Is There A Pot Of Canagold At The End Of The Sun Valley?

Canagold Resources Ltd. (TSX: CCM) is in a fight for control with a shareholder advocating a hostile takeover of the company. The Canadian firm’s shareholders are set to decide in July who controls the board of the US$28.5-million gold miner.

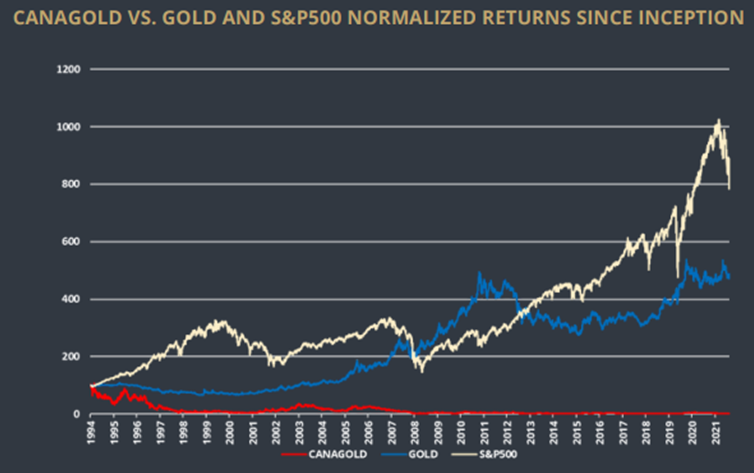

Sunvalley Company (Sun Valley) is contesting the board’s leadership under its chairman, founder Bradford Cooke. The UAE-based private equity firm is claiming that Canagold suffered an “unconscionable 98% destruction of shareholder value” since its Toronto Stock Exchange listing in 1994.

The Canagold board is fighting back, claiming that Sun Valley is only trying to hijack its way to gaining full company control without having to pay a premium.

Canagold vs. New Canagold

Sun Valley’s main argument is Canagold’s 98% decline in share price since 1994. The firm currently trades at around $0.29 per share.

“During [Cooke’s] tenure, there has been a consistent destruction of value, and Canagold’s flagship project, New Polaris, has not moved in a staggering 28 years,” the equity firm said in its circular.

The Canagold board, however, is asserting that it has “successfully advanced the New Polaris gold project towards a feasibility study” in the past two years.

“References to “value destruction” in the Dissident’s press release simply mischaracterize the nature of Canagold’s business and operations. As a growth-oriented gold exploration company, Canagold is focused on discovering, exploring and developing strategic gold deposits in North America and has used shareholders’ investments in the Company judiciously to do so,” the board said in a news release.

The firm also claims that Sun Valley failed to mention that the New Polaris project, “had to be shelved for many years after 1997 due to the refractory nature of the ore and related metallurgical challenges that made it uneconomic.” It further added that the board only found “the metallurgical key in 2017 to unlock value”–referring to the BIOX process–and reactivated the project in 2018.

However, Sun Valley isn’t impressed, saying the “BIOX process has been in commercial operation for over 30 years.” This strengthens the activist shareholder’s resolve that the “board is incompetent.”

But if re-elected, the current board plans to complete an infill drilling program and feasibility study at the project, as well as upgrade inferred resources to measured and indicated.

“If we estimate gold price at $1,500 gold, with an expected after tax internal rate of return of 56%, the net present value of the New Polaris Project US$333M and payback is expected in under two years,” the company added.

But that is not soon enough for Sun Valley, who also plans to tender and start a feasibility study once its nominees are elected.

“Current management [has] been talking about a feasibility study for 20 years but [has] never started one and we can’t even find an indication of a schedule for this in any of their corporate presentations of the last 10 years,” the equity firm said in a press release.

It also plans to “salvage this year’s drilling season and continue in 2022/23 to further increase the resource base.”

Second royalty

Instead, Cooke is reportedly considering encumbering the project with a second royalty, according to Sun Valley.

“A second royalty at an early stage of a project can result in destruction of shareholder value and further reduce the share price,” the firm said. It further added that the board chief responded that it “was exclusively a management decision” when challenged on this move.

“The likely amount that could be raised by a 2% Net Smelter Return (NSR) is around $4 to $6 million, which we believe is insufficient to move the project to a construction decision. It would, however, be enough to allow the company to hibernate for a few years,” the firm added.

Sun Valley promised that if its nominees get elected, they would cease all royalty talks.

But for Canagold, there are no royalty talks to stop. The board claimed Sun Valley’s accusations as false, asserting that the management “never tried to sell a royalty.”

