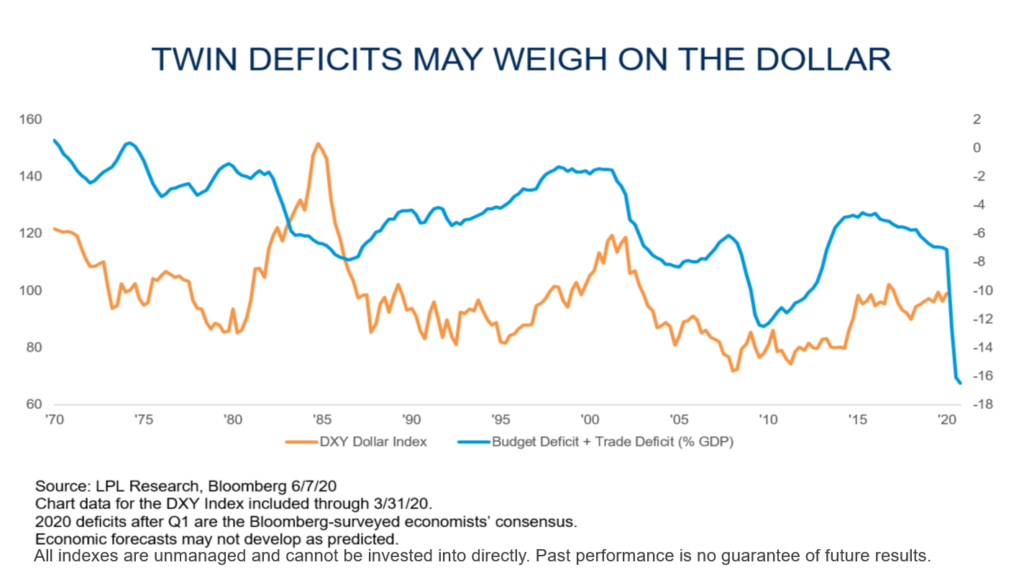

For decades now, people have been asking, how can the US run twin deficits? Meaning they spend more on imports than they bring in via exports coupled with the fact they consistently run large government deficits. Out of a vacuum, one would expect the US dollar to consistently lose value in such a scenario. If this were to happen in Ghana, Turkey, or Colombia, surely these countries would struggle to maintain their purchasing power relative to other countries. In simple terms, when a country keeps spending more than they make domestically while spending more than they offer the world internationally, the value of said country’s currency should only decline.

Of course, that logic makes no sense when one considers the US dollar and its twin deficits.

The US dollar has been the dominant currency in international trade since the 1970s when the petrodollar system was established giving the Saudi Kingdom protection from the US Military. Over the last year, we have seen discussion surrounding the removal of the US dollar’s use for buying and selling oil, which of course creates a massive risk to the global monetary system as we know it.

Many people think the United States’ main export is the US dollar, but in actuality, it is military protection. Building the world’s great military is a nebulous, negative cashflow-generating concept, which for the most part, doesn’t show up on a country’s current account or help with their fiscal revenue generation.

