Billionaire tech entrepreneur and one of Facebook’s earliest investors Peter Thiel has stepped down from his position as a board member of parent company Meta Platforms Inc. (NASDAQ: FB), in order to focus on the Republican agenda ahead of the 2022 midterm elections. The move follows Thiel making an investment last year into Youtube-competitor Rumble, which is said to have a number of right-wing affiliations.

Thiel, who was one of Facebook CEO Mark Zuckerberg’s earliest advisors for nearly 20 years, announced on Monday he will be leaving the company’s board following its annual shareholder meeting, which is usually in May. Thiel cited an increased interest in former president Donald Trump’s political agenda for the upcoming 2022 midterm elections, which would otherwise be distracting for Facebook. “He thinks that the Republican Party can advance the Trump agenda and he wants to do what he can to support that,” an individual close to Thiel told Bloomberg.

Presently, Thiel is supporting four Senate candidates as well as twelve House candidates. All of which are running on political platforms similar to that of Donald Trump’s. Even more notably, three of the House Candidates are running against Republican peers that voted to impeach Trump in relation to the unfolding of events on January 6.

The billionaire entrepreneur is considered to be one of the strongest conservative voices in the tech industry, and his retirement from Facebook will mark the end of one of the most controversial relationships between a company CEO and a major investor. Since joining Facebook’s board back in 2005, Thiel has been one of Zuckerberg’s most prominent advisors, and is credited with influencing the CEO’s ideology during Facebook’s inception and its rigorous growth.

Thiel seeds Facebook $FB

— SmallCapSteve (@smallcapsteve) February 8, 2022

Thiel backs Trump $DWAC

Thiel seeds Rumble (SPAC – $CFVI )

Thiel leaves Facebook Board $FB

Rumble Offers Rogan $100M to Leave Spotify $SPOT

The Problem: Thiel Also Owns Spotify! #RichPeopleProblems pic.twitter.com/Koi4yJ2DDv

Thiel also became one of Trump’s strongest Silicon Valley supporters during his presidential election in 2016, making substantial donations to his campaign before becoming an advisor throughout the presidency. That at the time was not without controversy either, with Netflix co-founder Reed Hastings, whom at the time was a fellow board member of Facebook, referring to Thiel’s support of Trump as not “different judgement” but “bad judgement.”

Reed Hastings emails Peter Thiel

— Internal Tech Emails (@TechEmails) February 7, 2022

August 14, 2016 pic.twitter.com/HAYsUq5JtE

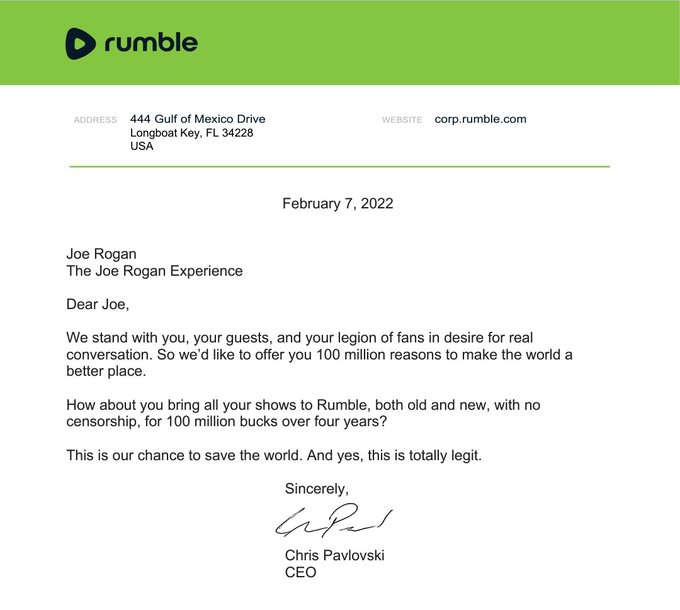

Now, alongside with focusing new efforts on pursuing a similar agenda during the forthcoming midterms, the tech tycoon is also simultaneously extending his right-wing influence across other tech services, most notably Rumble. Rumble, which has recently entered the spotlight after offering Joe Rogan $100 million to leave Spotify and move his controversial podcast to the video platform, last year received an investment from Thiel for an undisclosed amount.

The announcement from Rumble is noteworthy in that it came the same day in which Thiel announced his departure from Meta.

The investment last year was spearheaded by venture capital firm Narya, and will go towards furthering free speech and alternative viewpoints. “These funds will help us launch our new cloud services, enhance our video platform, and help create the rails for a new economy that is desperately needed,” said Rumble CEO Chris Pavlovski in a statement.

It should also be stated that much of Thiel’s investment in Meta has since been unloaded. After originally taking a 10% stake in the company for $500,000 back in 2004, Thiel sold much of his stake in the firm in 2012 after lockup restrictions had expired. In 2020, he sold a total of 53,602 shares that remained, resulting in a further 80% decline in his overall stake. The latest reports peg Thiel as owning just 12,947 shares of the company as of May 15, 2021.

Finally, the timing of Thiel’s departure, if nothing else, is noteworthy. The equity is down over 33% over the last five days, with the company now holding the record for the fastest decline in valuation in public markets history on a dollar basis, erasing over $230 billion in value in a single day. The decline follows the company announcing declining monthly active users for the first time ever, while forward guidance provided by the company indicated the firm is expecting growth to materially slow, with growth expected “to be impacted by headwinds to both impression and price growth.“

That leaves us with a final question: Does Thiel’s departure from Meta indicate that the social media platform is officially on the downslide?

Information for this briefing was found via Bloomberg, The New York Times, Forbes and Rumble. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.