“[The management] simply exercised their fiduciary responsibility to investigate the red-hot royalty market at the time… As a result of their diligent search, management found that royalty companies had no interest in buying a royalty at this early stage of project development,” the company clarified.

The board also reiterated that it informed Vikram Sodhi, Sun Valley’s Managing Director, in at least two instances about this.

“However, they continue to perpetuate the fiction that we were trying to sell a royalty,” the company added.

No skin in the game

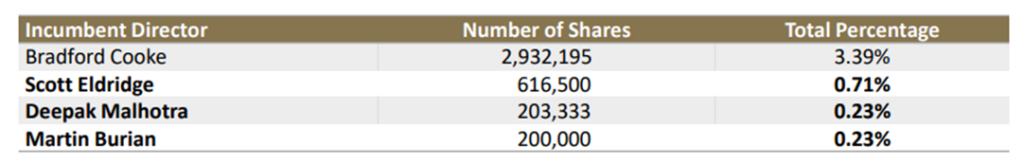

Sun Valley attributes the “destruction of value” to the Canagold board’s lack of economic interest in the company.

“Despite multiple years on the Board, three of Canagold’s directors hold a total of just 1.17% of the company’s shares collectively,” the firm said in its circular. “The incumbent Board’s lack of economic interest in Canagold is alarming.”

The equity firm believes that because of this, the current board “lacks commitment and has no skin in the game.”

Canagold board counters, maintaining that it represents the interests of all shareholders.

“By simply reviewing the SEDI filings and circular, the Dissident could easily confirm that each of our directors has a material shareholding in the Company,” the gold firm said.

Fighting out of the blue (proxy) corner are Sun Valley nominees: mining engineer Dr. Carmen Letton, finance professional Sofia Bianchi, and chartered accountant Andrew Trow. The 3-person director nominees, if elected, would control the 5-seat company board.

Sun Valley maintains that the three nominees “possess superior mining-sector experience and will add diverse and valuable skillsets in mining operations, corporate governance and audit.” They are “motivated to deliver results for all shareholders,” the firm puts it.

But the current board castigated the Dubai-based firm’s nominees, highlighting the part that none of them have shareholdings in Canagold.

“With no “skin in the game”, the Dissident Nominees are not aligned with current shareholders pertaining to any aspect of long-term value enhancement for all Canagold shareholders,” the company board said.

Canagold board added that the proposed nominees by Sun Valley are “based in Australia, Switzerland, and South Africa.” This contrasts the firm’s current board composition in which, “majority of its members [are residing] within British Columbia where the New Polaris project is located.”

Sun Valley itself, while previously holding discussions with the Canagold board, owns 9.4% equity. The board said it “was willing to include two of the Dissident nominees for election to the board” in exchange for withdrawing their advance notice to nominate a majority of the directors to the board.

“However, instead of withdrawing their advance notice, the Dissident immediately breached the agreement,” explained the company. Sun Valley announced on June 10 that it was buying 7,140,371 Canagold shares at a 19.6% premium in a private transaction from 2176423 Ontario Ltd. (a company beneficially owned by Eric Sprott). This increased the equity firm’s stake in the company to 17.61%.

“Don’t allow a minority dissident shareholder with only 9.4% as of the record date take control and dictate the remainder of the 90.6% interest by controlling the board,” the company board told its shareholders in a letter.

Cooke selling shares

“If Mr. Cooke believes in the future of the project with it immediately advancing to feasibility, and a higher share price, why would he sell 44% of his holdings?” is one of Sun Valley’s questions.

The equity firm is basing this on public disclosures a year apart where Cooke’s position “was reduced by 2.3 million shares, 44% of his shareholding,” by April 22, 2022.

The Canagold board categorically denies this.

“Mr. Cooke did not sell 44% of his share position in April. His previous insider report filing agent missed filing the company’s share consolidation in December 2020 and Mr. Cooke only caught this oversight in April, and his new insider report filing agent promptly filed the share consolidation,” the firm’s board explained.

It added that Cooke “has not sold any of his Canagold shares within the last twelve months.”

Sun Valley claims this is just meant to “distract people from a number of misleading disclosures.”

“Is it a shareholder’s responsibility to figure out this mess of disclosure and guess which version to rely on? Mr. Cooke needs to clarify, which record and documents are correct. Has Mr. Cooke sold shares? Or does he and Canagold just not care about disclosure?” the equity firm challenged.

