Marathon Gold (TSX: MOZ) this morning announced the expansion of ongoing drilling at its flagship Valentine Gold Project, located in Newfoundland. The current drill program is to be expanded by 8,000 metres, enabling the company to conduct further infill drilling at the Berry zone. The drilling is expected to support the first resource estimate for the zone, which the company expects to release early next year.

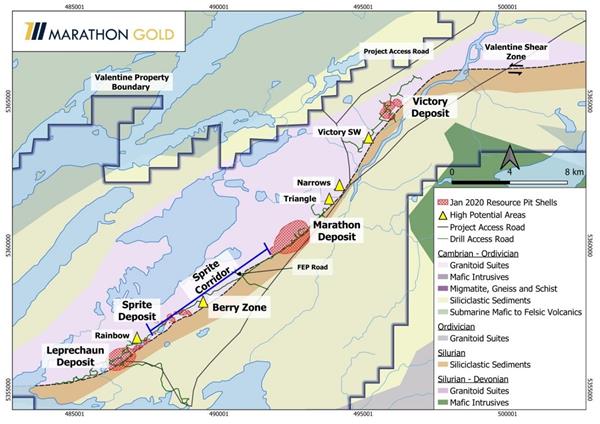

Currently, Marathon Gold is looking to complete a feasibility study along with an environmental assessment for proposed open pit mining at two separate locations at the Valentine Gold project. These open pit mines are to be located approximately 6 kilometres apart from each other, at the Leprechaun and Marathon deposits, which are anticipated to have a 12 year mine life. The company is currently in the process of finding new deposits in the region that could potentially come online in year nine of the current mine plan.

Located in the corridor between the two deposits, referred to as the Sprite Corridor, the Berry deposit fits the bill perfectly for Marathon in terms of location, with the deposit located right next to the proposed mill site. The zone is the stand out deposit along the six kilometre deposit, which currently has two drill rigs conducting step out drilling along its length. The latest announcement brings a third drill rig into the mix.

Mineralization at Berry has been intersected over a strike length of 650 metres, with the latest results released just last week. The infill drill program conducted at the zone is to consist of 55 metres, with an expected cost of $1.3 million. An average drill density of 25 metres over a strike length of 450 metres is currently targeted.

Marathon Gold last traded at $2.37 on the TSX.

Information for this briefing was found via Sedar and Marathon Gold. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.