Microsoft (Nasdaq: MSFT) last week released their first quarter results for fiscal 2023, which ended on September 30th, 2022. The company announced that revenues increased 11%, or 16% on a constant currency basis, to $50.1 billion. While operating income increased by 6% to $21.5 billion. Though this did not trickle down to the company’s net income, as they reported a decrease of 14% to their net income, which came in at $17.6 billion, or an earnings per share of $2.35.

Microsoft’s productivity and business processes segment saw its revenue increase by 9% to $16.5 billion, with LinkedIn revenue increasing by 17%. At the same time, its Cloud segment revenue was $20.3 billion, an increase of 20% yearly. Revenue in the More Personal Computing segment decreased slightly to $13.3 billion.

On the call, Microsoft provided second-quarter guidance. The company expects Cloud revenues to be between $21.25 and $21.55 billion. While personal computing is expected to come between $14.5 and $14.9 billion, and productivity and business processes are to be between $16.6 and $16.9 billion. Lastly, Microsoft expects a decrease of 5% to their full-year growth due to the foreign currency impact.

After the results, several analysts lowered their 12-month price target, bringing the average down to $306.91 from $333.24 last month. Out of the 52 analysts covering the stock, 19 have strong buy ratings, 29 analysts have buy ratings, and four analysts have hold ratings on the stock. The street-high price target sits at $411.

In BMO Capital Markets’ note on the results, they reiterate their outperform rating on the stock but lower their 12-month price target to $270, down from $295, saying that Microsoft reported a very un-Microsoft report “with numerous sources of disappointment.”

BMO starts the note by saying that the Azure growth guidance of 37% year over year for the December quarter is disappointing and reflects continuing issues from this quarter, specifically a continued slowdown in spend due to optimization. They also believe that Microsoft’s near-term optimization is impacting consumption growth.

On the productivity and business processes guide and results, BMO suspects that businesses are consolidating spending around Microsoft, trying to bundle their services and, in exchange, getting a discount on all their services. They also believe there could be a slowdown in this segment when there is a slowdown in employment. While the guidance was slightly below their estimate, BMO says that the miss is driven by LinkedIn,”which we expect to face headwinds from hiring and advertising spend.”

On the More Personal Computing segment and guide, BMO says that general economic headwinds affected this segment the most, but results did not come in as bad as expected. However, they do continue to expect general economic headwinds to affect this segment on top of segment-specific headwinds such as the state of the PC market. In which they expect to remain challenging for the next few quarters, “if not longer.” As for the guidance, they say it is “particularly poor,” as guidance suggests revenues will decrease by ~13%. BMO believes the PC market is much to blame for this horrible guidance.

Lastly, BMO says that Microsoft’s cash flow continues to be strong, though down meaningfully year over year. They point to continued strong cloud billings and collections as the driver of this strength. They believe that Microsoft’s operating and free cash flow remains one of the best in their coverage and that it will remain strong despite macro pressure.

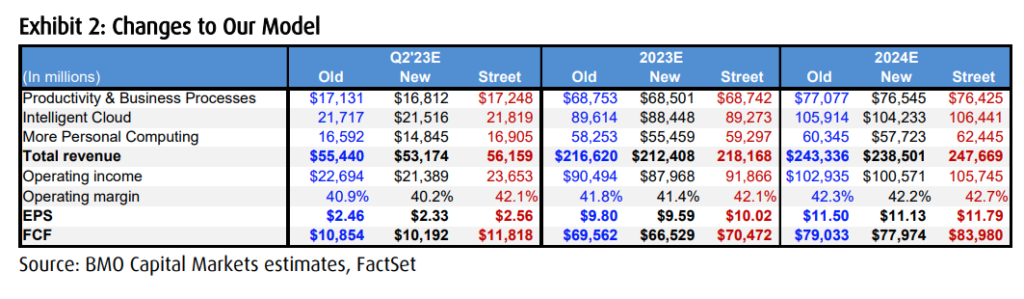

Below you can see BMO’s updated estimates.

Information for this briefing was found via Edgar and Refinitiv. The author has no securities or affiliations related to this organization. Not a recommendation to buy or sell. Always do additional research and consult a professional before purchasing a security. The author holds no licenses.