Greenlane Renewables Inc. (TSXV: GRN) sat atop the TSX Venture in terms of volume traded after the July 2nd session, the 19.8 million total volume consisting largely of a 12.7 million share cross trade executed at the close. The cross appears to be part of a framework agreement facilitating the winding down of a stock and warrant position of shareholder and promissory note holder Pressure Technologies PLC to a holding co controlled by Greenlane CEO Brad Douville and three other company directors.

The transaction geared down Greenlane’s balance sheet leverage, while telegraphing that the company is interested in maintaining an orderly market, staying on top of its float, and is staffed by executives who believe. The transaction takes $5.8 million off of the company’s single largest liability line, leaving $1.7 million outstanding on the promissory note, based on the March 30 balance.

The directors’ bullishness is likely based on between $17.1 million and $21 million worth of new contracts from California-based clients that the company announced June 29th (one $3.5 million contract is contingent on an un-named buyer sourcing financing). The contracts to install biogas upgrading systems for a California-based dairy operation are designed to allow the dairy to generate energy and sell it back to the Pacific Gas and Electric Company (NYSE: PCG).

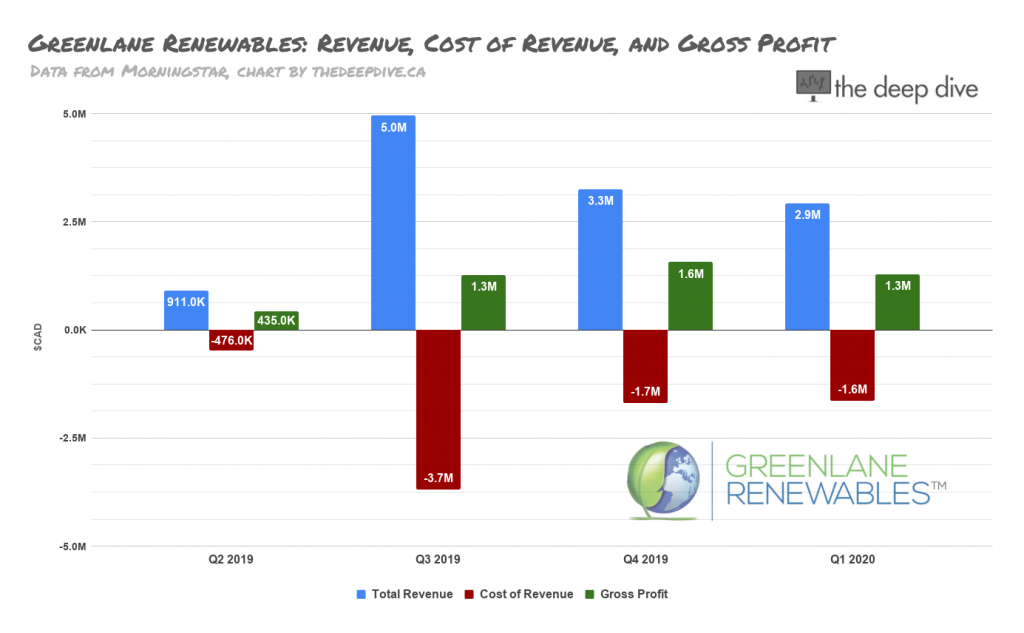

Greenlane burned $2 million in operating cash in the March quarter, and did just shy of $3 million in revenue for a $1.2 million dollar top-line profit, generating a ($1 million) bottom line loss. It’s unclear when these contracts begin to pay out, the rate at which they pay, the margin GRN expects to clear on them, or how they will be financed. The company showed $6.7 million in cash at the end of March.

Greenlane fell short of a $11 – $12 million 2019 revenue projection it had made shortly before the last time they landed in the Market Movers column this past February, printing $9.1 million in revenue for the 12 months ending December 2019. That put a lid on GRN’s post-COVID-crash resurgence in late April, sending the price on a downward-sideways drift on low volume.

The volume generated by the block trades have since bumped the price up above its COVID-era peak in April. Greenlane averaged 1.3 million shares per day in TSX.V trading in February and March of 2020, making an annual peak and six month trough in the high-volatility period in which it saw its first decent action. Since then, Greenlane has looked forgotten, averaging only 358,000 shares per day before the Pressure Tech stock started being crossed out on June 29th. The coming sessions will be a crucial test of whether or not GRN and its sell-side partners can generate the same kind of interest in the broader market that they have in their C suite.

Our previous coverage of Greenlane included fellow TSX Venture renewable gas provider Xebec Adsorption Inc. (TSXV: XBC), who has drawn a much more consistent chart following the COVID slide.

Xebec is reliably among the leaders in dollar-weighted volume on the TSX.V, and are roughly ten times the size of Greenlane in terms of market cap at $385 million. Xebec is a more diversified company within the space. It generates a larger top line and had managed both operating and bottom line profits before slipping in Q4 of 2020 and Q1 of 2021. Accordingly, Xebec has found a great deal more institutional support. We bring it up here to show that there is a resurgent investor appetite for biogas cleantech service co’s that demonstrate an ability to make the street pay attention.

Information for this briefing was found via Sedar and Greenlane Renewables. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.