There are rare moments in history where investors are offered an opportunity to participate in the growth of an emerging revolutionary technology at the ground floor – as well as the company leading the charge. Graphene is that industry. And the confluence of advances in nanotechnology, chemistry, and manufacturing processes are positioning graphene to become an invaluable raw material in the manufacture and functionality of a limitless array of products across almost every industry.

Most industries have been subject to disruptive innovation that changed them for the better, or were relegated to the dustbin of history. Graphene has been around for years and has been produced primarily by mining graphite, a capital intensive and often environmentally destructive process. While the end products are often referred to as ‘graphene,’ typically they are simply just fine strips of graphite.

Graphene is a “Super-Material”

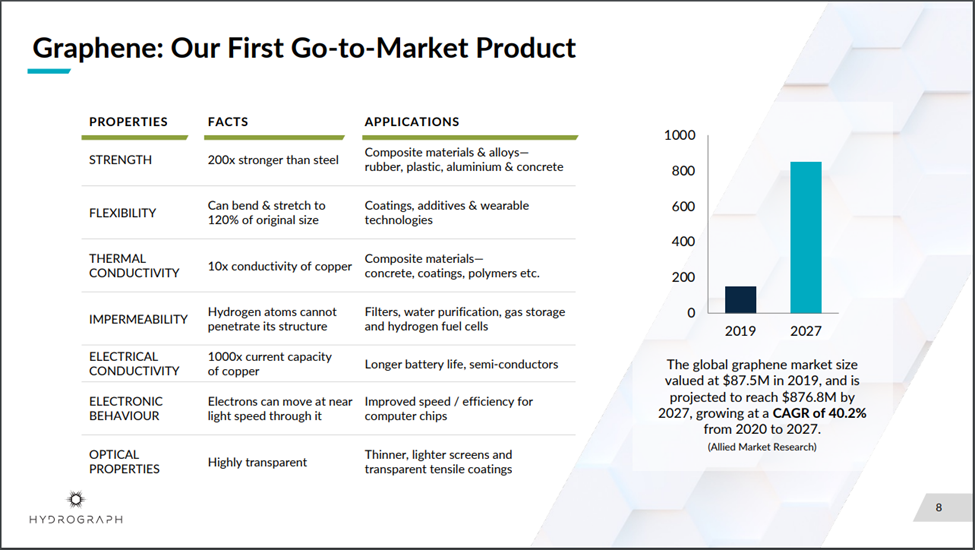

Graphene is considered to be a “super-material” that is stronger than steel, harder than diamonds, and more conductive than copper. It is a single atom-thick, two-dimensional sheet of hexagonally coordinated carbon atoms. The wonderful aspect of graphene is that it can be infused into existing products and technologies. This improves and/or enhances their performance characteristics and lifespan, providing users with economic and technological advantages over their competitors.

When added to existing products, graphene provides better electron mobility than silicon, superior electrical conductivity, and enhanced strength and flexibility. This makes the material ideal for clean energy technologies, as it improves battery life, solar panel effectiveness and longevity.

HydroGraph and their Revolutionary Proprietary Process

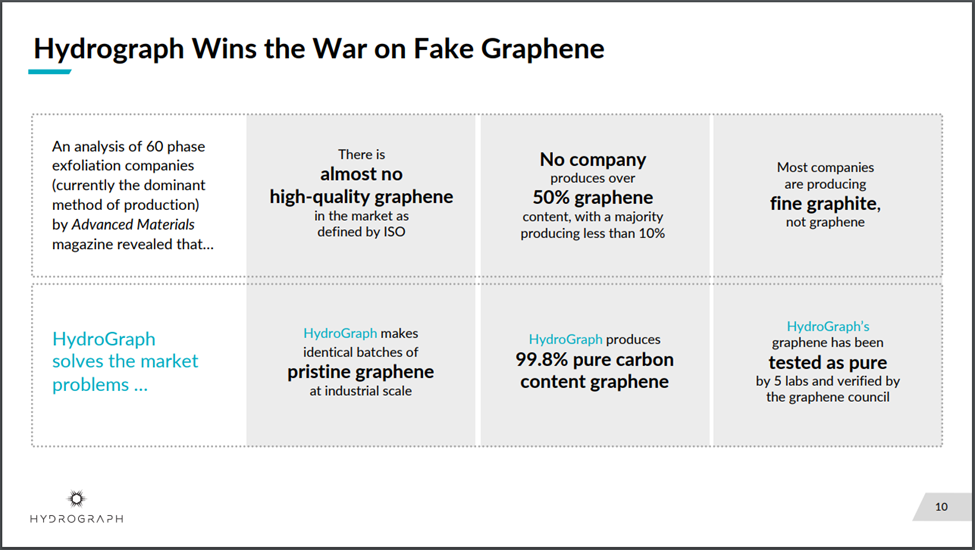

One company is poised to disrupt the existing graphene industry. HydroGraph Clean Power Inc. (CSE: HG) has the rights to a proprietary process for manufacturing 99.8% pure carbon-content graphene, one with consistent, identical production quality. HydroGraph’s graphene purity has been verified by 5 separate labs and by the Graphene Council. This is the consummate environmentally-friendly “green” technology. Currently no company produces over 50% graphene content and most produce less than 10%.