Personal piggy bank

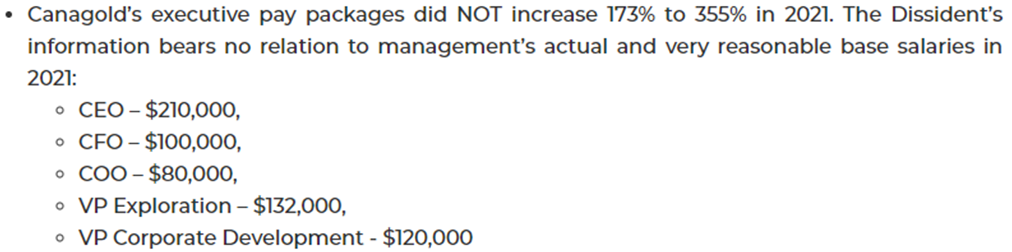

All the while the company is losing valuation, Canagold has seen its executive compensation packages increase–with a total payout of $1.7 million in 2021, according to Sun Valley.

“[The] Board has increased executive compensation packages – with increases in 2021 ranging from 173% to 355%, all as Canagold’s share price plummeted by 50%,” the firm explained.

The firm also highlighted that Cooke was paid over $2.6 million in cash between 1994 and 2021, “and to date, has been granted millions of options.” It also claims the board chair saw his director fees increase to $199,497 in 2021 from $25,400 the prior year. Cooke is a member of the company’s compensation committee.

“The Board members are treating the company like their personal piggy bank. Shareholders put the money in, and the directors are taking it out,” the firm added.

The Canagold board disputes this, saying the activist shareholder’s “misleading” calculations “suggests broader incompetence.”

“Mr. Cooke does not hold millions of options, he currently holds 1,050,000 options at prices between $0.30 and $0.50,” the board clarified. It also added that all directors, including Cooke, “only received directors’ fees of $8,000 in cash.”

The board, however, used the same argument against Sun Valley’s director nominees.

“Based on publicly available information, the only two of the three Dissident Nominees who have served on a board of a Canadian public company received US$170,000 and US$81,451 respectively in cash compensation for acting as a director of a company in 2021,” the board said. “This disparity in compensation may act as a disincentive for the Dissident Nominees to act as Directors of Canagold in terms of their risk/reward and time commitment.”

