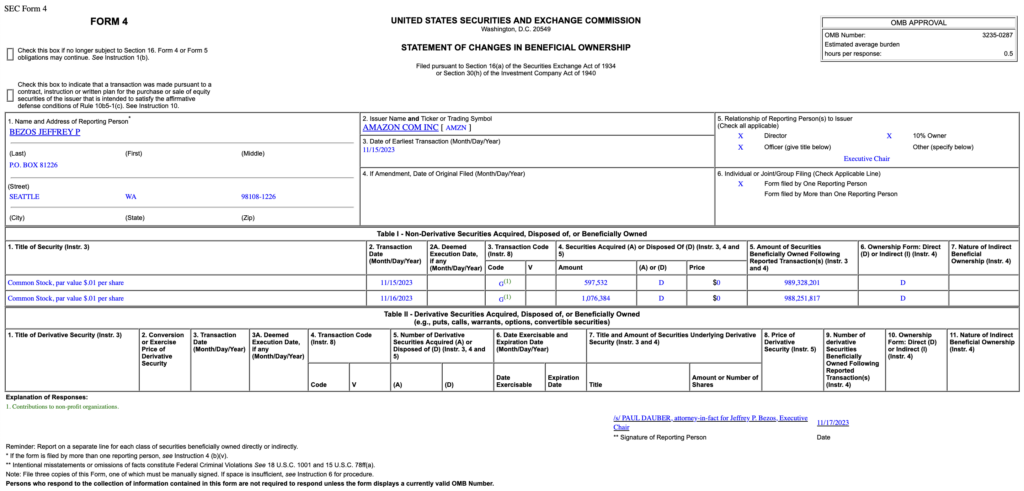

Amazon (NASDAQ: AMZN) founder and executive chairman Jeff Bezos was expected to sell a large number of shares in the company this week, according to sources familiar with the matter. The sources told CNBC’s David Faber that Bezos could sell as many as 8 million to 10 million shares, which would amount to more than $1 billion worth of stock.

Bezos has been selling shares of Amazon on a regular basis for several years, but this would be one of his largest sales to date. The sources said that Bezos is selling the shares in order to fund his philanthropic endeavors and other investments.

Most recently, the Amazon founder said he will give $118 million to nonprofit groups helping families experiencing homelessness.

Bezos is the third-richest person in the world, with a net worth of around $170 billion. He still owns about 988 million Amazon shares, which amounts to a nearly 10% stake in the company.

Since stepping down as CEO of Amazon in 2021, Bezos has accelerated his charitable giving. He has said that he plans to give away much of his fortune in his lifetime. In recent years, Bezos has made large donations to organizations fighting climate change, homelessness, and other causes.

Bezos is also investing heavily in his rocket startup, Blue Origin. He has said that he sells at least $1 billion of Amazon stock a year to fund Blue Origin.

In addition to his philanthropic and business interests, Bezos is also planning to move to Miami. He announced earlier this month that he will be leaving Seattle, where he has lived for several decades.

Information for this story was found via CNBC, and the sources mentioned. The author has no securities or affiliations related to the organizations discussed. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.