The Graphene Council has only awarded 4 Companies globally with “Verified Graphene Producer” status, and one is Hydrograph. Of those four, only Hydrograph and Ceylon Graphene are in commercial production.

Ceylon Graphene currently produces 1.8 tonnes per year, while Hydrograph just announced the expansion of their new commercial production cell and expect to have 10.0 tonnes per year of production capacity by the end of Q4, 2022.

HydroGraph is currently in commercial production for prospective customers in several addressable vertical markets. The new Hyperion graphene cell will put them on track to be one of the largest graphene producers in the world. That title is held at this time by NanoXplore (TSX: GRA) with 4,000 tonnes per year of production.

Target Markets

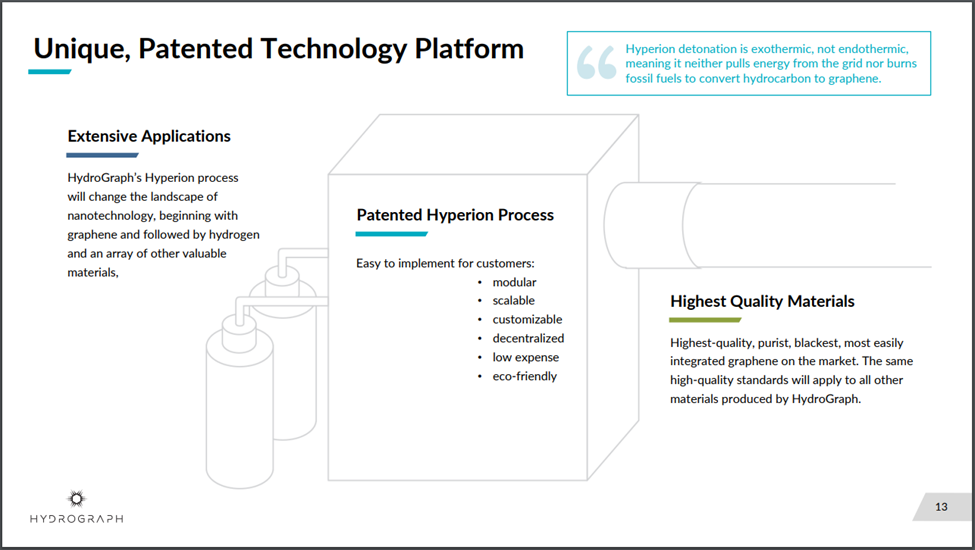

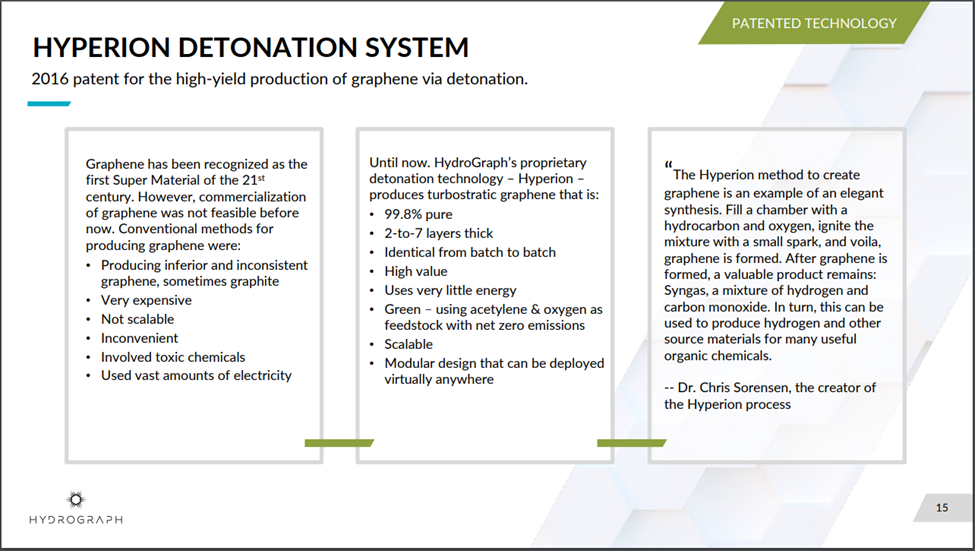

HydroGraph’s Hyperion system is a scalable, modular, customizable, and cost-effective reactor unit. As such it produces almost 100% pure carbon-content graphene, with minimal energy usage, no solvents, and zero carbon emissions. Making it one of the cleanest graphene producers in the world.

