Noram Ventures (TSXV: NRM) is quickly becoming a market mover this morning, with the equity trading up 8.2% on 575,000 shares this morning. Bids appear to be coming in strong as well, with roughly $300,000 worth of cash looking to move into the equity based on current level two data.

The company is a junior exploration firm focused on developing its lithium deposits at its project in Clayton Valley, Nevada. Just last week, the company announced that it had intersected visible lithium hosted clay in its ongoing phase five drill campaign, with cores being sent off for rushed assaying.

Exploration on the property remains ongoing, with the current program said to be 1440 metres in size, with each hole being drilled to roughly 120 metres as the company looks to bolster its resource estimate at the property. Lithium mineralization is known to extend to at least this depth on the property.

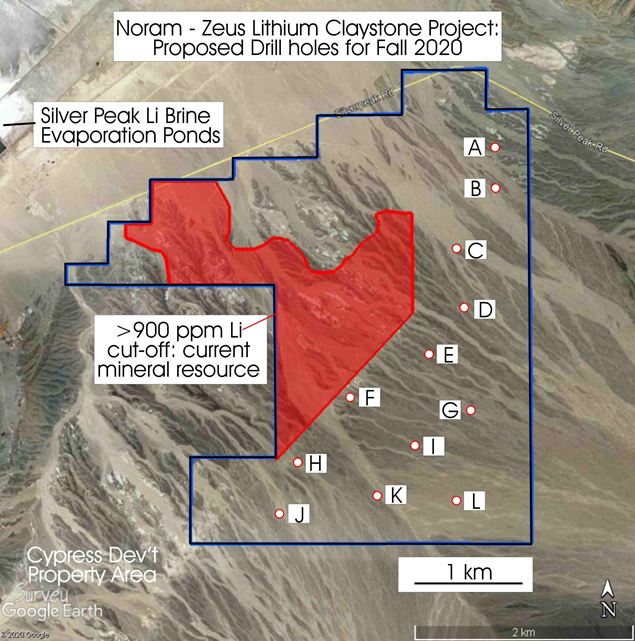

Presently, the company has a resource estimate of 124 million tonnes at 1136 ppm lithium as indicated resources, along with 77 million tonnes lithium at 1045 ppm as inferred resources. At a 900 ppm cutoff, this translate to roughly 1,177,074 tonnes of lithium carbonate equivalent. Notably however, this resource estimate only covers a portion of the 3,000 acre property. The map below indicates the portion of the property for which the resource estimate covers.

The currently ongoing drill program is focused in the areas marked as being open in the map above, with the current phase of drilling to be utilized to expand upon the current resource estimate for the project. Two drill teams are presently onsite, with the operation being conducted around the clock to complete the current program.

The program will see both infill and step out drilling conducted, enabling the company to also improve the current resource estimate from indicated and inferred resources to that of measured and indicated, while expanding the overall resource to the south. The proposed drill holes for the current phase five program can be seen below, as per the company.

An updated resource estimate for the property is expected to be released within the first quarter of 2021. An open pit design for the project is also to be released with the resource estimate, while the company works aggressively towards completing a preliminary economic assessment to “outline the strong economics of the resource and its potential to generate significant cash flow to the benefit of its shareholders.”

The project as a whole consists of 150 placer claims and 140 lode claims, while covering a total area of 3,000 acres. The project is notably located within one mile of the only lithium production currently occurring in the US – Albemarle Corp’s lithium brine operations. Lithium has been produced nearby since 1967 on a continuous basis, while notable peer Cypress Development Corp (TSXV: CYP) is located just next door.

Noram Ventures last traded at $0.265 on the TSX Venture.

FULL DISCLOSURE: Noram Ventures is a client of Canacom Group, the parent company of The Deep Dive. The author has been compensated to cover Noram Ventures on The Deep Dive, with The Deep Dive having full editorial control. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security.