K92 Mining (TSXV: KNT) this morning reported results from the first significant exploration undertaken on the Judd vein system at its Kainantu Gold Mine in Papua New Guinea. The company conducted 109 metres worth of channel sampling on the first vein in the system, revealing 5.5 g/t gold equivalent within an estimated 6,200 tonnes.

The sampling then saw multiple vein faces emerge from the sampling, that include 4.2 metres thickness of 8.7 g/t gold equivalent and 2.2 metres thickness of 18.7 g/t gold equivalent among others, with the average thickness being 3.4 metres. Mineralization is said to be similar to the Kora structure, and a diamond drill rig has been mobilized to conduct underground phase 1 drilling on the Judd vein system.

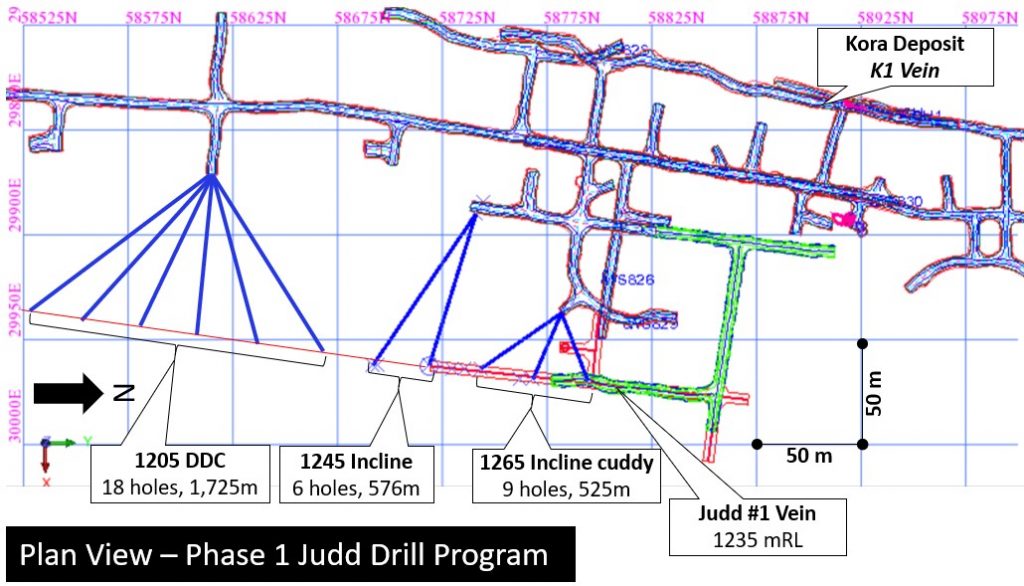

The Judd system is currently believed to consist of four veins, with the bulk sampling reported above from the first vein in the system. The system as a whole is believed to have 2.5 kilometres of strike, with the only previous drilling conducted by the company on the system being a surface drill hole that was intended to intersect the Kora system in 2019. That hole returned 4.7 metres of 4.98 g/t gold, 0.02% copper and 19 g/t silver.

Drilling is currently planned to consist of a 33 hole program that targets strike extensions from the development drive of 250 metres. The company will also look to conduct up-dip and down-dip step out drilling while the bulk sample will also be extended.

The majority of the bulk sample conducted on the Judd vein has been stockpiled for processing through the Kainantu processing plant.

K92 Mining last traded at $8.40 on the TSX Venture.

Information for this briefing was found via Sedar and K92 Mining. The author has no securities or affiliations related to these organizations. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.