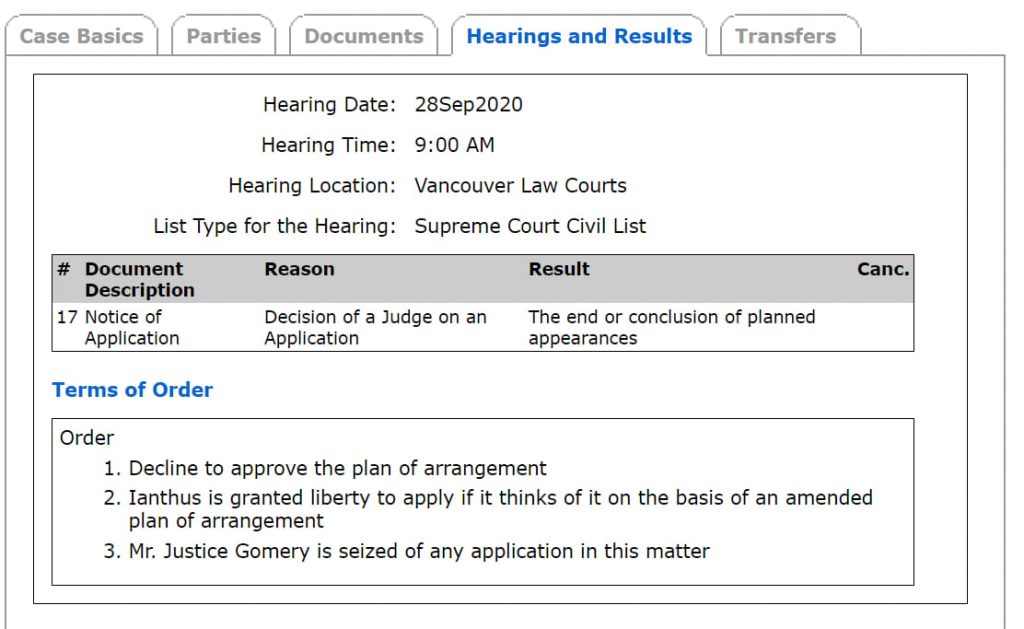

iAnthus Capital Holdings (CSE: IAN) has seen the courts deny the proposed plan of arrangement following the hearing that took place Friday morning before the Supreme Court of British Columbia. While previously reported as being approved by the three stakeholder groups involved in the court case, it appears that the vigorous shareholder fight has successfully pushed the company to CCAA proceedings following the final hearing on the matter.

The proposed plan of arrangement, referred to commonly as the recapitalization transaction, had proposed that the secured lenders of iAnthus, along with the unsecured debenture holders would each receive 48.625% of the company – leaving just 2.75% for shareholders.

As can be expected, there was significant pushback from long term shareholders whom felt they were getting a raw deal. A massive campaign later, and it seems the shareholders – for once – have come out victorious in their attempt to recover some of their lost investment. While they technically have not won anything yet, they have succeeded in turning the tables in their favour at the eleventh hour, providing hope that they might carve out more than the 2.75% pittance they were to be assigned in the recapitalization transaction.

While iAnthus has halted trading in its equity on the CSE pending news, the company has yet to release the material details of its go-forward plan. However, it is anticipated that the company will now proceed to CCAA proceedings, where shareholders will hope to get more than 2.75% of the company once the dust settles.

It should be stated however, that iAnthus has previously claimed that current shareholders will receive nothing in return should proceedings result in a filing under the Companies Creditor Arrangement Act.

iAnthus Capital last traded at $0.12 on the CSE.

Information for this briefing was found via Sedar, BC Courts and iAnthus Capital Holdings Inc. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.