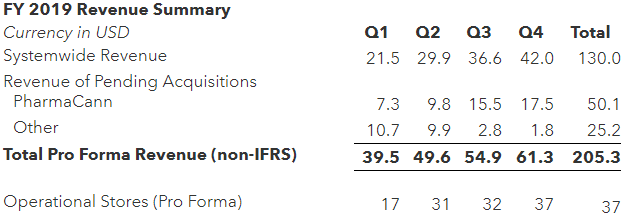

MedMen Enterprises (CSE: MMEN) released preliminary financials for the fourth quarter of FY2019, stating system-wide revenues of US$61.3 million for the quarter. The estimate includes revenues from the endlessly pending acquisition of Pharmacann.

More significantly, MedMen identified that it is currently on track to reduce quarterly SG&A spend by up to 30% from that of its December 2018 quarter. The firm expects to reduce annual selling, general, and administrative expenses from that of US$164 million to a slightly less grotesque US$115 million.

For perspective, that infers that just under half of its recently acquired $250 million cash infusion from Gotham Green will likely go towards keeping the lights on, versus being put towards growth initiatives.

The massive overhead that MedMen runs with has significantly held the firm back by all accounts, with quarter over quarter revenue growth significantly slowing as of late, with the latest quarter seeing 15% sequential revenue growth in a period where other operators are growing at a much larger rate. The high overhead costs of the operation have resulted in the firm now taking steps to reduce employment figures, eliminate non-core functions, and to search out any and all possible areas of cost savings.

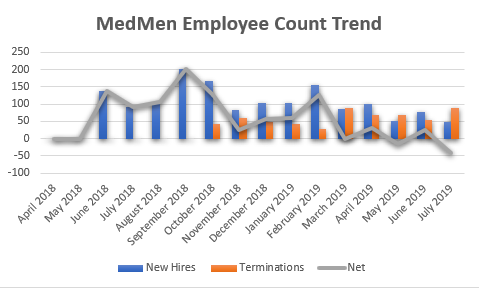

Thanks to Form 7 filings on the CSE, The Deep Dive has been able to track on a month over month basis the employee count trend of MedMen Enterprises. While previously reporting only the net change, the firm has been reporting both new hires and terminations individually since October 2018. In the time since, the trend of hiring has largely reversed, suggesting that the company is no longer able to maintain its significant employee base as a result of depleting capital. Specifically, the net change has begun to trend negative over the course of the last several months.

With a depleting employee base, comes the realization that the growth story for the firm may be nearing an end. Slowing quarter over quarter growth in a growing sector is not a positive indicator for a company whose story is predicated on becoming one of the largest multi state operators within the US.

MedMen Enterprises is currently trading at $2.51 per share.

Information for this briefing was found via Sedar and MedMen Enterprises. The author has no affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.