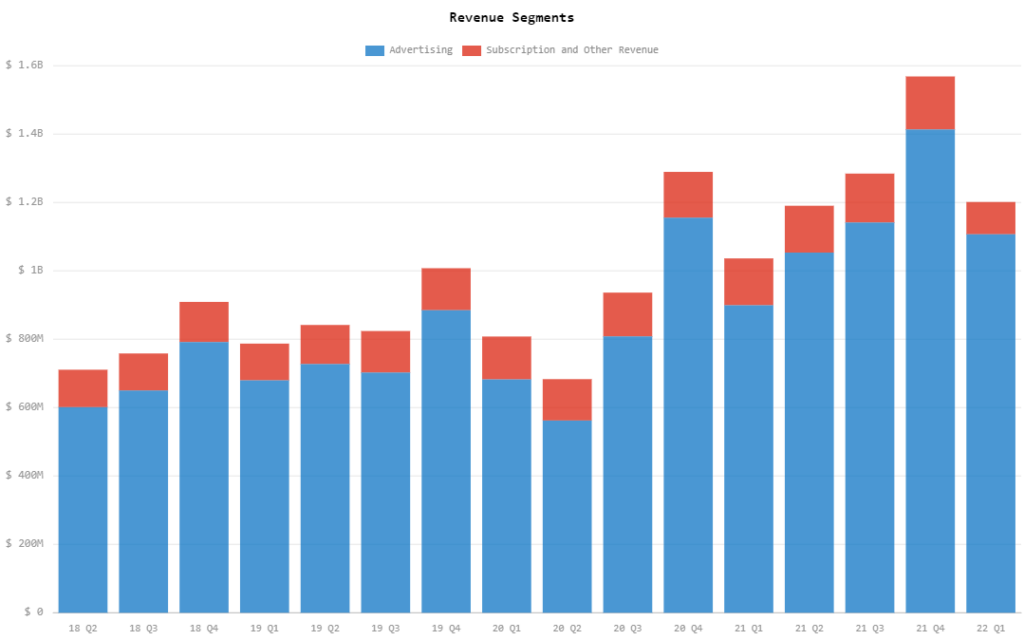

Twitter (NYSE: TWTR) reported today its Q1 2022 financials, highlighting US$1.20 billion in quarterly revenue. This is a jump from Q1 2021’s US$1.04 billion and also US$30 million short of the estimate.

The release comes on the heels of signing a definitive agreement to be wholly acquired by Tesla CEO Elon Musk at US$54.20 per share or roughly US$44 billion in total. The social media giant said that the proposed transaction has already got the approval of the board of directors.

“In light of the proposed transaction with Mr. Musk, as is customary during the pendency of an acquisition, Twitter will not be hosting a conference call, issuing a shareholder letter, or providing financial guidance in conjunction with its first quarter 2022 earnings release,” the company said in its statement.

The firm also recorded an average monetizable daily active usage of 229.0 million for the quarter, up from 214.7 million last quarter and 197.6 million last year. The figure also beat the expected 226.9 million for the quarter.

On the topline revenue figure, advertising revenue for the quarter contributed a total of US$1.11 billion, a dip from last quarter’s US$1.41 billion but an increase from last year’s US$899 million.

In a now-deleted tweet posted even before the proposed acquisition, Musk suggested that the platform should make its verified blue checkmark status a service accessible through a subscription model. He also floated the idea of eliminating ads altogether, which currently makes up around 90% of the company’s revenue.

Changes Elon Musk thought to bring, re: after Twitter takeover:

— PlayerIGN (@PlayerIGN) April 27, 2022

• Edit button

• Reduce ad reliance

• Moderation changes

• Longer Tweets

• Combat spam bots

• Open-source alg.

Note:

• Ads are ~90% of Twitter revenue

• New moderation policies may not be advertiser-friendly pic.twitter.com/AxkK3fEB3A

With total costs and expenses greater than the revenue for the quarter, the social media giant recorded an operating loss of US$127.8 million compared to an operating income of US$52.2 million from the year-ago period.

But thanks to a US$970.5 million gain on sale of asset group MoPub, the firm was able to end the quarter with a net income of US$513.3 million, up from last year’s US$68.0 million. Non-GAAP earnings per share ended at US$0.90, beating the US$$0.87 estimate.

Adjusted EBITDA came in at US$1.18 billion, a huge jump from last year’s US$294.1 million.

The firm generated US$126.1 million in operating cash flow compared to US$390.2 million from the year-ago period. It then ended with a free cash outflow of US$34.6 million vis-a-vis last year’s inflow of US$210.8 million.

The company ended the quarter with US$2.28 billion in cash and cash equivalents, pushing the current assets balance at US$7.48 billion. Meanwhile, current liabilities ended at US$1.14 billion.

The firm also said that Musk’s acquisition of the social media platform is expected to close within the year, after which it would be taken private.

Twitter last traded at US$48.56 on the NYSE.

Information for this briefing was found via Edgar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.