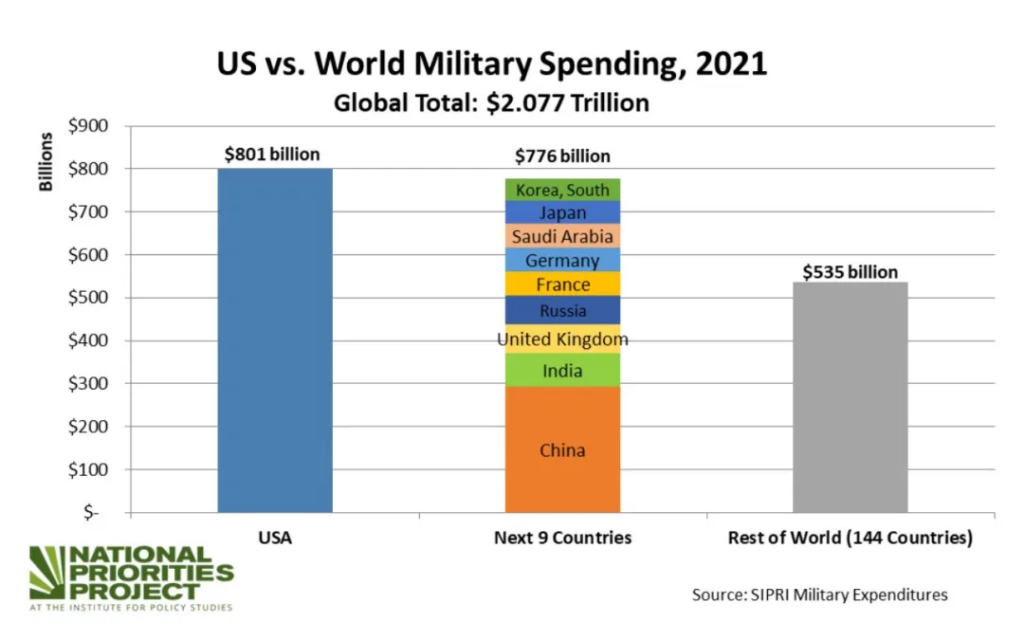

The US spends more on its military than the rest of the world combined. Many people think this is just a self-enrichment scheme for politicians and business people who play into crony capitalism, and it does create those opportunities, but make no mistake the real asset backing the US dollar is the military technology and capital behind it. And they export that technology with bases across the world. Today the United States has over 50,000 troops stationed in Japan, over 30,000 in Germany, and nearly 10,000 in the UK.

How Canada Plays into the Petrodollar System

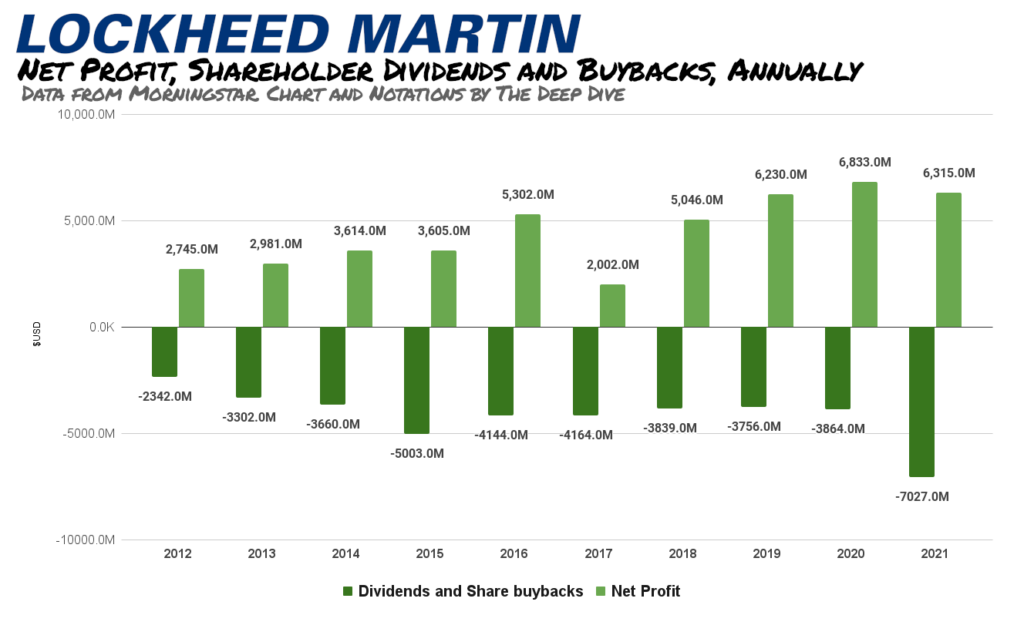

In January, Canada agreed to buy 88 planes for $19B+ from Lockheed Martin.

Why does Canada need these F35s? Are we afraid that a bunch of MAGA losers will storm the border because they hate Trudeau’s insistence on using pronouns? Are we afraid the Russians are going to come steal our beloved Bryan Adams? Why does Canada need these planes?

