As a result of physical distancing measures and stay-at-home orders being imposed across Canada as a means of mitigating the spread of the coronavirus pandemic, the real estate market became the subject of significant volatility.

The Greater Vancouver area, which is known to skew a variety of national variables pertaining to real estate, is currently experiencing a bout of disequilibrium between prices and output. According to the Real Estate Board of Greater Vancouver, home sales have fallen 44% in May compared to the same time a year prior, and are 54% lower than the 10 year average for the month. April however, was most likely the worst, with the lowest sales figures since 1982.

For the month of May, there was a total of 3,684 properties listed for sale in the Metro Vancouver area, which corresponds to a decrease of 37.1% compared to the same time a year prior. However, the figure also represents an increase of 59.3% compared to just the previous month.

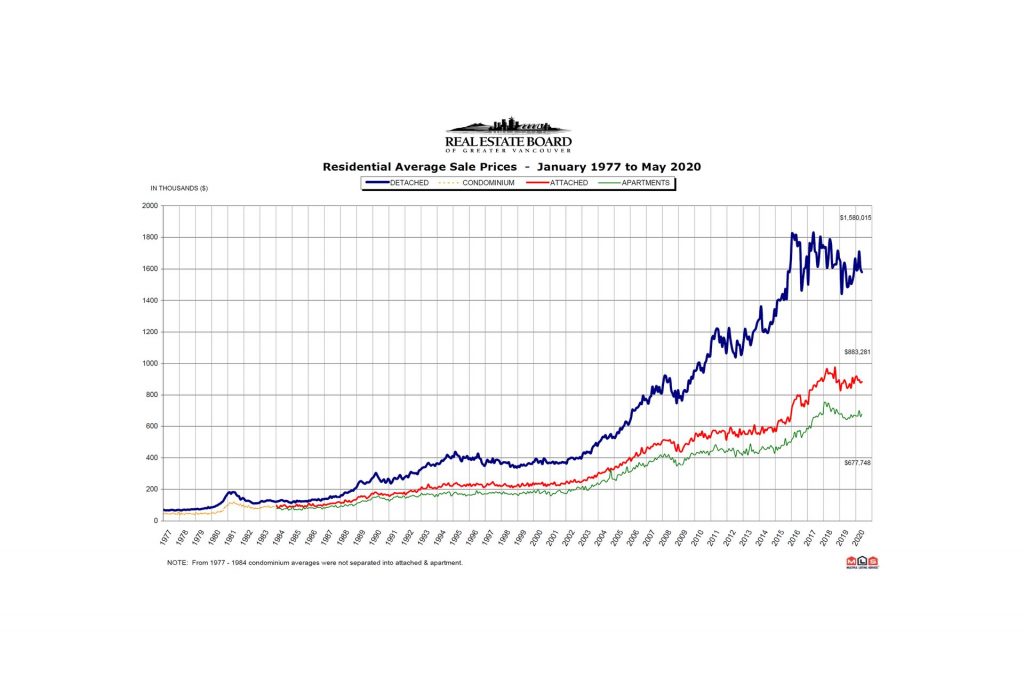

Most notable however, is the discrepancy between the decrease in home sales and the relatively unchanged corresponding prices. According to the real estate board, the MLS home price index composite benchmark price for Metro Vancouver residential properties was at $1.03 million – an increase of approximately 2.9% compared to the same time a year prior.

However, the real estate market in the Greater Vancouver area may soon fall back into equilibrium after all. As previously announced by the Canadian Mortgage and Housing Corp, the real estate sector is predicted to be subject to a significant price reduction of anywhere between 9% to 18%, with oil-producing regions experiencing up to a 25% reduction. Even if the economy is on track for a fast recovery, it will most likely not be until mid-2021 that a price recovery is evident; if the economy maintains a slower pace however, it may take until 2022 for prices to rebound to pre-pandemic levels.

Information for this briefing was found via Bloomberg, Real Estate Board of Greater Vancouver, and CBC News. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.