All markets and consumers were fixated on the outcome of today’s FOMC meeting, with bets going strong on whether the Fed’s hawkish pivot on monetary policy would deliver a 75 basis-point or a much bigger, 100 basis-point rate hike.

— Rektifyer2000 (@Rectifyer2000) September 21, 2022

Despite President Joe Biden’s word salad attempt at smoothening everyone’s concerns over the sharpest erosion of purchasing power in over 40 years, Fed Chair Jerome Powell just wasn’t having it with inflation today, and delivered yet another 75 basis-point rate hike, ominously suggesting further hikes will be necessary even against a backdrop of slower economic growth and a higher unemployment rate.

60 Min: "What can you do better to lower inflation?"

— Greg Price (@greg_price11) September 19, 2022

Biden: "inflation rate month to month was just up an inch."

60 Min:"You're not arguing 8.3% is good news?"

Biden: "You're acting like all of a sudden 'my God it went to 8.2%'"

60 Min: "It's the highest rate in 40 years." pic.twitter.com/DEwugGct4d

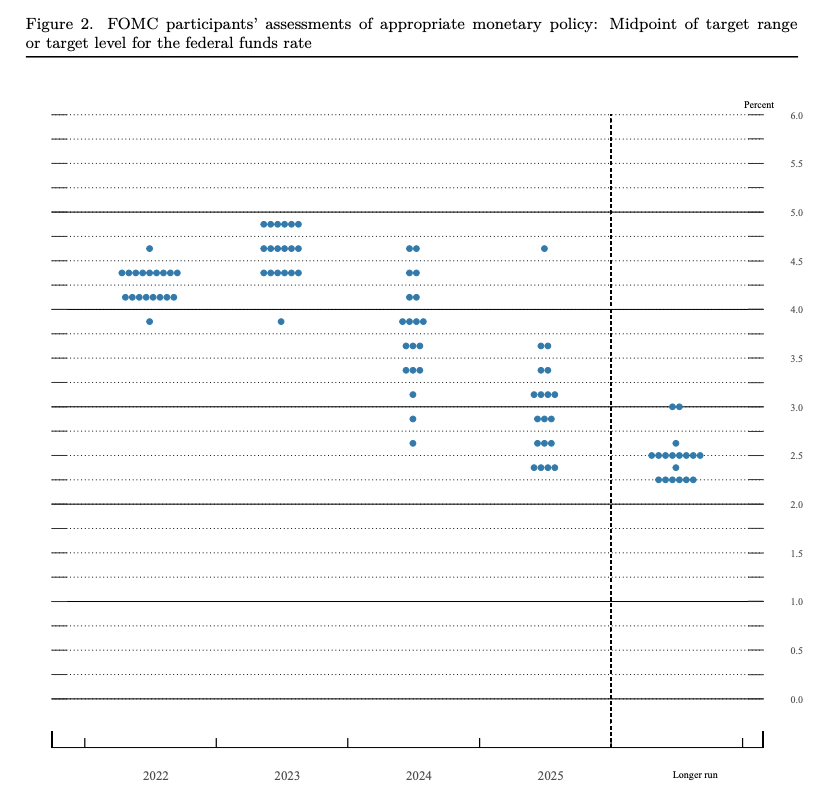

With the federal funds rate now sitting at a target range between 3% and 3.25%— the highest since 2008, markets shifted their focus on what’s yet to come, best illustrated by the FOMC’s infamous dot plot. It turns out inflation isn’t going away as quickly as Biden thinks it is, because a 10-9 majority are still in favour of a hike exceeding 4.25% before the end of the year, paving the way for a potential fourth consecutive 75 basis-point interest rate increase come November. “Our expectation has been we would begin to see inflation come down, largely because of supply side healing,” said Powell in a follow-up statement. “We haven’t. We have seen some supply side healing but inflation has not really come down.”

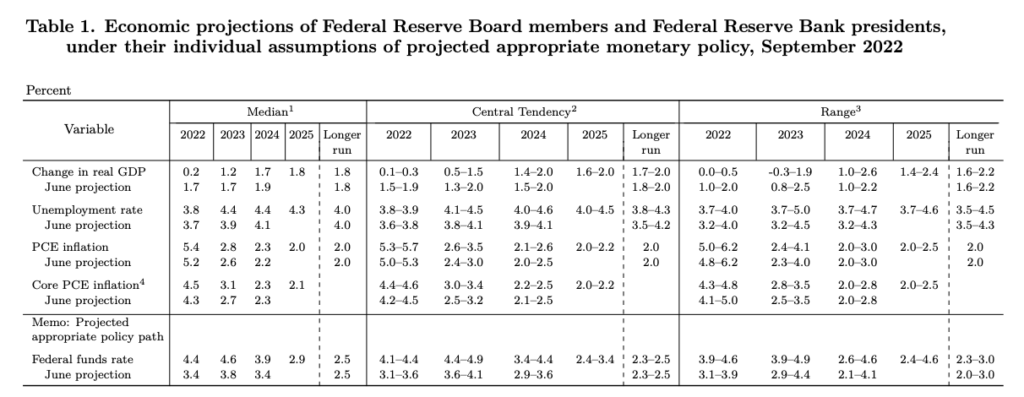

It doesn’t get much better the following year either, because members are projecting a hawkish rate to the tune of 4.6%, which may only subside to 3.9% sometime in 2024. Painting a bleaker future, though, were members’ updated projections on the economic pain that is yet to come. The Fed downwardly revised GDP projections, this time calling for growth of only 0.2% in 2022, instead of the 1.7% originally forecast during June’s meeting. Likewise, members predict the unemployment rate will rise to 4.4% in 2023 and 2024.

The Fed expects its Hail Mary rate hikes will bring inflation to 5.4% by the end of 2022, down from a current 6.3% as per PCE index, while core inflation is forecast to fall from 4.6% to 4.5%. However, what is most alarming and largely indicative there is still a lot of catch-up to play, members don’t see inflation receding back to the 2% target range until sometime in 2025. “That’s a pretty good summary of where we are with inflation and that’s not where we wanted to be,” Powell conceded. “We need to continue, and we did today do another large increase as we approach the level we think we need to get to. We’re still discovering what that level is.”

''The government f*cked up with a humongous 5+ trillion fiscal stimulus and we were sleeping at the wheel in H221, so we are going to get you unemployed to repair that.

— Alf (@MacroAlf) September 21, 2022

Thank you very much''

Jerome Powell, FOMC press conference

In terms of what the Fed’s new monetary policies mean for an economy that is barreling straight into a recession, best not be asking the Fed. “No one knows whether this process will lead to a recession or if so how significant that recession would be,” warned Powell. “That’s going to depend on how quickly wage and price inflation pressures come down, whether expectations remain anchored and also if we get more labor supply.” Yikes, maybe time to turn up the “blame Putin for everything” narrative come November.

Information for this briefing was found via the Federal Reserve. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.