In fact, Trudeau ran on a platform in 2015 that he would bail on the F35 program.

Canada began investing in Lockheed’s F35 program back in 1997, and we still don’t have any planes. Partially, because there have been a couple of slip-ups along the way involving other suitors trying to steal the business from Lockheed, which may have proven to be a nice stall tactic for otherwise unneeded spending.

As Deep Dive contributor Braden Maccke points out, the F-35 program is like a Kick-Starter Campaign, with unlimited backing, that generates over $6B in bottom-line net income for Lockheed each year. And we’re not talking about financial engineering here, the company has done over $3B in dividends and buybacks annually for the last decade.

So why does Canada need these jets?

The answer is simple, the United States is Canada’s largest trading partner, and the US dollar’s strength benefits us. We have built an entire economy around building these ‘planes of the future’ for the rest of the world. Lockheed claims the F35 program employs 150,000 people across Canada; many of these are great jobs.

There hasn’t been much uproar over Trudeau’s deal with Lockheed. Especially since last week, as Canadians found out China has been floating spy balloons around the world for years.

One can only anticipate fighter jets will become a hot market as global tensions continue to escalate.

That being said, these conversations are dynamic and constantly changing. While some countries turn to the US, others are running away, and today the US Dollar is facing its greatest test since it became the global reserve currency in 1944 via the Bretton Woods Agreement.

Recent Events Impacting the Petrodollar Status

Last week, the People’s Bank of China signed an MOU with Brazil to set up yuan clearing systems to simplify cross-border transactions, with the goal of growing bilateral trade & investment. China already has similar agreements with Kazakhstan, Pakistan, and Laos in place.

Brazil and Argentina are now discussing a regional common currency named “Sur” to increase regional trade and reduce US dollar reliance.

The BRICS countries will discuss creating a common currency at a summit in August in South Africa, according to Russian Foreign Minister Sergey Lavrov. The Russians aren’t quiet about how the West has shown a willingness to betray ‘its allies’ and have publicly stated they want to reform the UN Security Council to increase the representation of African, Asian, and Latin American countries.

Of course, Saudi Arabia is now considering trading oil in currencies other than the US dollar. We discovered this in January when Finance Minister Mohammed Al-Jadaan told Bloomberg Television at the World Economic Forum in Davos. He added that the kingdom wants to develop its “very strategic relationship” with China and enhance ties with other key trading partners.

ICYMI, last month Saudi Arabia told Bloomberg they are open to discussing trading oil in non-US dollars. pic.twitter.com/WTXXwiB1u7

— The Dive Feed (@TheDeepDiveFeed) February 11, 2023

One can’t forget that China and Russia felt the need to make a public statement that the “friendship between the two States has no limits,” right before Russia began its invasion of Ukraine.

And then, we have China announcing large purchases of gold at the same time they are sending spy balloons over the West and publicly disclosing their interest in trading directly with partners in Yuan.

The writing is on the wall.

What the Experts Are Saying?

Nobel Prize-winning economist and right-wing punching bag Paul Krugman, says investors should not be worried about the dollar’s dominance as a major currency for international trade. According to Krugman, if countries like Russia, China, and Brazil were successful in creating alternatives to the dollar it wouldn’t be a big deal. Telling us that when central banks have diversified their holdings away from the dollar anyways; it’s done little damage.

On the other hand, the self-proclaimed ‘Dr. Doom,’ Nouriel Roubini predicts the yuan will end the US dollar’s dominance in the next decade and create a bipolar currency system with the world becoming more split between US and Chinese influence. Ditto for Zoltan Pozsar over at Credit Suisse; who is becoming an internet sensation with gold bugs.

I’m not an economist, I’m just an internet blogger and degenerate penny stock gambler, but if you ask me, any event impacting the Petrodollar deserves a great deal of attention. Just don’t expect it from the mainstream media, until it’s too late.

Information for this briefing was found via the sources linked within the article. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.