On September 23, Medmen Enterprises (CSE: MMEN) reported their fiscal fourth-quarter financial results. The company reported revenue of $42 million, up 18.5% quarter over quarter and 55.4% year over year. The company saw gross margins come in at 46.9%, up from 40.5% last quarter.

After the results, Canaccord Genuity raised their 12-month price target from C$0.40, while also giving Medmen a hold rating, an improvement from their previous sell rating. They say that the combination of Tilray’s debt extension and the $100 million equity financing, on top of a revenue beat, was the reason for the upgrade and price target raise.

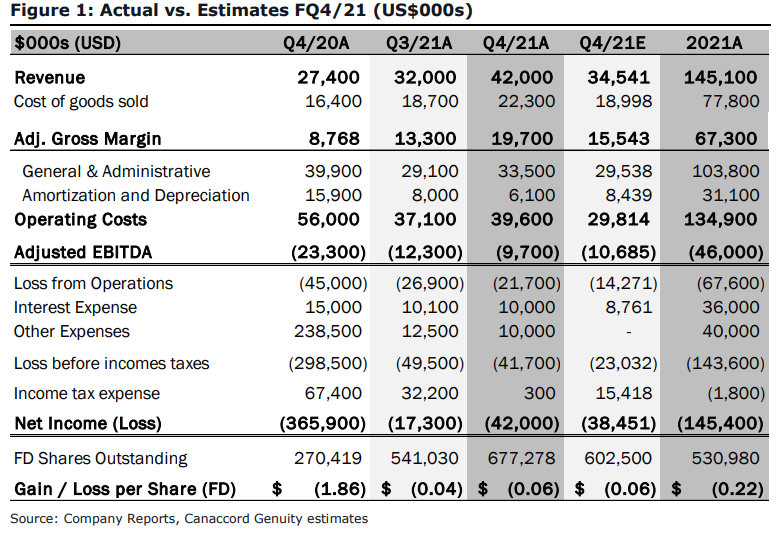

Medmen beat on most of Canaccord’s key estimates. Canaccord forecasted fourth quarter revenue to be $34.5 million, with adjusted EBITDA coming in at ($10.7) million. Canaccord says that the majority of the beat comes from a rebound in California, Medmen’s core market.

Medmen’s California segment grew 24.4% quarter over quarter. Canaccord says that the companies increased gross margins are “a result of increased operating leverage at the company’s remaining cultivation/manufacturing facilities.”

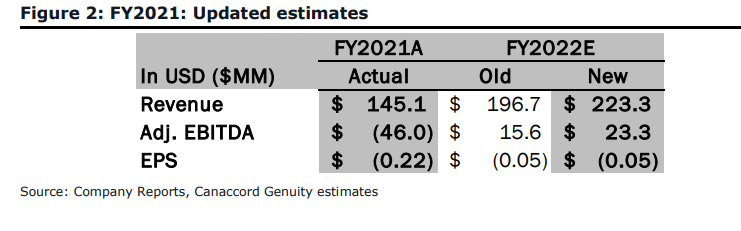

Canaccord re-touches on the Tilray and $100 million investment, saying that everyone was a winner in the transaction. Tilray now has a path to the US cannabis sector and Medmen has a reduced near-term interest and debt burden. They write, “After updating our model for a slightly reduced risk profile in CA and factoring in the company’s recent debt assumption from Tilray as well as its subsequent ~$100M equity financing, we believe the company’s turnaround prospects continue to improve.”

Below you can see Canaccord’s updated fiscal 2022 estimates.

Information for this briefing was found via Sedar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.