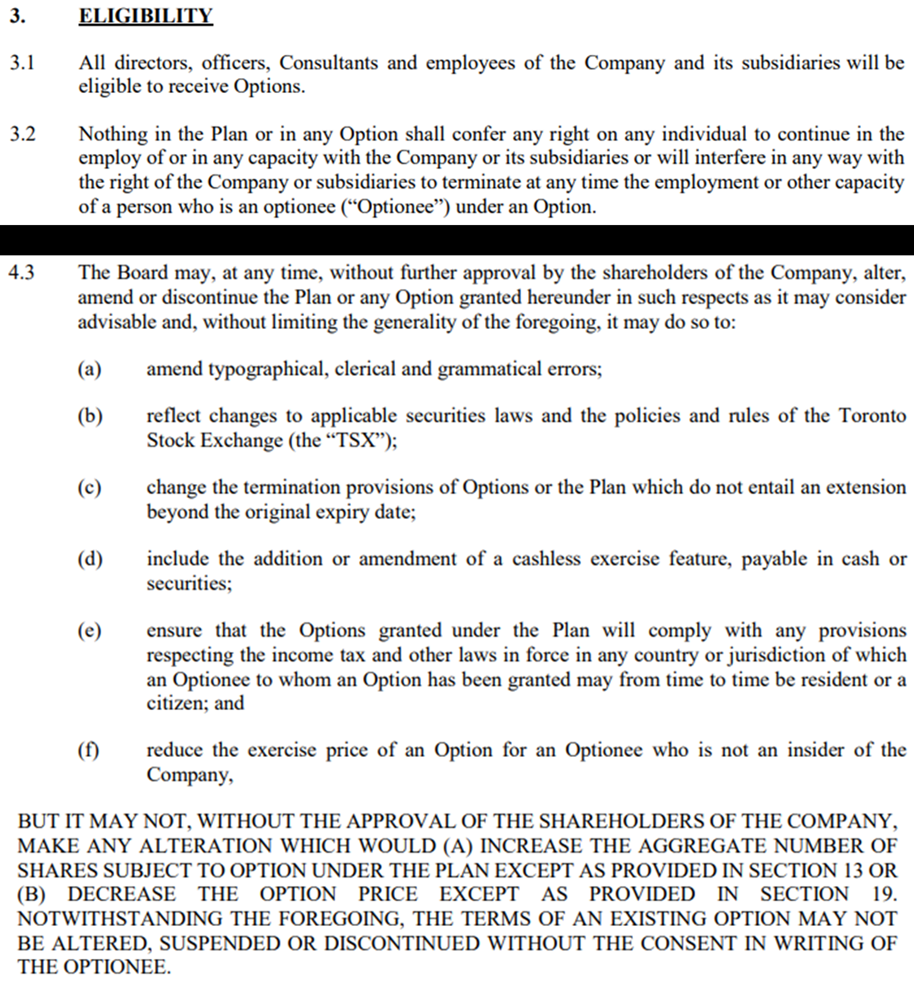

Sun Valley pointed to the proposed stock option plan by the Canagold board, also set for a shareholder vote at the next annual meeting, as part of the “personal piggy bank” argument. The firm is looking at increasing the number of shares subject to option to 17,311,919 shares, representing 20% of the float as of June 6.

“Given the dismal performance for shareholders, how is it possible that they want to be able to reward themselves with up to 20% of the company?” the equity firm questioned.

The firm also raised alarm over a number of provisions in the proposed stock option plan, including opening the initiative to non-directors and the power to amend the plan further without the need for approval from shareholders.

Jilted offer

Sun Valley said it is “deeply committed to Canagold’s long-term success,” claiming it can augment the company’s technical expertise and financial strength.

“Having invested in Canagold since November 20, 2020, we are prepared to invest even more,” the firm said.

Setting the premise that the gold explorer needs cash to fund its feasibility study–as it just reported around US$824,000 in cash in its Q1 2022 financials–Sun Valley offered Canagold $7.6 million (US$5.9 million) in equity this month. The offer, the equity firm claims, is “a 20% premium to market price or a 60% premium on a flowthrough basis.”

But the firm said Cooke rejected the offer and is “refusing to discuss it further.”

“Mr. Cooke rejected multiple premium financing offers to maintain control,” the firm claimed. It added that rejecting the equity offer and supposedly preferring a royalty agreement option “will result in project delays and undoubtedly sentence shareholders to watching their investment decay further in price.”

The Canagold board has a different side to the story: it received one offer from Sun Valley and it was not rejected. The company said there is “a process underway to generate and evaluate offers of financing.”

The board also disputed the “premium” part of the offering.

“The Dissident offered a flow through financing at $0.42 per share which is a 16% discount to our last flow through financing at $0.50 per share, and a non-flow through financing at $0.32 per share which is a 20% discount to our last non-flow through financing of $0.40 per share,” the company explained.

The Canadian gold miner’s board also said that the offer would result in Sun Valley owning “over 35% of the company.”

“The Board’s fiduciary duties involve acting in the best interest of the Company and taking into consideration the interests of all stakeholders, whereas the Dissident has no such duty,” the company added. “By demanding that the Board accept their offer of financing… the Dissident Shareholder has demonstrated that it is only acting in its own best interest.”

The costly proxy fight

Both firms are claiming they don’t want a proxy fight and the other party only forced them to engage.

Canagold points to Sun Valley, after “open communication,” increasing its equity to 17.61% on June 10, making it the largest individual shareholder. The gold firm also said that Sun Valley had noted the vendor of the shares provided “an irrevocable proxy” to vote for the acquired shares.

“The acts of breaching a verbal agreement, soliciting proxies for the election of a majority of directors to the board, and acquiring shares with the intent that they be voted… are the actions of a shareholder intent on initiating a proxy contest rather than avoiding one,” the company said.

On the other hand, Sun Valley posited that Canagold might be using the funds raised through flow through financing (around $822,000) to “commence an unprovoked attack on its own shareholders.”

“Costs will be well over the $250,000 disclosed which is already almost one-third of Canagold’s cash resources at March 31, 2022. By waging this proxy fight with flow through money, Canagold risks review by [Canada Revenue Agency] for non-allowable flow through expenses,” the equity firm argued.

“This proxy fight has been commenced by Canagold, at the expense of shareholders, for the sole purpose of entrenching an underperforming board of directors,” it added.

The proxy fight’s deadline is on July 14, the results of which may be the deciding factor in this tumultuous power struggle–set for a dramatic conclusion on July 19 at the company’s annual meeting.

Canagold Resources last traded at $0.27 on the TSX.

Information for this briefing was found via Sedar and the companies mentioned. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.