It appears that the pesky US economy still continues to be in a rut. In fact, an even bigger rut than since the beginning of the pandemic. According to a recent report by the National Multifamily Housing Council (NMHC), the number of households that are able to make a full or partial rent payment in September has been the lowest since the onset of coronavirus crisis.

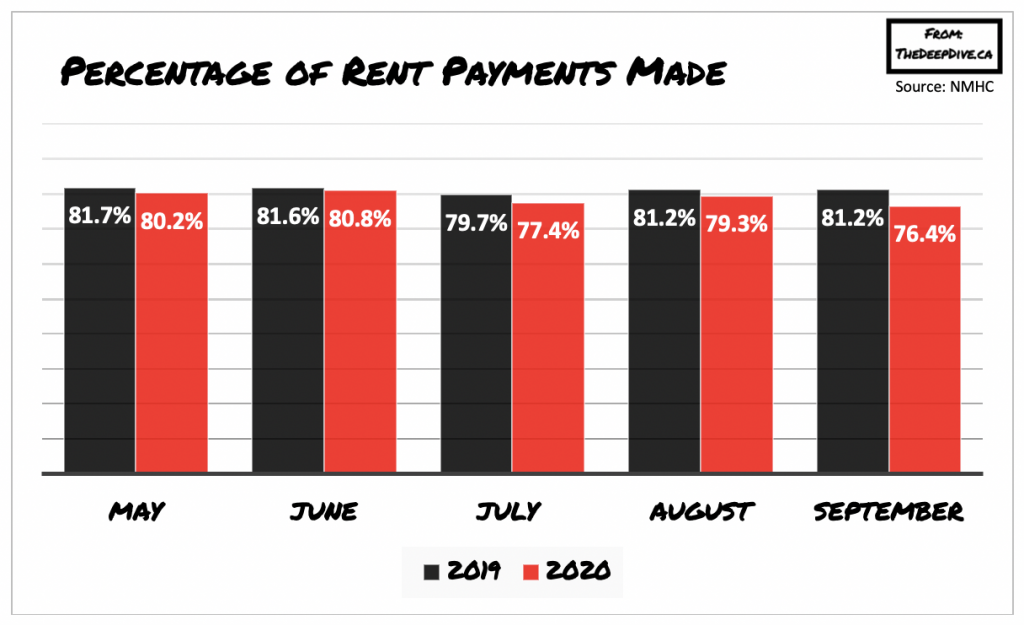

The NMHC’s Rent Payment Tracker, which surveys over 11.4 million professionally managed apartment units, found that only 76.4% of apartment tenants across the country were able to either make a full or partial rent payment in September. This translates to a 4.8% decrease compared to the same time a year prior, and a 2.9% drop since August.

However, the monthly data also shows that the number of households successfully making their rent payments has been steadily declining since May, suggesting that an economic recovery has yet to even begin. Despite the CARES Act providing millions of Americans with income support during the pandemic, tenants still continue to struggle in meeting their rent payment obligations, which in turn is causing further financial strain for landlords.

With declining rent payments, apartment owners are facing increased difficulty in making mortgage payments and other recurring expenses. Moreover, NMHC president Doug Bibby notes that the recent enactment of a eviction moratorium is not as helpful to tenants and landlords as it may seem. In fact, the moratorium only serves as a temporary solution to a significantly deeper problem that is putting the entire housing finance system at risk. Apartment residents continue to accumulate debt burdens, which in turn puts landlords in problematic financial situations.

Information for this briefing was found via the NMHC. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.