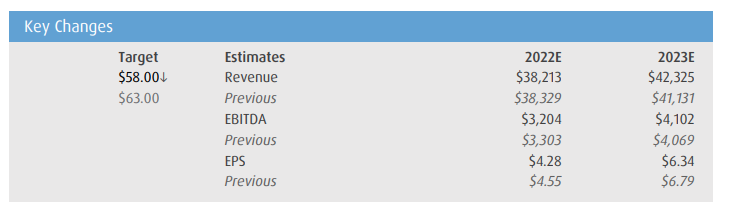

On October 17, BMO released a note on Magna International (TSX: MG) revising their estimates due to higher input costs and the impact of rising interest rates affecting global vehicle production. As a result, they have lowered their 12-month price target to US$58 from US$63 and reiterated their market perform rating on the stock.

Magna International currently has ten analysts covering the stock with an average 12-month price target of US$78.65. Out of the ten analysts, one has a strong buy rating, eight analysts have buy ratings, and the last analyst has a hold rating on the stock. The street-high price target on Magna currently sits at US$106.18.

BMO says they have elected to make these changes only after reviewing recent industry commentary “regarding escalating input costs, the potential impact of rising global interest rates and the outlook for global vehicle production schedules.” They point to Limar, another Canadian auto part company that recently announced that their input costs would rise, specifically calling out Europe’s higher energy costs as one of the main reasons.

Magna derives about 40% of its revenue from Europe and as a result, BMO believes that the company will have similar issues and rising costs will negatively impact the company’s third-quarter results and “quarters for the foreseeable future.” Magna has already noted that they will see an additional $565 million in unrecoverable costs for 2022; BMO believes this amount could rise when the company reports its third-quarter results.

Another factor that played a role is the current rising interest rate environment. They note that forecasting services have slowly been reducing their production estimates, with European production volumes revising their estimates the most.

As a result, BMO has revised its third-quarter earnings per share estimate down to $0.91 from $1.02 and its full-year earnings per share estimate to $4.28 from $4.55. While adjusting their full-year 2023 earnings per share, they now expect the company to report $6.34 in earnings per share, down from $6.79.

Even with these reductions, BMO believes their estimates could be at risk for further revisions. They note that input costs continue to rise and are not covered under Magna’s arrangements with its vehicle manufacturing customers. The “magnitude of unrecoverable costs will be larger than we are currently forecasting.”

They also turn to the demand for cars over the next two years. BMO believes there still to be a considerable amount of pent-up demand due to the semiconductor shortage, giving consumers a long wait time to purchase new vehicles. This is coupled with dealer inventories being at “unprecedented low levels and need to be replenished.”

They expect the constant barrage of rate hikes by the various central banks will hurt consumer spending and will not create a strong 2023 for cars until the financing rates come down. They add that auto part stocks have generally underperformed the market during periods of central bank tightening as “this is clearly an interest-sensitive sector in terms of consumer demand for vehicles, which are largely financed.”

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.