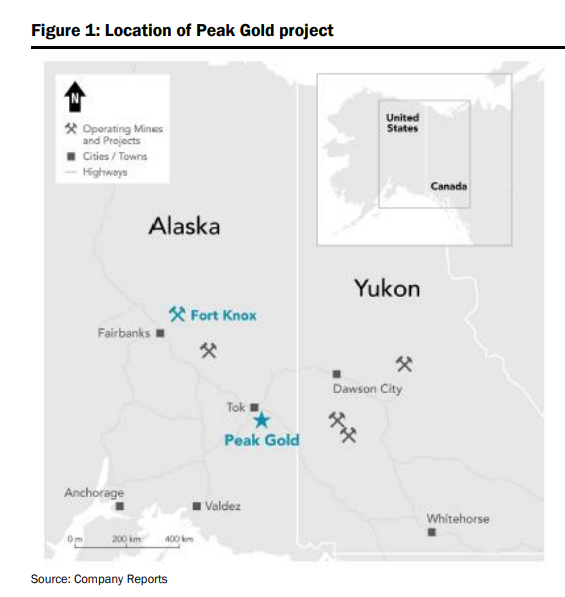

Yesterday, Kinross Gold Corp (TSX: L) (NYSE: KGC) announced that they had entered into agreements to acquire a 70% interest in a high-quality gold project called Peak Gold. Located in Alaska, the purchase will be from that of Royal Gold Inc (NASDAQ: RGLD) and Contango ORE, Inc.

Kinross will pay a total cash consideration of $93.7 million for the 70% stake. The $93.7 million consists of $49.2 million to Royal Gold for its 40% direct interest in the project, $12.1 million to acquire RGLD’s 11.9% ownership in Contango, and $32.4 million in cash to Contango.

In addition to cash, Royal Gold will receive a 28% net smelter royalty on silver produced from an area of interest, which includes the current resource estimate. This NSR can be purchased by Peak Gold for $4 million however. Royal also has a 3% net smelter royalty on the project as a whole.

Canaccord’s mining analyst Carey MacRury sees “the transaction as accretive, adds to its medium-term production profile with potential exploration upside in a solid mining jurisdiction, and leverages the company’s existing infrastructure.”

Currently, Cannacord has a C$16.50 price target and a buy rating on Kinross Gold and a C$150 price target and hold rating on Royal Gold Inc. After this news, only one analyst raised its 12-month price target on Kinross. Eight Capital raised its price target from C$15 to C$15.50.

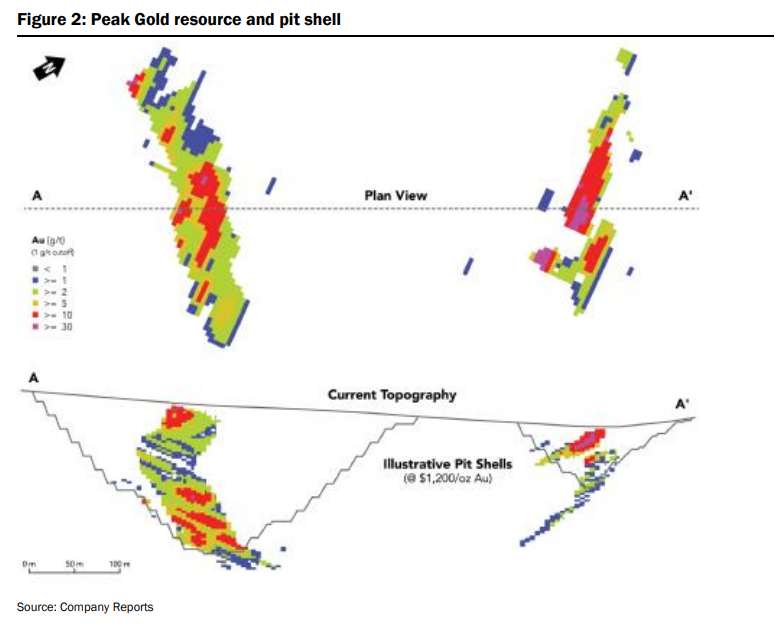

Per Royal Gold and Contango, the project has an estimated measured and indicated resource of 1.2 million ounces of gold grading 4.1 grams per tonne and 4.2 million ounces of silver grading 14 grams per tonne. An inferred resource of 116,000 ounces of gold grading 2.7 g/t and 694,000 ounces of silver grading 16 g/t is also present on the property.

On a 100% basis and a $1,200-ounce assumption, Kinross has completed a preliminary economic assessment based on an open-pit mine at Peak Gold and will truck the ore to its existing Fort Knox mill. In the PEA, Kinross says that the mine’s total life would be 1 million ounces over 4.5 years and an average grade of 6 g/t with an all-in sustaining cost of $750 per ounce.

MacRury estimates the projects net present value (5%) at $157 million based on $1,300 an ounce gold, which means the implied valuation is 0.6x of net asset value. MacRury has used the net present value (8%) of $346 million and a long term gold price of $2,015 per ounce to value the project based on preliminary economics for its model of Kinross.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.