The crypto twitter year started off with a budding feud. Gemini’s Earn program, a yield product offered to customers, continues to see its funds locked in Genesis Global Trading — and Gemini’s co-founder Cameron Winklevoss wants some answers.

READ: Gemini Earn Program Sees Customer Funds Locked Up With Genesis

Genesis announced in November 2022 that it would be halting redemptions and withdrawals on its lending products. The company reportedly has $175 million tied up in accounts at the now-bankrupt FTX.

Genesis is a subsidiary of Digital Currency Group (DCG), run by CEO Barry Silbert.

In an open letter to Silbert, Winklevoss laments on the standstill of halted withdrawals on Genesis, which in turn also froze Gemini’s Earn accounts. He wrote the letter “on behalf of more than 340,000 Earn users who are looking for answers.”

“For the past six weeks, we have done everything we can to engage with you in a good faith and collaborative manner in order to reach a consensual resolution for you to pay back the $900 million that you owe, while helping you preserve your business,” Winklevoss said in his letter. “However, it is now becoming clear that you have been engaging in bad faith stall tactics.”

Winklevoss also relayed that his team sent a proposal to DCG to ameliorate the situation on December 17, with an updated version on December 25.

“Despite this, you continue to refuse to get into a room with us to hash out a resolution… After six weeks, your behavior is not only completely unacceptable, it is unconscionable,” Winklevoss added.

Earn Update: An Open Letter to @BarrySilbert pic.twitter.com/kouAviTho4

— Cameron Winklevoss (@cameron) January 2, 2023

The Gemini co-founder further blamed Silbert for the debacle, saying the “mess is entirely [his] own making.” He alleged that DCG owes its subsidiary Genesis approximately $1.675 billion–which involves the “money that Genesis owes to Earn users and other creditors.”

Winklevoss added that DCG used this money “to fuel greedy share buybacks, illiquid venture investments, and kamikaze Grayscale NAV trades that ballooned the fee-generating AUM of [the] Trust.”

Silbert created the Bitcoin Investment Trust in 2013, which simply put was a private trust that allowed accredited investors to speculate on bitcoin. The trust was later renamed The Grayscale Bitcoin Trust, which currently owns around 650,000 bitcoin, a figure that works out to around 3% of the total bitcoin in circulation.

The fund trades at a 45% discount to Net Asset Value on the public markets (at the time of writing).

READ: “What Is Grayscale Hiding?” Lawsuit Filed Against Grayscale Demands Opening The Books

“[For] the final time, we are asking you to publicly commit to working together to solve this problem by January 8th, 2023. We remain ready and willing to work with you, but time is running out,” Winklevoss ended.

So Gemini gave the money to Barry (Genesis), who then gave the money to Barry (DCG), who then gave the money to Barry (Grayscale)?

— db (@tier10k) January 2, 2023

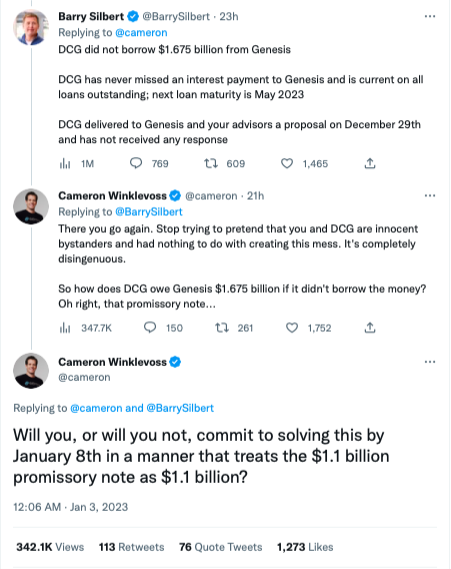

Silbert replied to the letter in a tweet, disputing that DCG borrowed approximately $1.675 billion from Genesis.

“DCG has never missed an interest payment to Genesis and is current on all loans outstanding; next loan maturity is May 2023,” he added.

Silbert also said that a proposal was delivered to Genesis and Gemini. However, DCG has yet to receive a response.

The reply further spurred Winklevoss, claiming that Silbert and DCG are pretending to be “innocent bystanders.”

“Will you, or will you not, commit to solving this by January 8th in a manner that treats the $1.1 billion promissory note as $1.1 billion?” Winklevoss reiterated his deadline.

However, some observers in crypto twitter are not holding out their breath for a resolution.

The only chance that Gemini has of recovering the money their sucke… customers lost in Genesis, is to sell their bullshit letter as an NFT, then use any and all proceeds to buy lottery tickets.

— Bitfinex’ed 🔥🐧 Κασσάνδρα 🏺 (@Bitfinexed) January 2, 2023

There's always a chance.

**Grayscale Trust assets are NOT at risk in the aggregate. DCG’s Grayscale position ($GBTC et al) is at risk of liquidation.

— Andrew (@AP_Abacus) January 3, 2023

In connection with this, three Gemini Earn users have filed a class action arbitration request against Genesis and DCG. The claimants contend that Genesis has failed to return their and all other Gemini Earn users’ digital assets as mandated by the firm’s and users’ Master Agreements, as well as breaching such agreement when the company became insolvent in the summer of 2022 but concealed the situation from its clients.

They also allege that Genesis then participated in a sham transaction with its parent company, DCG, to disguise its insolvency, surrendering the right to collect a $2.3 billion debt owing to Genesis by the now-insolvent hedge fund Three Arrows Capital in exchange for a $1.1 billion promissory note due in 2033.

The situation is a complete turnaround from November when Gemini announced the update on its Earn program after Genesis halted its trading. The company then said that they “are encouraged by Genesis’ and its parent company Digital Currency Group’s commitment to doing everything in their power to fulfill their obligations to customers under the Earn program.”

They also relayed then that the difficulties with the Earn program are said not to impact other products and services offered by Gemini. The company affirmed that its customer funds are backed 1:1 and “available for withdrawal at any time.”

Information for this briefing was found via Coinbase and the sources mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.