The Hyperion system can be adapted to produce fractal and reactive graphene, the unique reactive shell graphene can used to better chemically combine with other products. HydroGraph’s graphene can be easily integrated into a limitless variety of products, including lubricants, energy storage anodes, lithium batteries, solar cells, supercapacitors and functional coatings. HydroGraph’s initial target markets are resins, lubricants and coatings, which can be used to greatly enhance product durability, strength, and performance.

According to Grandview Research, the global coatings market, which was valued at US$83 billion in 2021, is projected to grow at 3.5% CAGR through 2030. The US$128 billion lubricants industry in 2020 will continue to grow at a 3.7% CAGR through 2028, due to rising demand for higher performance lubricants. The thermoplastic resin market meanwhile is expected to grow by a CAGR of 7.7% to reach US$40.06 billion by 2030, as they have a higher heat tolerance, more fatigue resistance, and are 30%-40% lighter than aluminum. Vantage Market Research meanwhile estimates the global graphene market will reach $2.5 billion in market size by 2028.

HydroGraph’s Strategy

The primary reason for addressing these initial markets is because HydroGraph’s CEO, Mr. Stuart Jara, has over 20 years of senior executive experience and credibility in these industries. Jara understands the value proposition that the company brings to enhance the many products these industries produce. His business strategy is to provide a steady stream of HydroGraph’s unique graphene to the producers of multitudes of products, who in turn can enhance their product lines for their customers.

HydroGraph will not be in direct competition with its customers, but will be an invaluable ally. Many of the companies in these industries are large multinational conglomerates with global reach, and they would essentially leverage HydroGraph’s market penetration.

How Does HydroGraph’s Hyperion System Work?

The Hyperion reactor was patented by Kansas State University and the rights were granted to HydroGraph. Although the company’s current focus is commercializing applications for customers, research and development is ongoing. An added benefit is that as new products are developed, they can be patented by HydroGraph as its own intellectual property.

The nature of how the Hyperion reactor produces graphene is incredibly simple. A chamber is filled with a hydrocarbon and oxygen, the mixture is ignited with a small spark, and graphene is formed. After the graphene is formed, Syngas, which is a mixture of hydrogen and carbon monoxide, is left behind as a byproduct. This, in turn, can be used to produce both hydrogen and as a source material for many other organic chemicals.

The company currently has a 13,000 sq.ft manufacturing facility in Manhattan, Kansas, near Kansas State University. A unique feature of HydroGraph low cap-ex Hyperion Systems, is that they have the capability to build processing plants near their customers locations, in order to provide them with a steady supply of just-in time graphene. The reactors are modular and scalable – i.e. they can be implemented to meet the customer’s volume requirements by installing the requisite number of reactors that are needed without the need for sophisticated re-engineering.

Extremely Well-Positioned

The graphene industry is in its infancy. HydroGraph is well positioned to become an industry leader due to its unique, cost-efficient production process, one that should enable high profit margins by supplying the highest quality graphene currently available. The product has a nearly infinite amount of potential applications – and in almost any industry.

The company’s management team has the experience and industry connections to make inroads into the marketplace. Initially they are focused on familiar industries, that can lead to rapid revenue growth and almost instant profitability once sales begin.

READ: Hydrograph Reports Insider Buying In Recent $4.2 Million Financing

HydroGraph Clean Power Inc. has 154.9 million shares outstanding and a market capitalization of only $21.7 million. The company appears to have a competitive advantage within the industry, as they are the only producer of nearly pure graphene. They are also environmentally friendly, ticking all the ESG (Environmental, Social, and Governance) boxes that many consumers and investors are very concerned about.

HydroGraph represents a potential ground-floor opportunity for investors and shareholders in a firm that may be positioned now to become an industry leader. And the graphene industry will likely see rapid exponential growth over the next ten years, as many industries enhance their products by integrating graphene into them.

FULL DISCLOSURE: HydroGraph Clean Power is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover HydroGraph Clean Power on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. We may buy or sell securities in the company at any time. Always do additional research and consult a professional before purchasing a security.